- Taiwan

- /

- Semiconductors

- /

- TWSE:6257

Undiscovered Gems with Promising Potential in November 2024

Reviewed by Simply Wall St

In November 2024, global markets are experiencing significant shifts as the U.S. sees a "red sweep" in its elections, leading to expectations of faster earnings growth and regulatory changes that have fueled a rally in major indices. The small-cap Russell 2000 Index has notably surged, reflecting renewed investor interest in smaller companies amidst these dynamic economic conditions. In this environment, identifying stocks with strong fundamentals and potential for growth becomes crucial, as investors seek opportunities that can thrive under evolving fiscal and regulatory landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Société Multinationale de Bitumes Société Anonyme | 54.45% | 24.68% | 23.10% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.63% | 22.92% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wema Bank | 53.09% | 32.38% | 56.06% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Aksa Enerji Üretim (IBSE:AKSEN)

Simply Wall St Value Rating: ★★★★☆☆

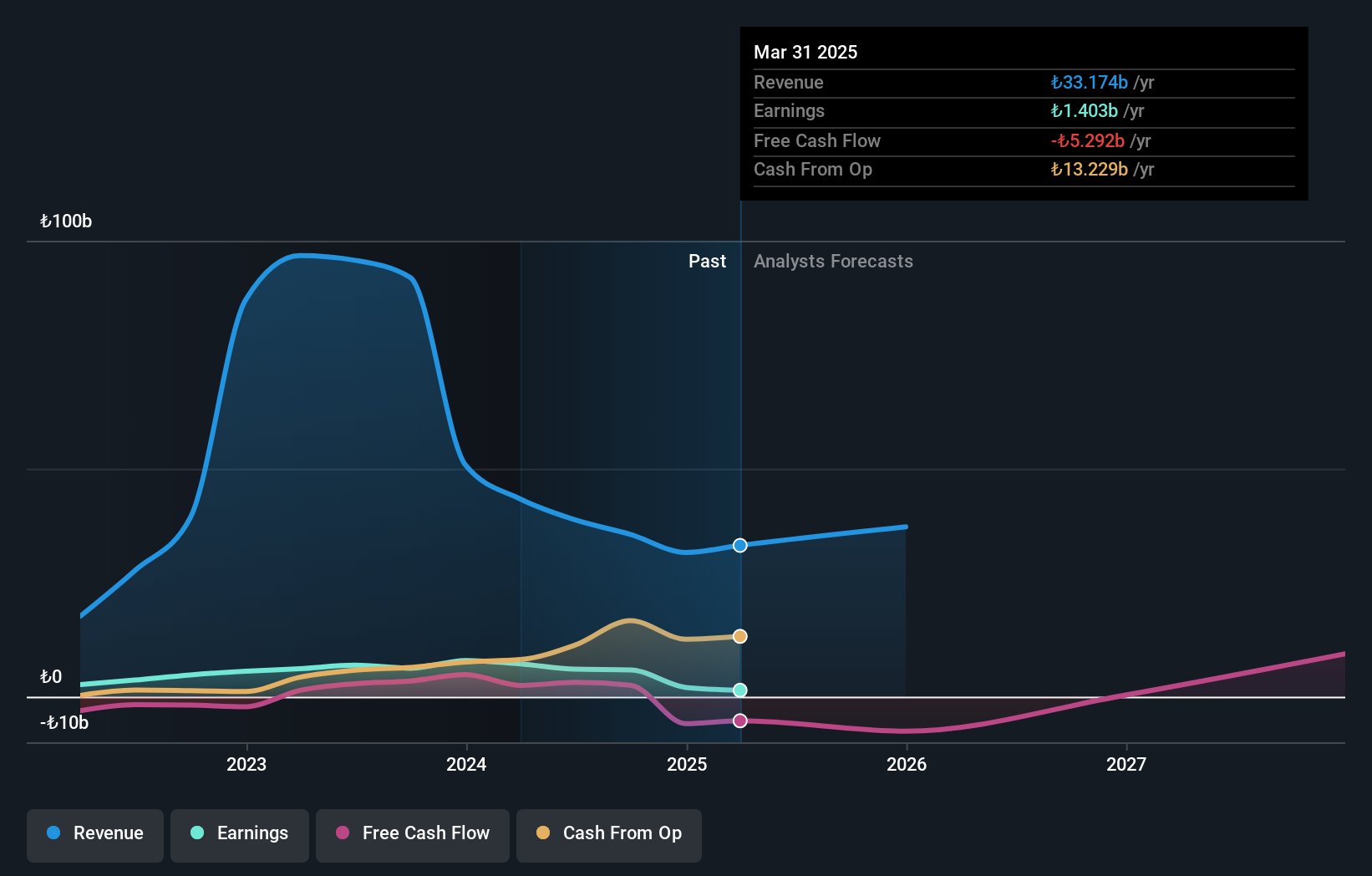

Overview: Aksa Enerji Üretim A.S. is an independent power producer that generates and sells electricity across Turkey, Asia, and Africa with a market capitalization of TRY40.71 billion.

Operations: Aksa Enerji Üretim generates revenue primarily from the production and sale of electricity across Turkey, Asia, and Africa. The company focuses on optimizing its operations to manage costs effectively. Notably, it has achieved a net profit margin of 9.5%, reflecting its ability to convert a portion of its revenues into profits efficiently.

Aksa Enerji, a company with potential yet facing challenges, has seen its debt to equity ratio improve from 158.5% to 57.5% over five years, suggesting better financial management. Despite this progress, it still carries a high net debt to equity ratio at 55.6%, and its earnings growth has been negative at -49.1% in the past year compared to the industry average of 74.4%. The firm's sales for Q3 were TRY 8.20 billion, down from TRY 11.39 billion the previous year, while net income decreased to TRY 660 million from TRY 805 million last year, reflecting ongoing hurdles in revenue generation despite high-quality past earnings and well-covered interest payments with EBIT coverage of 3.6 times interest repayments.

- Delve into the full analysis health report here for a deeper understanding of Aksa Enerji Üretim.

Explore historical data to track Aksa Enerji Üretim's performance over time in our Past section.

AUPU Intelligent Technology (SHSE:603551)

Simply Wall St Value Rating: ★★★★★☆

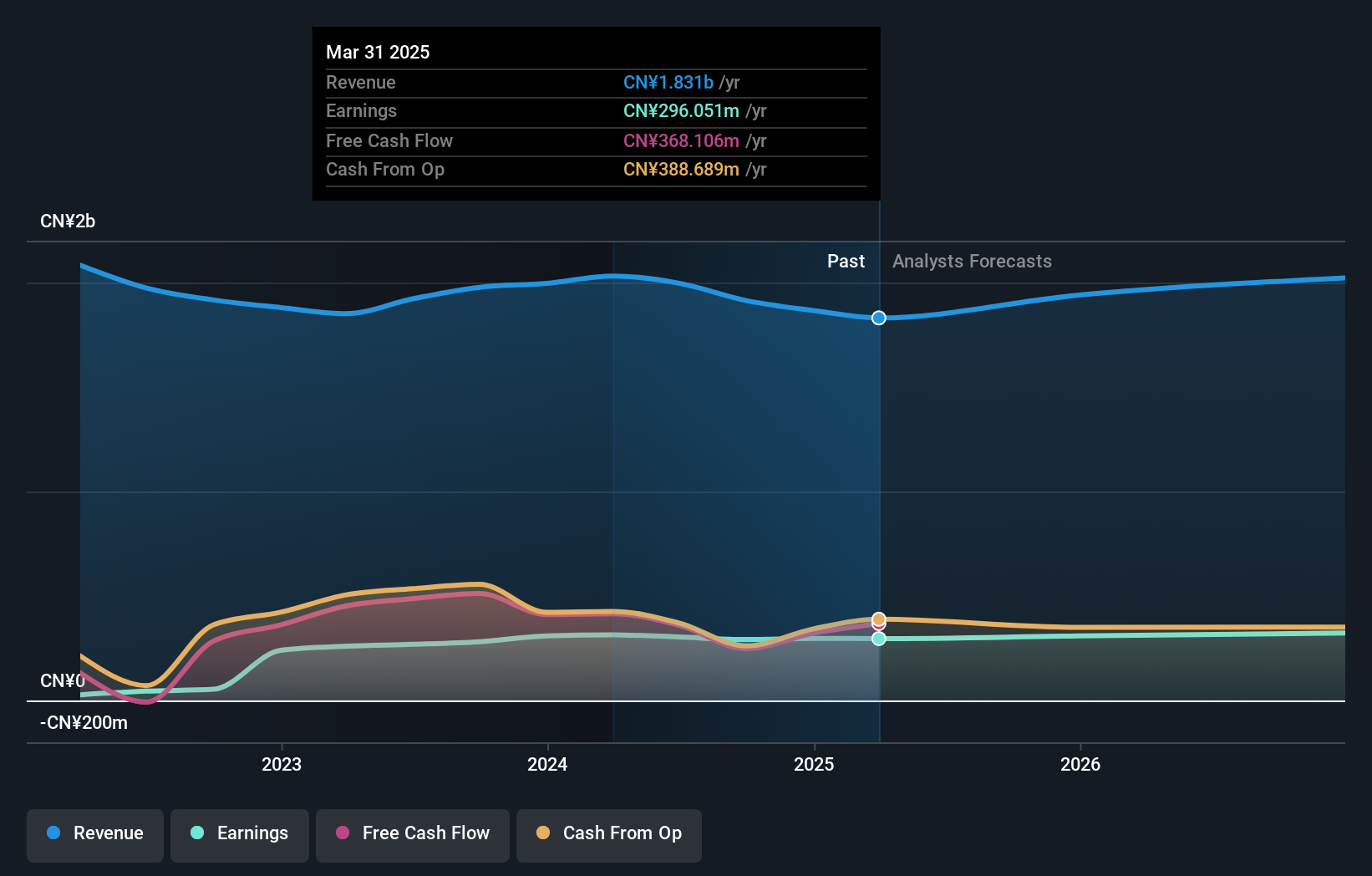

Overview: AUPU Intelligent Technology Corporation Limited focuses on the research and development, production, sales, and service of various household products in China, with a market capitalization of CN¥4.38 billion.

Operations: AUPU Intelligent Technology generates revenue primarily from the production and sale of household products in China. The company has a market capitalization of CN¥4.38 billion.

AUPU Intelligent Technology, a small player in the tech space, showcases a mixed financial picture. Over the past year, earnings grew by 3.6%, outpacing the Consumer Durables industry which saw a 2.1% contraction. With cash exceeding total debt and free cash flow remaining positive at CNY 247.72 million as of September 2024, financial health seems stable. Despite reporting lower sales and net income for nine months ending September 2024 compared to last year (CNY 1,288.52 million vs CNY 1,371.13 million), its price-to-earnings ratio stands attractively at 15x against the CN market's average of 36x suggesting good relative value potential for investors seeking growth opportunities within this sector.

- Click here to discover the nuances of AUPU Intelligent Technology with our detailed analytical health report.

Gain insights into AUPU Intelligent Technology's past trends and performance with our Past report.

Sigurd Microelectronics (TWSE:6257)

Simply Wall St Value Rating: ★★★★★☆

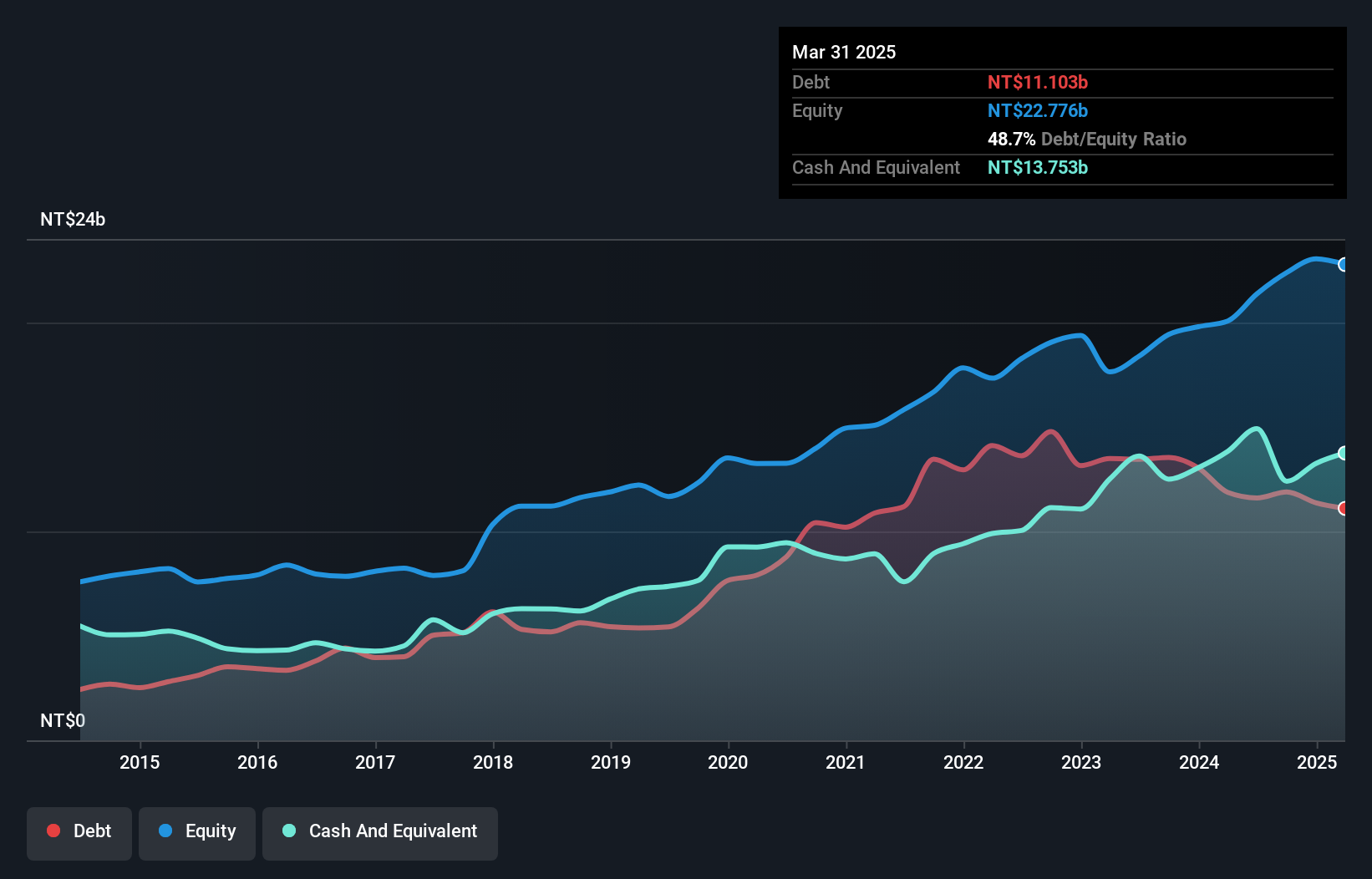

Overview: Sigurd Microelectronics Corporation, along with its subsidiaries, operates in the design, processing, testing, burn-in treatment, manufacture, and trading of integrated circuits (ICs) across Taiwan, Singapore, America, China and other international markets with a market capitalization of approximately NT$36.24 billion.

Operations: Sigurd Microelectronics generates revenue primarily from its Packaging and Testing Business, which accounts for NT$16.82 billion, while the Trading Business contributes NT$40.24 million.

Sigurd Microelectronics, a promising player in the semiconductor industry, has shown impressive earnings growth of 27% over the past year, surpassing the industry's 3.9%. Its price-to-earnings ratio of 14.5x is notably lower than Taiwan's market average of 21.5x, suggesting potential value for investors. The company is free cash flow positive with recent figures at US$4.43 billion as of June 2024 and maintains more cash than its total debt, indicating strong financial health despite shareholder dilution last year. Recent board changes aim to bolster risk management and governance, reflecting proactive corporate strategy adjustments amidst evolving market dynamics.

Make It Happen

- Embark on your investment journey to our 4664 Undiscovered Gems With Strong Fundamentals selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6257

Sigurd Microelectronics

Engages in the design, processing, testing, burn-in treatment, manufacture, and trading of integrated circuits (ICs) in Taiwan, Singapore, America, China, and internationally.

Solid track record with excellent balance sheet and pays a dividend.