- China

- /

- Commercial Services

- /

- SZSE:300815

EIT Environmental Development Group Co.,Ltd (SZSE:300815) Shares Fly 41% But Investors Aren't Buying For Growth

The EIT Environmental Development Group Co.,Ltd (SZSE:300815) share price has done very well over the last month, posting an excellent gain of 41%. Notwithstanding the latest gain, the annual share price return of 6.2% isn't as impressive.

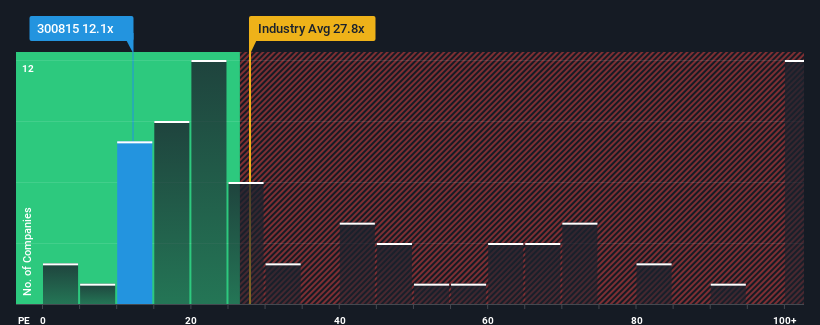

Although its price has surged higher, EIT Environmental Development GroupLtd's price-to-earnings (or "P/E") ratio of 12.1x might still make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 34x and even P/E's above 64x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

EIT Environmental Development GroupLtd's negative earnings growth of late has neither been better nor worse than most other companies. It might be that many expect the company's earnings performance to degrade further, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. At the very least, you'd be hoping that earnings don't fall off a cliff if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for EIT Environmental Development GroupLtd

How Is EIT Environmental Development GroupLtd's Growth Trending?

In order to justify its P/E ratio, EIT Environmental Development GroupLtd would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 1.6%. As a result, earnings from three years ago have also fallen 11% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 17% per year during the coming three years according to the four analysts following the company. That's shaping up to be materially lower than the 19% per annum growth forecast for the broader market.

In light of this, it's understandable that EIT Environmental Development GroupLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Even after such a strong price move, EIT Environmental Development GroupLtd's P/E still trails the rest of the market significantly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of EIT Environmental Development GroupLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for EIT Environmental Development GroupLtd (1 is potentially serious!) that you should be aware of.

If these risks are making you reconsider your opinion on EIT Environmental Development GroupLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if EIT Environmental Development GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300815

EIT Environmental Development GroupLtd

Provides municipal environmental sanitation services in China.

Adequate balance sheet and fair value.

Market Insights

Community Narratives