Zhejiang Cfmoto Power Co.,Ltd's (SHSE:603129) Low P/E No Reason For Excitement

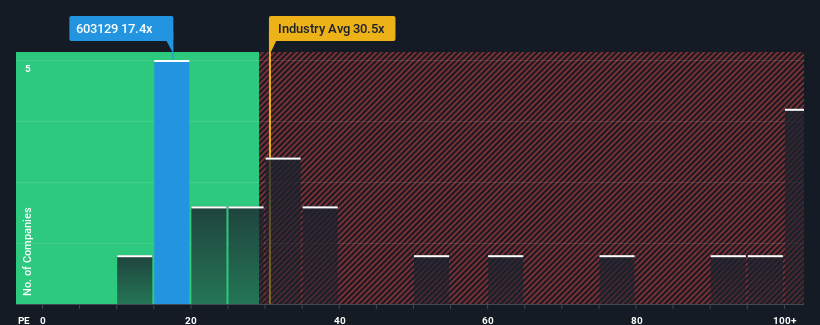

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 37x, you may consider Zhejiang Cfmoto Power Co.,Ltd (SHSE:603129) as a highly attractive investment with its 17.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Zhejiang Cfmoto PowerLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Zhejiang Cfmoto PowerLtd

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Zhejiang Cfmoto PowerLtd's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 37% gain to the company's bottom line. Pleasingly, EPS has also lifted 189% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 26% as estimated by the nine analysts watching the company. That's shaping up to be materially lower than the 39% growth forecast for the broader market.

In light of this, it's understandable that Zhejiang Cfmoto PowerLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Zhejiang Cfmoto PowerLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Zhejiang Cfmoto PowerLtd with six simple checks on some of these key factors.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Cfmoto PowerLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603129

Zhejiang Cfmoto PowerLtd

Engages in the research and development, production, and sales of all-terrain vehicles, motorcycles and leisure sports equipment worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives