- China

- /

- Commercial Services

- /

- SZSE:301127

Wuhan Tianyuan Environmental Protection Co.,LTD's (SZSE:301127) Share Price Boosted 40% But Its Business Prospects Need A Lift Too

Wuhan Tianyuan Environmental Protection Co.,LTD (SZSE:301127) shareholders have had their patience rewarded with a 40% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 59% in the last year.

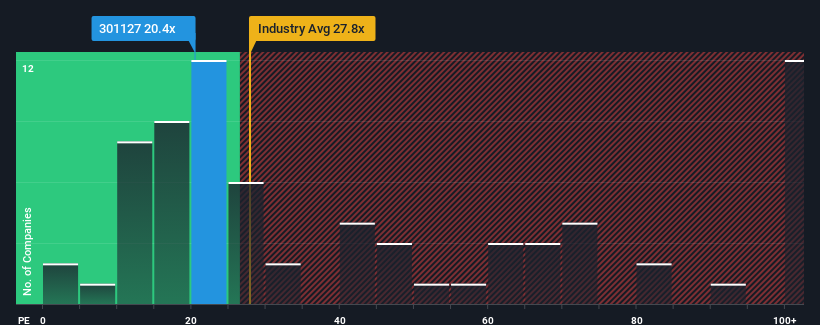

Even after such a large jump in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 34x, you may still consider Wuhan Tianyuan Environmental ProtectionLTD as an attractive investment with its 20.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's exceedingly strong of late, Wuhan Tianyuan Environmental ProtectionLTD has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Wuhan Tianyuan Environmental ProtectionLTD

Is There Any Growth For Wuhan Tianyuan Environmental ProtectionLTD?

Wuhan Tianyuan Environmental ProtectionLTD's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered an exceptional 62% gain to the company's bottom line. Pleasingly, EPS has also lifted 78% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 37% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Wuhan Tianyuan Environmental ProtectionLTD's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Despite Wuhan Tianyuan Environmental ProtectionLTD's shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Wuhan Tianyuan Environmental ProtectionLTD revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Wuhan Tianyuan Environmental ProtectionLTD (1 shouldn't be ignored!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Wuhan Tianyuan Environmental ProtectionLTD, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Tianyuan Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301127

Low risk with imperfect balance sheet.

Market Insights

Community Narratives