- China

- /

- Commercial Services

- /

- SZSE:301049

Risks Still Elevated At These Prices As Anhui Chaoyue Environmental Protection Technology Co., Ltd. (SZSE:301049) Shares Dive 32%

The Anhui Chaoyue Environmental Protection Technology Co., Ltd. (SZSE:301049) share price has softened a substantial 32% over the previous 30 days, handing back much of the gains the stock has made lately. Longer-term shareholders would now have taken a real hit with the stock declining 4.7% in the last year.

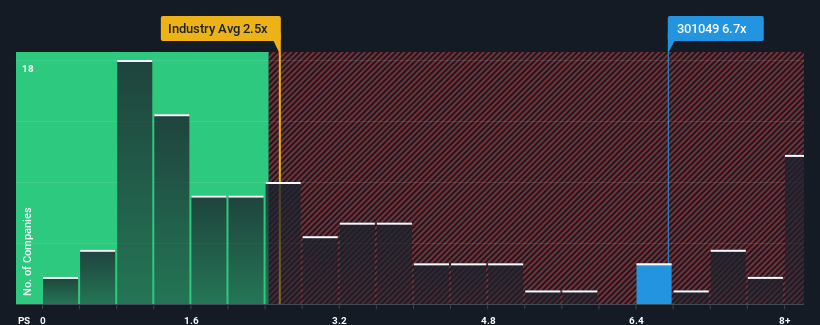

Although its price has dipped substantially, when almost half of the companies in China's Commercial Services industry have price-to-sales ratios (or "P/S") below 2.5x, you may still consider Anhui Chaoyue Environmental Protection Technology as a stock not worth researching with its 6.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Anhui Chaoyue Environmental Protection Technology

What Does Anhui Chaoyue Environmental Protection Technology's Recent Performance Look Like?

Anhui Chaoyue Environmental Protection Technology has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Anhui Chaoyue Environmental Protection Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Anhui Chaoyue Environmental Protection Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Anhui Chaoyue Environmental Protection Technology would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 30% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 13% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 30% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Anhui Chaoyue Environmental Protection Technology is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From Anhui Chaoyue Environmental Protection Technology's P/S?

A significant share price dive has done very little to deflate Anhui Chaoyue Environmental Protection Technology's very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Anhui Chaoyue Environmental Protection Technology currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Anhui Chaoyue Environmental Protection Technology that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301049

Anhui Chaoyue Environmental Protection Technology

Anhui Chaoyue Environmental Protection Technology Co., Ltd.

Adequate balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success