Stock Analysis

Unveiling Three Leading Growth Companies With High Insider Ownership On The Chinese Exchange

Reviewed by Simply Wall St

As global markets navigate through varying economic signals, China's mixed data on industrial production and retail sales reflect a nuanced landscape for investors. In such an environment, examining growth companies with high insider ownership can offer valuable insights into firms potentially poised for resilience and informed strategic direction.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.5% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

| Eoptolink Technology (SZSE:300502) | 26.7% | 39.1% |

| UTour Group (SZSE:002707) | 24% | 33.1% |

| Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

Let's take a closer look at a couple of our picks from the screened companies.

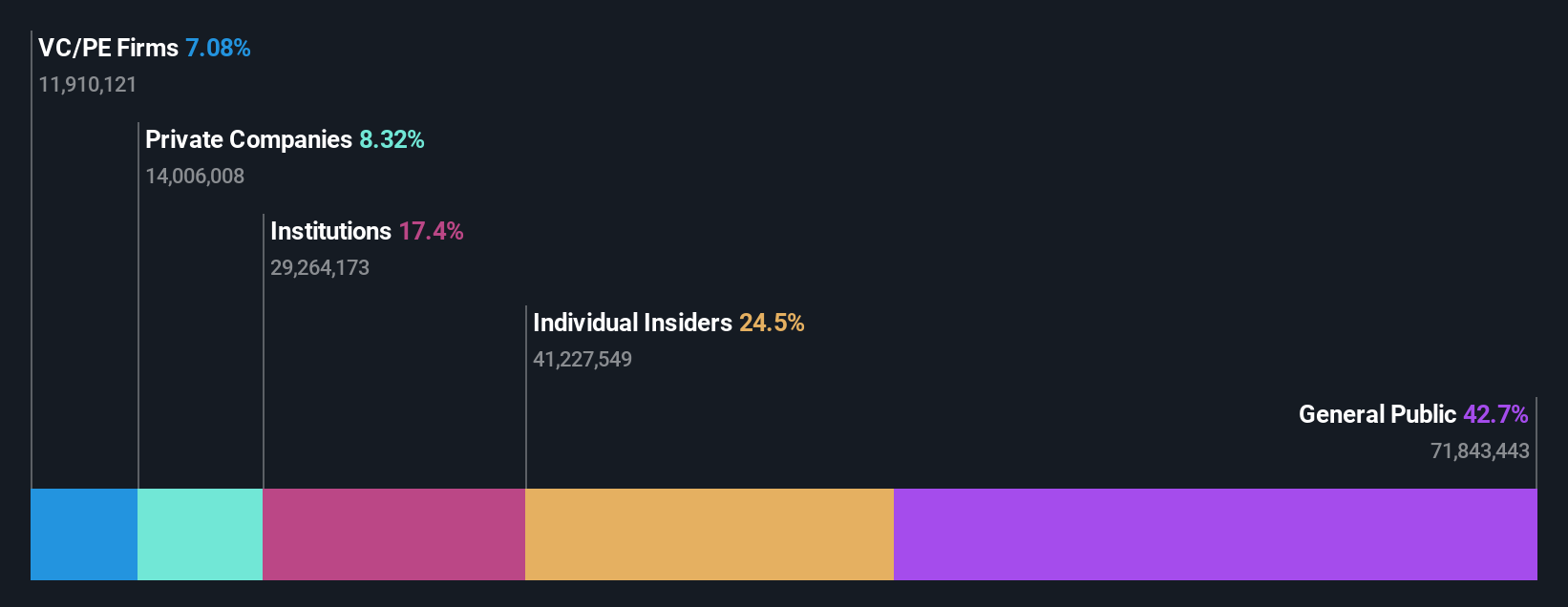

Wangli Security & Surveillance Product (SHSE:605268)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wangli Security & Surveillance Product Co., Ltd specializes in the research, development, manufacturing, sales, and service of safety doors and security door locks, with a market capitalization of approximately CN¥3.11 billion.

Operations: The company generates revenue through the development, production, and sale of safety doors and security door locks.

Insider Ownership: 10.2%

Revenue Growth Forecast: 19.5% p.a.

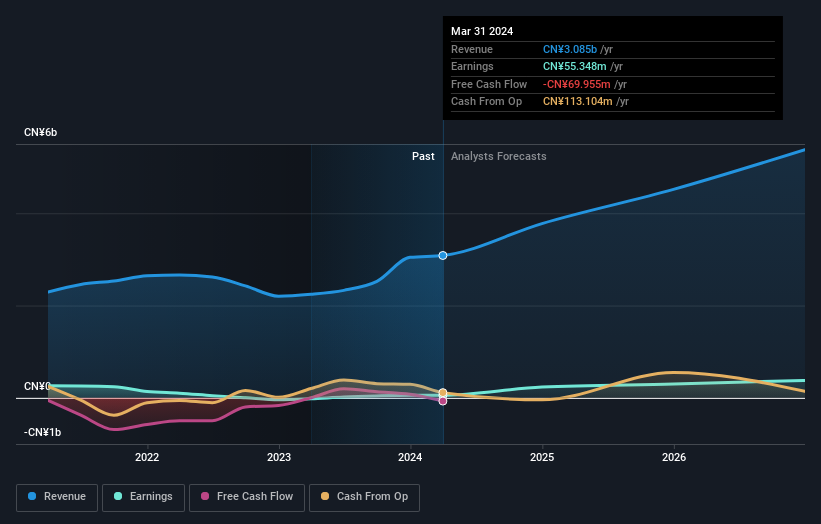

Wangli Security & Surveillance Product Co., Ltd recently turned profitable, with a significant jump in annual revenue from CNY 2.20 billion to CNY 3.04 billion and a shift from a net loss to a net income of CNY 54.64 million. Earnings are expected to grow by 45% annually, outpacing the Chinese market's average. Despite this robust growth and high insider ownership, the company's dividend coverage is weak, reflecting potential cash flow concerns amidst its expansion efforts.

- Delve into the full analysis future growth report here for a deeper understanding of Wangli Security & Surveillance Product.

- Insights from our recent valuation report point to the potential overvaluation of Wangli Security & Surveillance Product shares in the market.

Bestechnic (Shanghai) (SHSE:688608)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bestechnic (Shanghai) Co., Ltd. specializes in the research, design, development, manufacture, and sale of smart audio and video SoC chips, with a market capitalization of approximately CN¥17.22 billion.

Operations: The company generates revenue primarily from its integrated circuit segment, totaling CN¥2.45 billion.

Insider Ownership: 25.7%

Revenue Growth Forecast: 21.9% p.a.

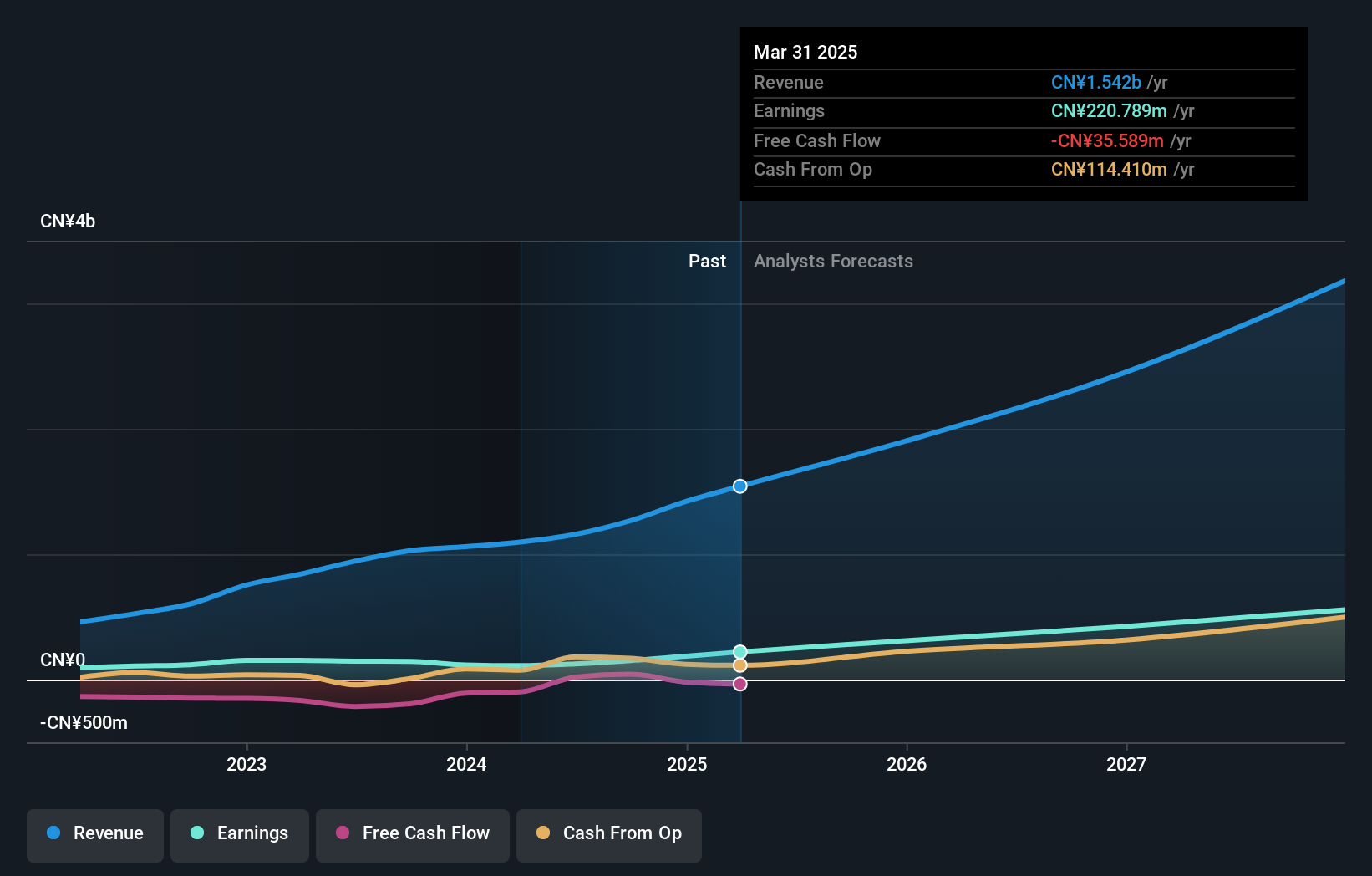

Bestechnic (Shanghai) Co., Ltd. has shown robust financial improvement, transitioning from a net loss to a profit with its latest quarterly earnings reaching CNY 27.6 million, up from a previous loss. Revenue nearly doubled to CNY 653.19 million, supported by substantial share buybacks totaling CNY 51.01 million. Despite these gains, the company's forecasted return on equity remains modest at 6.7%. However, both revenue and earnings are expected to grow significantly over the next three years, outstripping broader market averages in China.

- Navigate through the intricacies of Bestechnic (Shanghai) with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Bestechnic (Shanghai) is trading beyond its estimated value.

Xi'an Sinofuse Electric (SZSE:301031)

Simply Wall St Growth Rating: ★★★★★★

Overview: Xi'an Sinofuse Electric Co., Ltd. specializes in the research, development, production, and sale of circuit protection devices and fuses, with a market capitalization of approximately CN¥5.51 billion.

Operations: The company generates its revenue from the sale of circuit protection devices and fuses.

Insider Ownership: 36.8%

Revenue Growth Forecast: 28.8% p.a.

Xi'an Sinofuse Electric Co., Ltd. is experiencing solid growth with revenue and earnings forecast to increase by 28.8% and 43.1% per year, respectively, outpacing the broader Chinese market rates of 13.7% and 22.2%. Despite high insider ownership indicating confidence, profit margins have decreased from 18.2% to 10.2%, raising concerns about future profitability sustainability amidst aggressive expansion plans confirmed at recent shareholder meetings where dividends were also affirmed.

- Unlock comprehensive insights into our analysis of Xi'an Sinofuse Electric stock in this growth report.

- Our valuation report unveils the possibility Xi'an Sinofuse Electric's shares may be trading at a premium.

Next Steps

- Unlock more gems! Our Fast Growing Chinese Companies With High Insider Ownership screener has unearthed 364 more companies for you to explore.Click here to unveil our expertly curated list of 367 Fast Growing Chinese Companies With High Insider Ownership.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Wangli Security & Surveillance Product is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605268

Wangli Security & Surveillance Product

Engages in the research, development, manufacturing, sells, and service of safety doors and security door locks.

Reasonable growth potential with adequate balance sheet.