Hubei Mailyard Share Co.,Ltd (SHSE:600107) Stock Rockets 29% As Investors Are Less Pessimistic Than Expected

Hubei Mailyard Share Co.,Ltd (SHSE:600107) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 32% over that time.

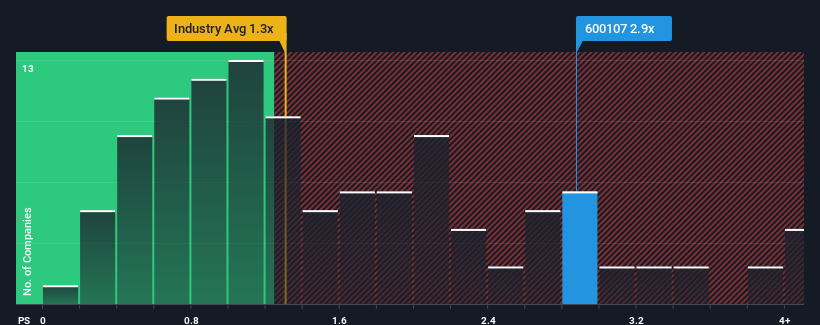

Since its price has surged higher, when almost half of the companies in China's Luxury industry have price-to-sales ratios (or "P/S") below 1.3x, you may consider Hubei Mailyard ShareLtd as a stock probably not worth researching with its 2.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Hubei Mailyard ShareLtd

What Does Hubei Mailyard ShareLtd's P/S Mean For Shareholders?

Revenue has risen firmly for Hubei Mailyard ShareLtd recently, which is pleasing to see. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Hubei Mailyard ShareLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Hubei Mailyard ShareLtd?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Hubei Mailyard ShareLtd's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. Revenue has also lifted 18% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 16% shows it's noticeably less attractive.

In light of this, it's alarming that Hubei Mailyard ShareLtd's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Hubei Mailyard ShareLtd's P/S?

Hubei Mailyard ShareLtd shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Hubei Mailyard ShareLtd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Having said that, be aware Hubei Mailyard ShareLtd is showing 2 warning signs in our investment analysis, and 1 of those is potentially serious.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hubei Mailyard ShareLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600107

Hubei Mailyard ShareLtd

Engages in manufacture, processing, and sale of clothes, apparel, textiles, and accessories in China and internationally.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives