Stock Analysis

- China

- /

- Commercial Services

- /

- SZSE:000010

Even after rising 21% this past week, Shenzhen Ecobeauty (SZSE:000010) shareholders are still down 55% over the past three years

Shenzhen Ecobeauty Co., Ltd. (SZSE:000010) shareholders should be happy to see the share price up 21% in the last week. Meanwhile over the last three years the stock has dropped hard. Regrettably, the share price slid 55% in that period. Some might say the recent bounce is to be expected after such a bad drop. While many would remain nervous, there could be further gains if the business can put its best foot forward.

On a more encouraging note the company has added CN¥356m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

View our latest analysis for Shenzhen Ecobeauty

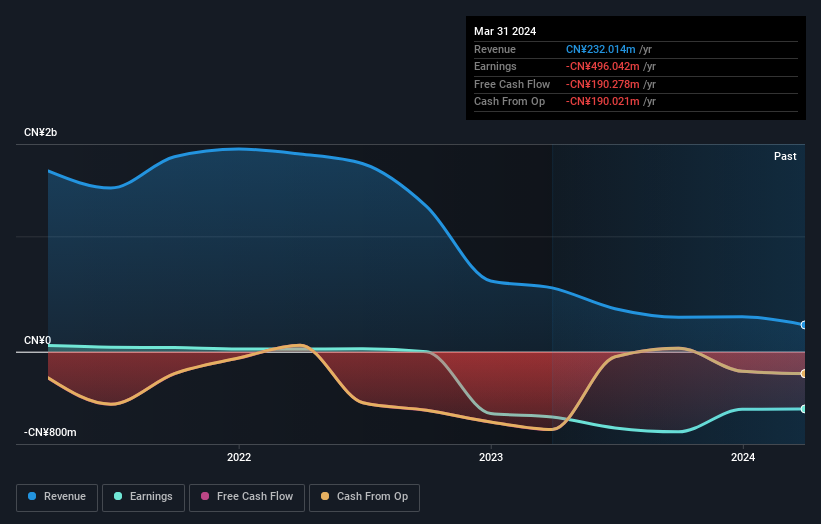

Shenzhen Ecobeauty isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, Shenzhen Ecobeauty's revenue dropped 57% per year. That means its revenue trend is very weak compared to other loss making companies. With no profits and falling revenue it is no surprise that investors have been dumping the stock, pushing the price down by 16% per year over that time. Bagholders or 'baggies' are people who buy more of a stock as the price collapses. They are then left 'holding the bag' if the shares turn out to be worthless. After losing money on a declining business with falling stock price, we always consider whether eager bagholders are still offering us a reasonable exit price.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Shenzhen Ecobeauty's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Shenzhen Ecobeauty shareholders are down 15% over twelve months, which isn't far from the market return of -14%. Unfortunately, last year's performance is a deterioration of an already poor long term track record, given the loss of 8% per year over the last five years. It will probably take a substantial improvement in the fundamental performance for the company to reverse this trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with Shenzhen Ecobeauty (including 2 which are concerning) .

But note: Shenzhen Ecobeauty may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Shenzhen Ecobeauty is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Shenzhen Ecobeauty is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000010

Shenzhen Ecobeauty

Engages in the civil engineering and construction business.

Overvalued with worrying balance sheet.