- China

- /

- Electrical

- /

- SZSE:300153

Exploring Three Undiscovered Gems in Asia

Reviewed by Simply Wall St

Amid escalating geopolitical tensions and fluctuating trade dynamics, Asian markets have experienced mixed performances. As investors navigate these uncertainties, the search for promising opportunities continues, with a focus on small-cap stocks that may offer unique growth potential in this evolving landscape. Identifying a good stock often involves looking beyond current market volatility to uncover companies with strong fundamentals and innovative strategies that align well with broader economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| MSC | 30.39% | 6.56% | 14.62% | ★★★★★★ |

| New Asia Construction & Development | 50.47% | 7.81% | 34.50% | ★★★★★★ |

| Shenzhen Coship Electronics | NA | 8.20% | 44.45% | ★★★★★★ |

| Kung Sing Engineering | 13.45% | 2.65% | -51.67% | ★★★★★★ |

| JHT DesignLtd | 2.19% | 33.65% | -8.51% | ★★★★★★ |

| Tibet Development | 48.40% | -0.31% | 52.09% | ★★★★★★ |

| Guangdong Goworld | 27.20% | 1.38% | -9.57% | ★★★★★☆ |

| Tait Marketing & Distribution | 0.71% | 8.00% | 12.85% | ★★★★★☆ |

| Dong Fang Offshore | 29.10% | 42.34% | 42.27% | ★★★★★☆ |

| ASRock Rack Incorporation | 26.93% | 225.32% | 6287.64% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Shanghai Cooltech Power (SZSE:300153)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Cooltech Power Co., Ltd. is a Chinese company that manufactures and sells power generation equipment, with a market cap of CN¥9.78 billion.

Operations: The company generates revenue primarily from the sale of power generation equipment. It has a market capitalization of CN¥9.78 billion.

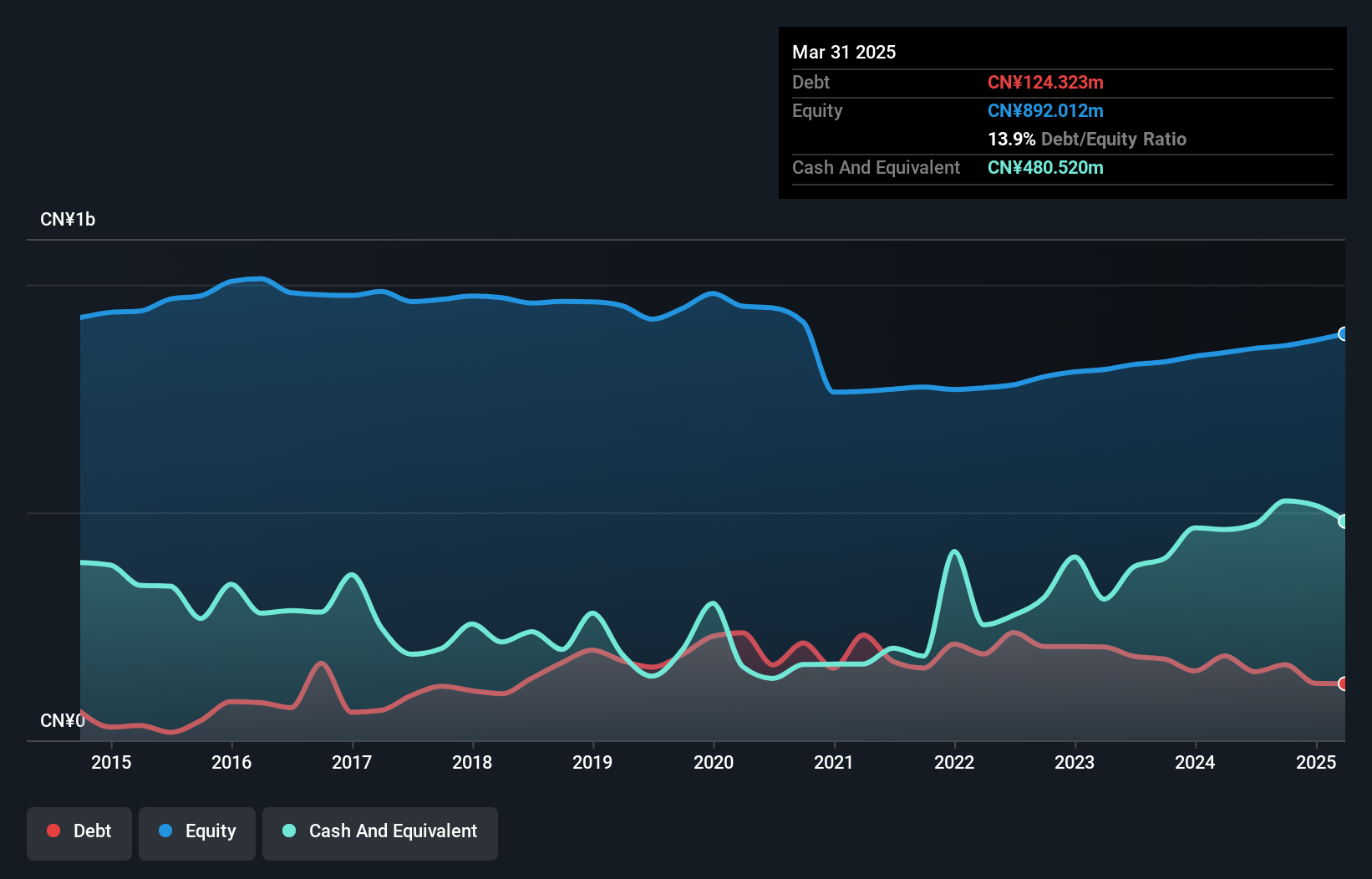

Shanghai Cooltech Power, a smaller player in the electrical industry, has been making waves with its impressive earnings growth of 19.4% over the past year, outpacing the industry's -1.4%. The company boasts high-quality earnings and a solid financial position with more cash than total debt, evidenced by a reduction in its debt to equity ratio from 24.8% to 13.9% over five years. Recent changes in company bylaws and shareholder activism suggest an evolving business strategy, while first-quarter sales surged to CNY 362.86 million from CNY 265.21 million last year, indicating robust operational performance and potential for future growth.

- Unlock comprehensive insights into our analysis of Shanghai Cooltech Power stock in this health report.

Understand Shanghai Cooltech Power's track record by examining our Past report.

Wuhan Tianyuan Group (SZSE:301127)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wuhan Tianyuan Group Co., Ltd. offers environmental treatment services and has a market cap of CN¥10.80 billion.

Operations: The company generates revenue primarily from environmental treatment services. It has a market cap of CN¥10.80 billion.

Wuhan Tianyuan Group, a nimble player in the Asian market, recently showcased robust earnings growth of 25.6%, surpassing industry averages. The company's net income for Q1 2025 reached CNY 50.24 million, up from CNY 26.63 million the previous year, reflecting its strong performance trajectory. With a price-to-earnings ratio of 30x, it presents good value compared to the broader CN market's average of 38x. Despite an increased debt-to-equity ratio from 28% to 75% over five years, interest payments are well-covered at a multiple of nearly eight times EBIT, indicating financial stability amidst expansion efforts and strategic share repurchases valued at up to CNY 200 million.

- Click to explore a detailed breakdown of our findings in Wuhan Tianyuan Group's health report.

Evaluate Wuhan Tianyuan Group's historical performance by accessing our past performance report.

V5 Technologies (TPEX:7822)

Simply Wall St Value Rating: ★★★★★★

Overview: V5 Technologies Co., Ltd. specializes in providing AI solutions for semiconductor manufacturing and health and medical care, with a market capitalization of NT$14.26 billion.

Operations: V5 Technologies generates revenue primarily from its Semiconductor Equipment and Services segment, which accounts for NT$721.10 million.

V5 Technologies, a nimble player in the tech sector, has recently turned profitable, outpacing the semiconductor industry's growth rate of 10.8%. The company boasts high-quality earnings and remains debt-free for five years, eliminating concerns over interest payments. Despite a volatile share price in recent months, V5's financial health is underscored by positive free cash flow as of June 2025 at US$13.33 million and significant capital expenditure at US$37.92 million last year. This financial agility positions V5 well within its industry context while highlighting potential for future expansion or value creation.

- Click here and access our complete health analysis report to understand the dynamics of V5 Technologies.

Assess V5 Technologies' past performance with our detailed historical performance reports.

Summing It All Up

- Discover the full array of 2621 Asian Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300153

Shanghai Cooltech Power

Manufactures and sells power generation equipment in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives