- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1818

3 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets navigate mixed signals, with major U.S. stock indexes closing a strong year despite recent volatility and economic indicators like the Chicago PMI showing contraction, investors are increasingly focusing on identifying opportunities that may be undervalued amidst these fluctuations. In such an environment, a good stock is often characterized by its potential for growth relative to its current price, making it crucial for investors to assess whether certain stocks might be trading below their estimated value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Livero (TSE:9245) | ¥1565.00 | ¥3120.65 | 49.9% |

| Camden National (NasdaqGS:CAC) | US$42.01 | US$83.84 | 49.9% |

| Brickability Group (AIM:BRCK) | £0.626 | £1.25 | 49.8% |

| Decisive Dividend (TSXV:DE) | CA$6.00 | CA$11.94 | 49.8% |

| Zhaojin Mining Industry (SEHK:1818) | HK$11.72 | HK$23.44 | 50% |

| Brunel International (ENXTAM:BRNL) | €9.84 | €19.64 | 49.9% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.73 | €5.44 | 49.8% |

| Constellium (NYSE:CSTM) | US$10.47 | US$20.81 | 49.7% |

| Neosperience (BIT:NSP) | €0.572 | €1.14 | 49.8% |

| Vogo (ENXTPA:ALVGO) | €2.92 | €5.81 | 49.8% |

Here we highlight a subset of our preferred stocks from the screener.

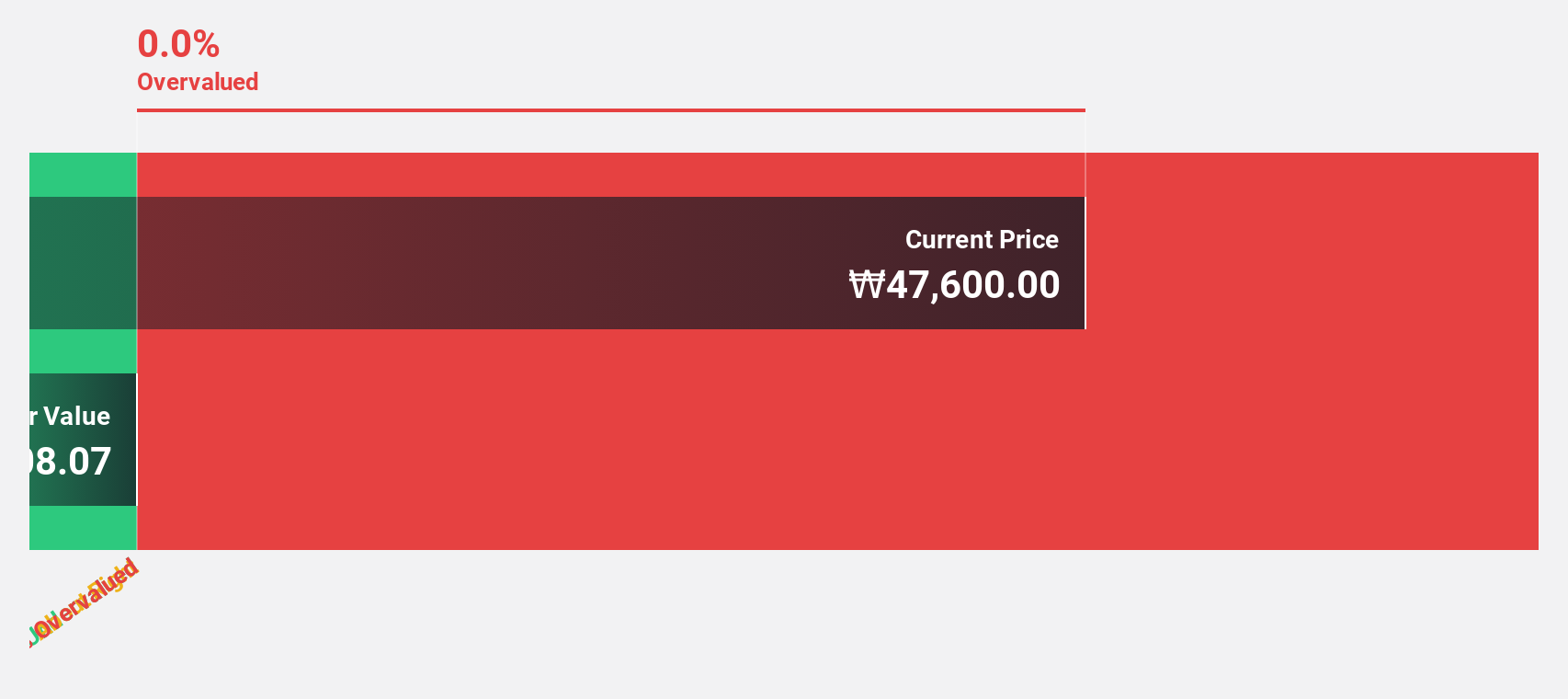

SK bioscienceLtd (KOSE:A302440)

Overview: SK bioscience Co., Ltd. focuses on the research, development, production, and distribution of vaccines and biopharmaceuticals both in Korea and internationally, with a market cap of approximately ₩3.99 trillion.

Operations: The company's revenue segment primarily comprises pharmaceuticals, generating approximately ₩201.30 billion.

Estimated Discount To Fair Value: 49.3%

SK bioscience is trading significantly below its estimated fair value, with a valuation 49.3% lower than anticipated. Despite past shareholder dilution, the company shows promising growth prospects, with earnings expected to increase by 57.59% annually and revenue projected to grow faster than the Korean market at 17.8% per year. Recent advancements in mRNA vaccine technology and international approvals for its influenza vaccine further bolster its potential for future profitability and market expansion.

- Our growth report here indicates SK bioscienceLtd may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of SK bioscienceLtd.

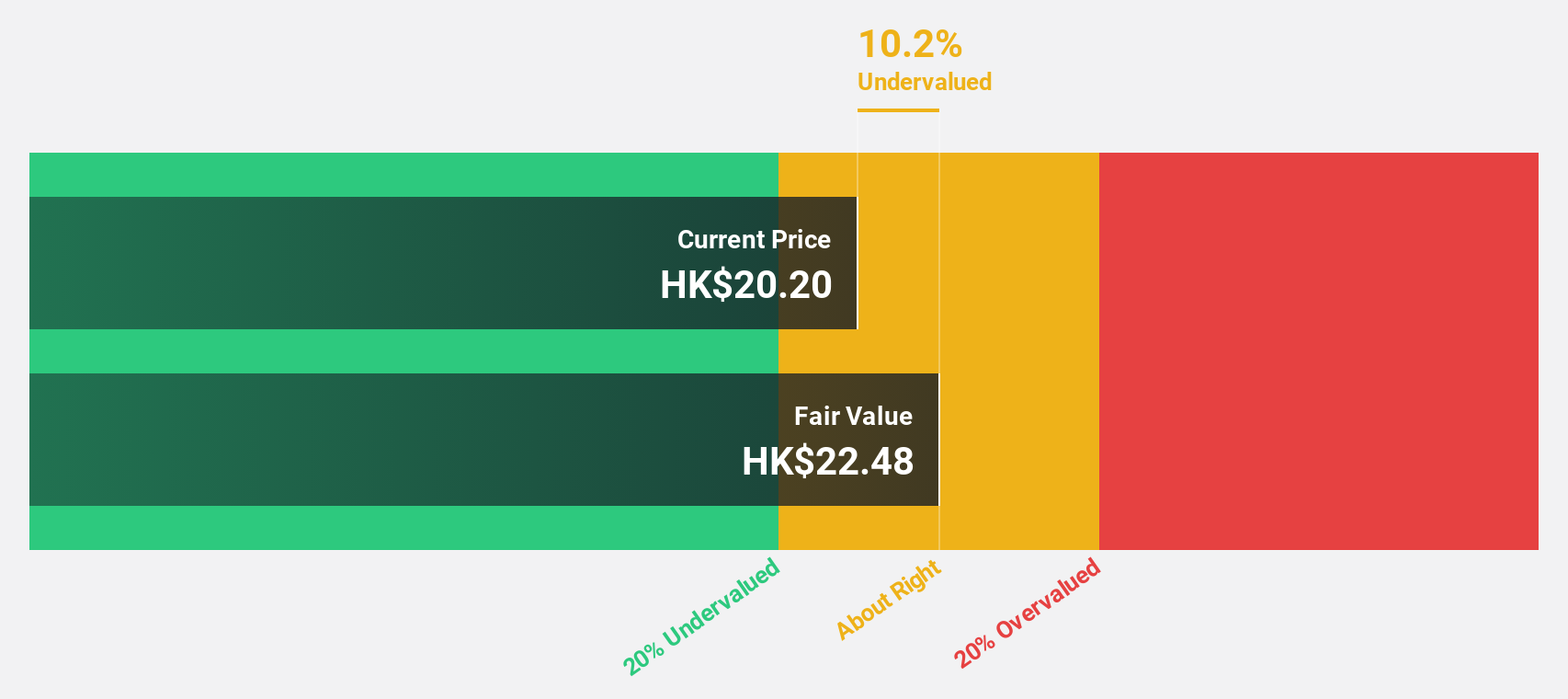

Zhaojin Mining Industry (SEHK:1818)

Overview: Zhaojin Mining Industry Company Limited is an investment holding company involved in the exploration, mining, processing, smelting, and sale of gold and silver products in the People’s Republic of China with a market cap of approximately HK$39.67 billion.

Operations: The company's revenue primarily derives from its activities in the exploration, mining, processing, smelting, and sale of gold and silver products within China.

Estimated Discount To Fair Value: 50%

Zhaojin Mining Industry is currently trading at a significant discount to its estimated fair value, with the stock price 50% below the projected HK$23.44. Despite previous shareholder dilution and low forecasted return on equity, the company demonstrates strong growth potential, with earnings expected to rise by 36.32% annually over three years. Recent agreements, such as the Finished Gold Sales Framework Agreement and strategic partnerships like Ruining Mining's establishment, further support its cash flow prospects.

- Insights from our recent growth report point to a promising forecast for Zhaojin Mining Industry's business outlook.

- Navigate through the intricacies of Zhaojin Mining Industry with our comprehensive financial health report here.

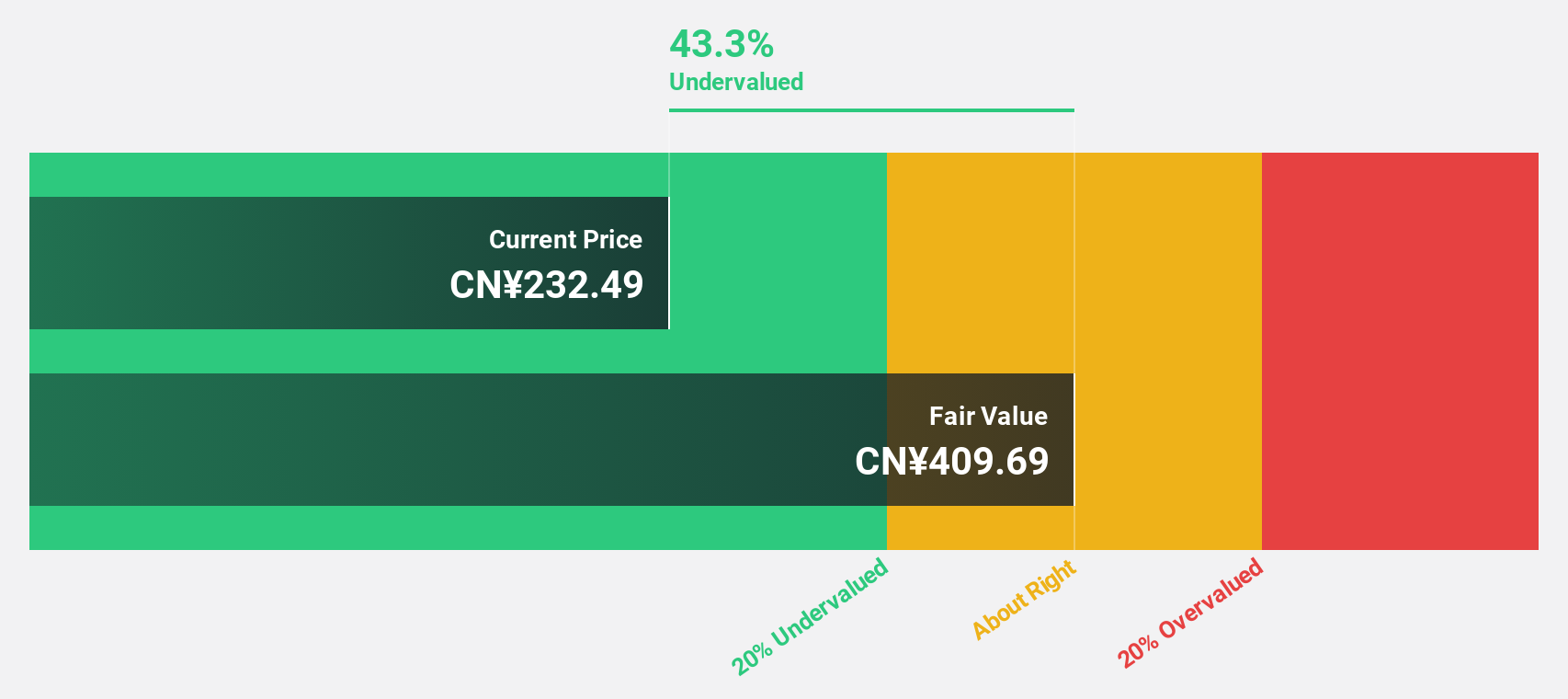

Zhejiang Cfmoto PowerLtd (SHSE:603129)

Overview: Zhejiang Cfmoto Power Co., Ltd is a global company that develops, manufactures, and markets motorcycles, all-terrain vehicles, side-by-side utility vehicles, powersports engines, gears, parts, and apparel and accessories with a market capitalization of approximately CN¥24.64 billion.

Operations: The company's revenue is derived from the development, manufacturing, and marketing of motorcycles, all-terrain vehicles, side-by-side utility vehicles, powersports engines, gears, parts, and apparel and accessories.

Estimated Discount To Fair Value: 49.1%

Zhejiang Cfmoto Power Ltd. is trading significantly below its estimated fair value of CN¥342.74, with a current price of CN¥174.59, highlighting potential undervaluation based on cash flows. The company reported strong financial performance for the nine months ending September 2024, with sales reaching CN¥11.45 billion and net income rising to CN¥1.08 billion from the previous year, supporting its robust earnings growth forecast of 22.34% annually over three years despite slower market growth expectations.

- Our expertly prepared growth report on Zhejiang Cfmoto PowerLtd implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Zhejiang Cfmoto PowerLtd.

Summing It All Up

- Click through to start exploring the rest of the 885 Undervalued Stocks Based On Cash Flows now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhaojin Mining Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1818

Zhaojin Mining Industry

An investment holding company, engages in exploration, mining, processing, smelting, and sale of gold and other metallic products in the People’s Republic of China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives