As global markets navigate a mixed landscape of fluctuating consumer confidence and economic indicators, investors are seeking stability in the form of reliable income streams. In such an environment, dividend stocks can offer a compelling option for enhancing portfolios by providing regular income and potential for capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.31% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.61% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.68% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.08% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.82% | ★★★★★★ |

Click here to see the full list of 1943 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

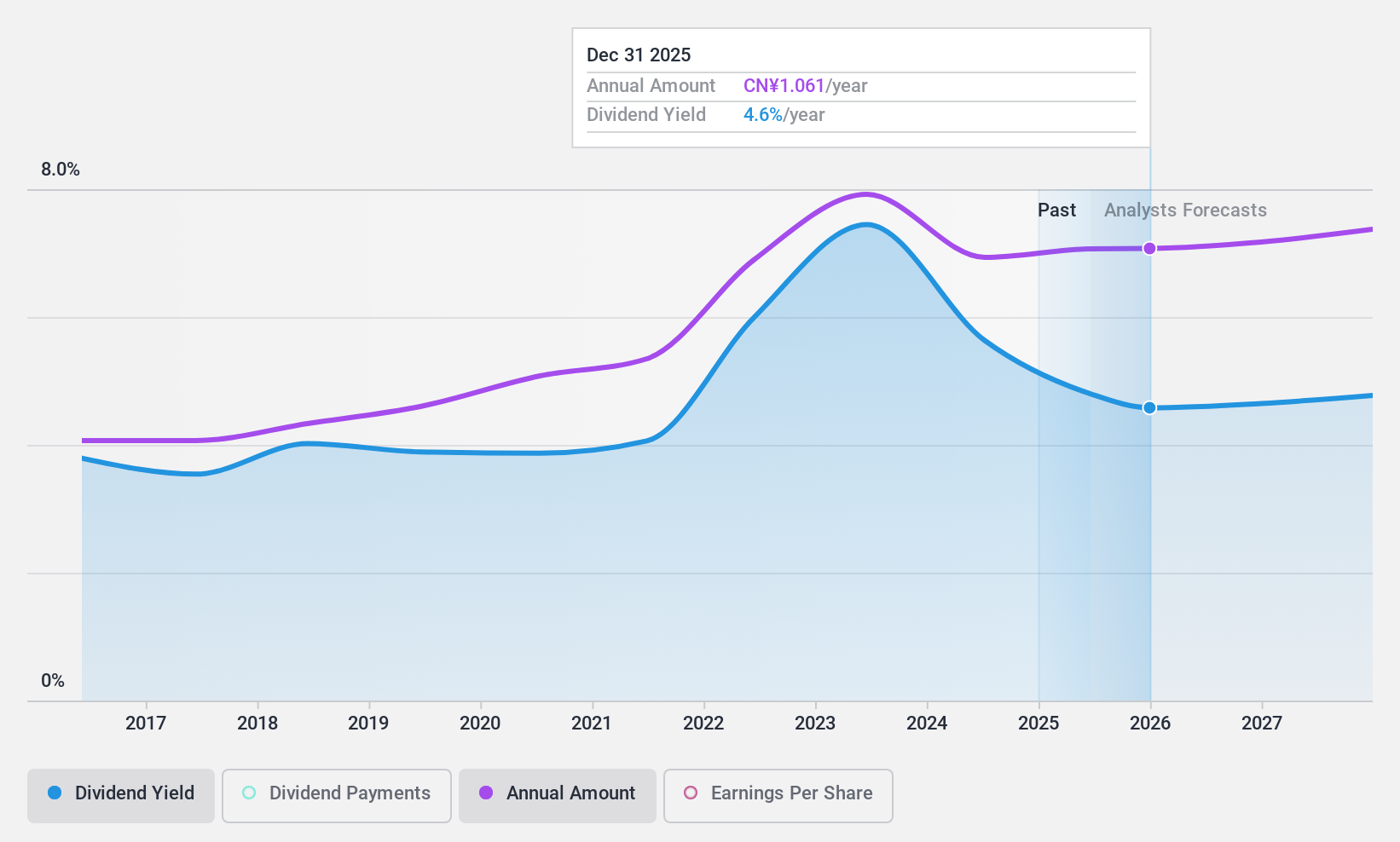

Industrial Bank (SHSE:601166)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Industrial Bank Co., Ltd. offers banking services in the People’s Republic of China and has a market capitalization of CN¥406.14 billion.

Operations: Industrial Bank Co., Ltd. generates revenue primarily through its Commercial Bank segment, which accounts for CN¥146.16 billion.

Dividend Yield: 5.3%

Industrial Bank offers a compelling dividend profile with a payout ratio of 30.5%, indicating dividends are well covered by earnings and expected to remain so in three years at 29.7%. Despite being among the top 25% of dividend payers in China, its track record shows volatility over the past decade. Trading significantly below estimated fair value enhances its appeal, although recent earnings show slight declines, with net income at CNY 63 billion for nine months ending September 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of Industrial Bank.

- The analysis detailed in our Industrial Bank valuation report hints at an deflated share price compared to its estimated value.

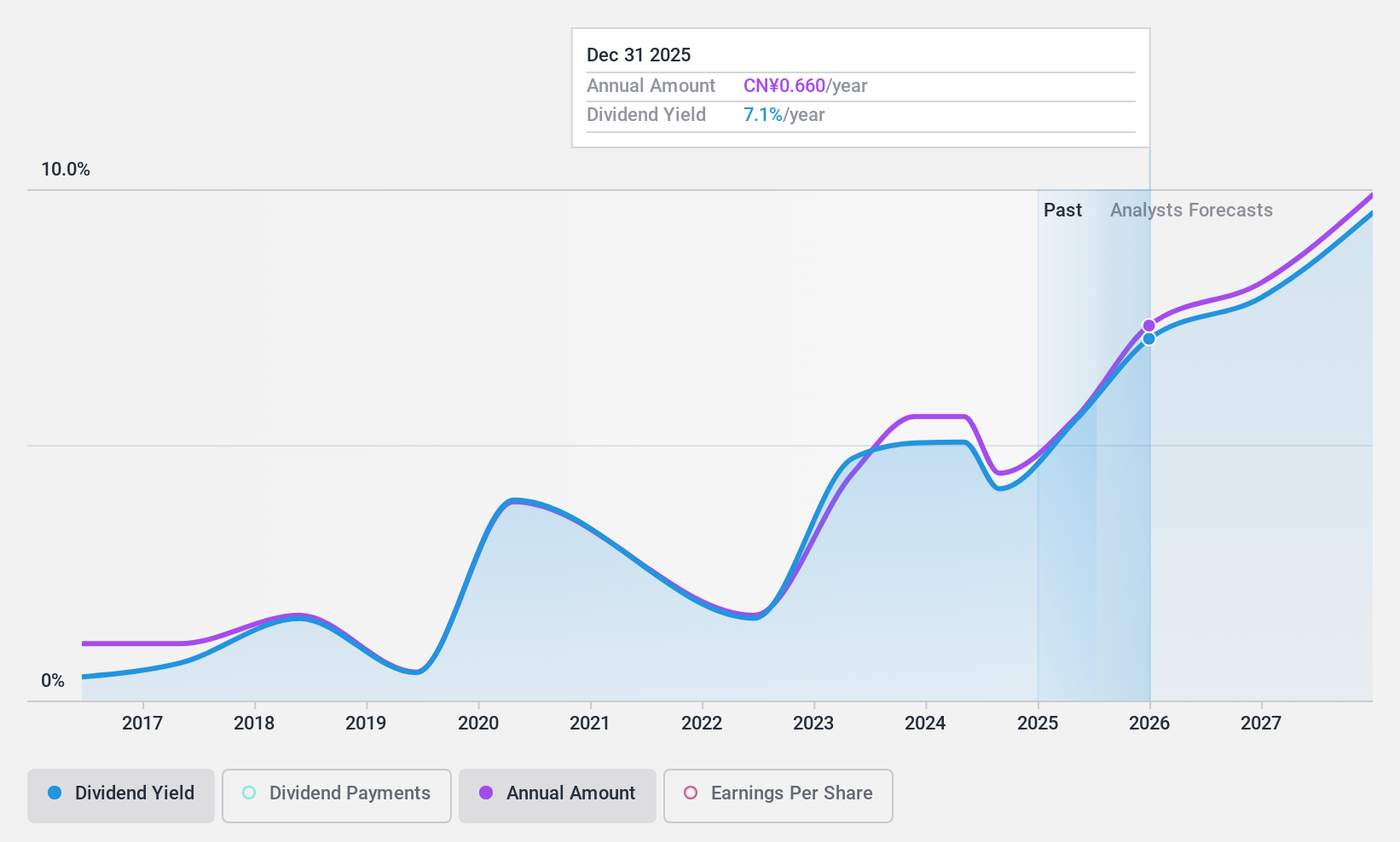

Zhejiang Jasan Holding Group (SHSE:603558)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Jasan Holding Group Co., Ltd. is involved in the design, manufacture, and sale of knitted sportswear globally and has a market cap of CN¥3.94 billion.

Operations: Zhejiang Jasan Holding Group Co., Ltd. generates its revenue primarily through the design, manufacture, and sale of knitted sportswear on a global scale.

Dividend Yield: 3.6%

Zhejiang Jasan Holding Group's dividend yield of 3.64% ranks it among the top 25% of Chinese dividend payers, yet its payments have been volatile and not consistently covered by free cash flows. While trading at a significant discount to fair value, recent earnings growth—net income rose to CNY 263.2 million for the nine months ending September 2024—offers some optimism despite past payout challenges and unreliable dividends over the last decade.

- Unlock comprehensive insights into our analysis of Zhejiang Jasan Holding Group stock in this dividend report.

- Our valuation report unveils the possibility Zhejiang Jasan Holding Group's shares may be trading at a discount.

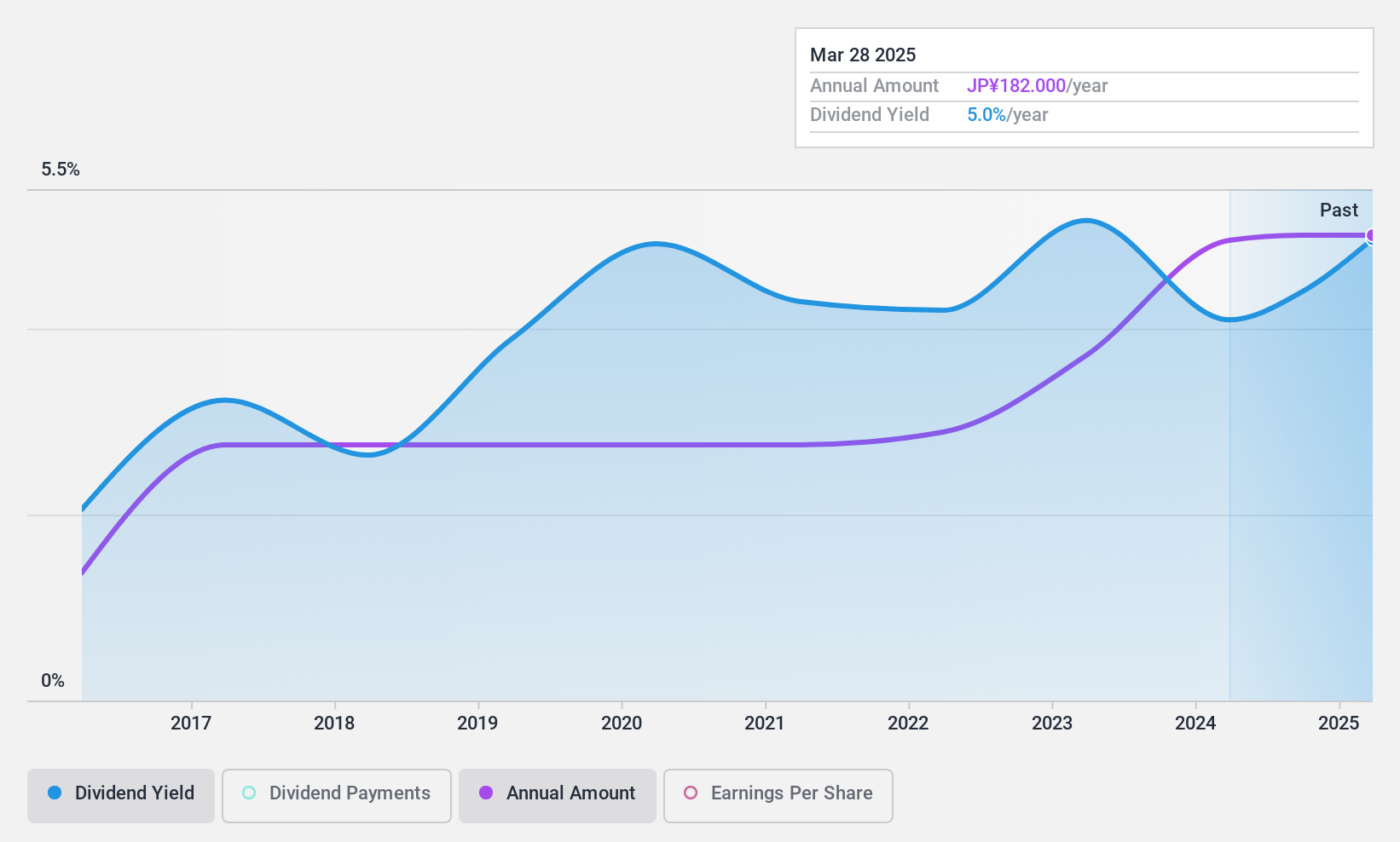

Toyo Kanetsu K.K (TSE:6369)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toyo Kanetsu K.K. operates in plant and machinery, material handling systems, and other businesses across Japan, Southeast Asia, and internationally with a market cap of ¥33.83 billion.

Operations: Toyo Kanetsu K.K. generates revenue through its operations in plant and machinery, as well as material handling systems, serving markets both domestically and abroad.

Dividend Yield: 4.2%

Toyo Kanetsu K.K.'s dividend yield of 4.15% places it in the top 25% of Japanese dividend payers, though past payments have been volatile with significant annual drops. Despite this, dividends are well covered by earnings and cash flows, with payout ratios at 37.1% and 42.4%, respectively. Trading significantly below its estimated fair value, recent earnings growth of 133.5% suggests potential for improved stability in future payouts despite historical volatility.

- Click here to discover the nuances of Toyo Kanetsu K.K with our detailed analytical dividend report.

- According our valuation report, there's an indication that Toyo Kanetsu K.K's share price might be on the cheaper side.

Summing It All Up

- Click through to start exploring the rest of the 1940 Top Dividend Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Jasan Holding Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603558

Zhejiang Jasan Holding Group

Engages in the manufacture and sale of knitted sportswear worldwide.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives