Amid rising geopolitical tensions and trade-related concerns, Asian markets have experienced mixed performance, with some indices declining due to economic pressures, while others have shown resilience. In this environment of uncertainty, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiwan Union Technology (TPEX:6274) | NT$216.50 | NT$424.21 | 49% |

| StemCell Institute (TSE:7096) | ¥1070.00 | ¥2118.09 | 49.5% |

| Shenzhen KSTAR Science and Technology (SZSE:002518) | CN¥21.98 | CN¥43.55 | 49.5% |

| PixArt Imaging (TPEX:3227) | NT$219.50 | NT$436.51 | 49.7% |

| Peijia Medical (SEHK:9996) | HK$6.43 | HK$12.71 | 49.4% |

| Livero (TSE:9245) | ¥1719.00 | ¥3376.98 | 49.1% |

| Good Will Instrument (TWSE:2423) | NT$43.90 | NT$87.32 | 49.7% |

| Food & Life Companies (TSE:3563) | ¥6579.00 | ¥12942.09 | 49.2% |

| Dive (TSE:151A) | ¥917.00 | ¥1832.47 | 50% |

| cottaLTD (TSE:3359) | ¥442.00 | ¥866.08 | 49% |

We'll examine a selection from our screener results.

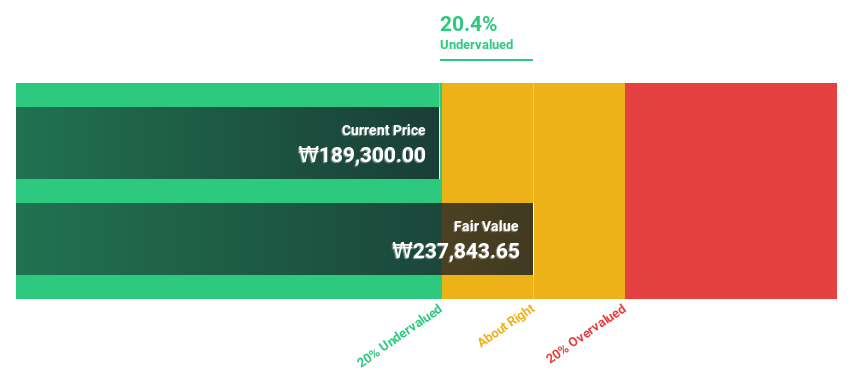

Celltrion (KOSE:A068270)

Overview: Celltrion, Inc. is a biopharmaceutical company focused on developing, producing, and selling therapeutic proteins for oncology treatments with a market cap of ₩35.78 trillion.

Operations: Celltrion generates revenue from its Biopharmaceutical segment, amounting to ₩6.18 trillion, and its Chemical Drugs segment, which contributes ₩523.71 million.

Estimated Discount To Fair Value: 15.6%

Celltrion appears undervalued based on cash flow analysis, trading at 15.6% below its estimated fair value of ₩191,807.09. Despite a modest undervaluation, the company shows promising growth prospects with earnings expected to grow significantly at 27.2% annually, outpacing the Korean market average of 21%. Recent strategic moves like share buybacks aim to enhance shareholder value while an expanded FDA designation for YUFLYMA® supports long-term revenue growth potential in biosimilars.

- The analysis detailed in our Celltrion growth report hints at robust future financial performance.

- Click here to discover the nuances of Celltrion with our detailed financial health report.

Akeso (SEHK:9926)

Overview: Akeso, Inc. is a biopharmaceutical company focused on the research, development, manufacture, and commercialization of antibody drugs globally, with a market cap of HK$88.73 billion.

Operations: The company's revenue primarily comes from the research, development, production, and sale of biopharmaceutical products, totaling CN¥2.12 billion.

Estimated Discount To Fair Value: 28.5%

Akeso is trading at HK$98.85, well below its estimated fair value of HK$138.35, suggesting undervaluation based on cash flows. The company is poised for significant growth with earnings forecasted to increase 58.28% annually and expected profitability within three years, surpassing market averages. Recent regulatory approvals for innovative treatments like cadonilimab and ivonescimab bolster Akeso's position in oncology, potentially driving revenue growth as these therapies address critical unmet needs in cancer treatment across China and internationally.

- Our earnings growth report unveils the potential for significant increases in Akeso's future results.

- Get an in-depth perspective on Akeso's balance sheet by reading our health report here.

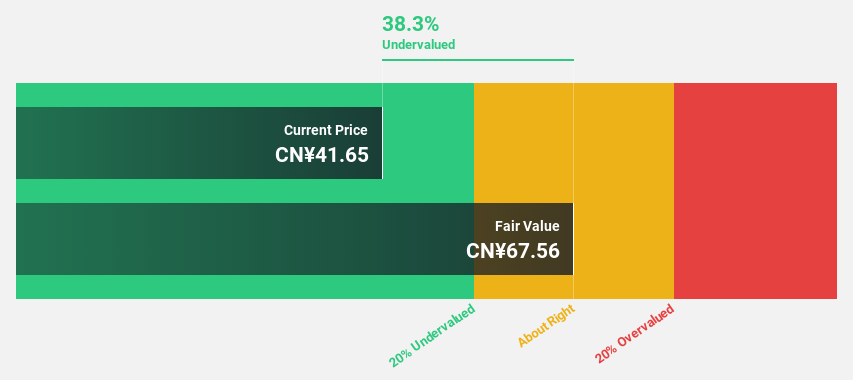

HMT (Xiamen) New Technical Materials (SHSE:603306)

Overview: HMT (Xiamen) New Technical Materials Co., Ltd. operates in the technical materials industry with a market cap of CN¥13.39 billion.

Operations: The company generates revenue from the Automobile Parts Manufacturing Industry, amounting to CN¥2.28 billion.

Estimated Discount To Fair Value: 34.5%

HMT (Xiamen) New Technical Materials is trading at CNY 40.69, significantly below its estimated fair value of CNY 62.09, indicating undervaluation based on cash flows. The company's earnings are projected to grow at 22.24% annually, outpacing the market's revenue growth rate of 12.4%. Recent developments include a private placement and share buyback program, which may enhance shareholder value despite a decrease in dividends and slower profit growth compared to the market average.

- Our comprehensive growth report raises the possibility that HMT (Xiamen) New Technical Materials is poised for substantial financial growth.

- Navigate through the intricacies of HMT (Xiamen) New Technical Materials with our comprehensive financial health report here.

Where To Now?

- Access the full spectrum of 292 Undervalued Asian Stocks Based On Cash Flows by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9926

Akeso

A biopharmaceutical company, engages in the research, development, manufacture, and commercialization of antibody drugs worldwide.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives