There's No Escaping Lao Feng Xiang Co., Ltd.'s (SHSE:600612) Muted Earnings

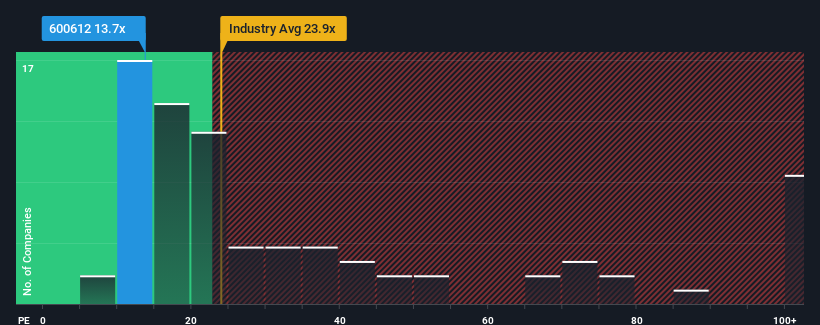

Lao Feng Xiang Co., Ltd.'s (SHSE:600612) price-to-earnings (or "P/E") ratio of 13.7x might make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 37x and even P/E's above 71x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Lao Feng Xiang has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Lao Feng Xiang

Is There Any Growth For Lao Feng Xiang?

The only time you'd be truly comfortable seeing a P/E as depressed as Lao Feng Xiang's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's bottom line. Regardless, EPS has managed to lift by a handy 9.4% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 9.1% as estimated by the twelve analysts watching the company. That's shaping up to be materially lower than the 38% growth forecast for the broader market.

With this information, we can see why Lao Feng Xiang is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Lao Feng Xiang's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Lao Feng Xiang's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Lao Feng Xiang with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Lao Feng Xiang's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600612

Lao Feng Xiang

Operates in the jewelry industry in the People's Republic of China and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives