Discovering Undiscovered Gems With Potential In January 2025

Reviewed by Simply Wall St

As we approach January 2025, global markets have been navigating a landscape marked by fluctuating consumer confidence and mixed economic indicators. While major stock indices like the S&P 500 and Nasdaq Composite have shown moderate gains, concerns about declining durable goods orders and rising unemployment claims underscore the importance of careful stock selection in this complex environment. In such times, identifying undiscovered gems—stocks with strong fundamentals that remain underappreciated by the market—can offer unique opportunities for investors looking to diversify their portfolios amidst broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| L&K Engineering | 14.36% | 37.26% | 54.49% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Forest Packaging GroupLtd | 17.72% | 2.87% | -6.03% | ★★★★★★ |

| An Phat Bioplastics | 58.77% | 10.41% | -1.47% | ★★★★★★ |

| AuMas Resources Berhad | NA | 14.09% | 57.21% | ★★★★★★ |

| Shandong Boyuan Pharmaceutical & Chemical | NA | 28.20% | 32.92% | ★★★★★★ |

| Tibet Development | 51.47% | -1.07% | 56.62% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Vietnam Container Shipping | 47.45% | 7.52% | -7.54% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

C&D Holsin Engineering Consulting (SHSE:603909)

Simply Wall St Value Rating: ★★★★★★

Overview: C&D Holsin Engineering Consulting Co., Ltd provides engineering and technical services in China and has a market capitalization of CN¥2.39 billion.

Operations: C&D Holsin Engineering Consulting generates revenue primarily through its engineering and technical services in China. The company's financial data reveals a market capitalization of CN¥2.39 billion, indicating its scale within the industry.

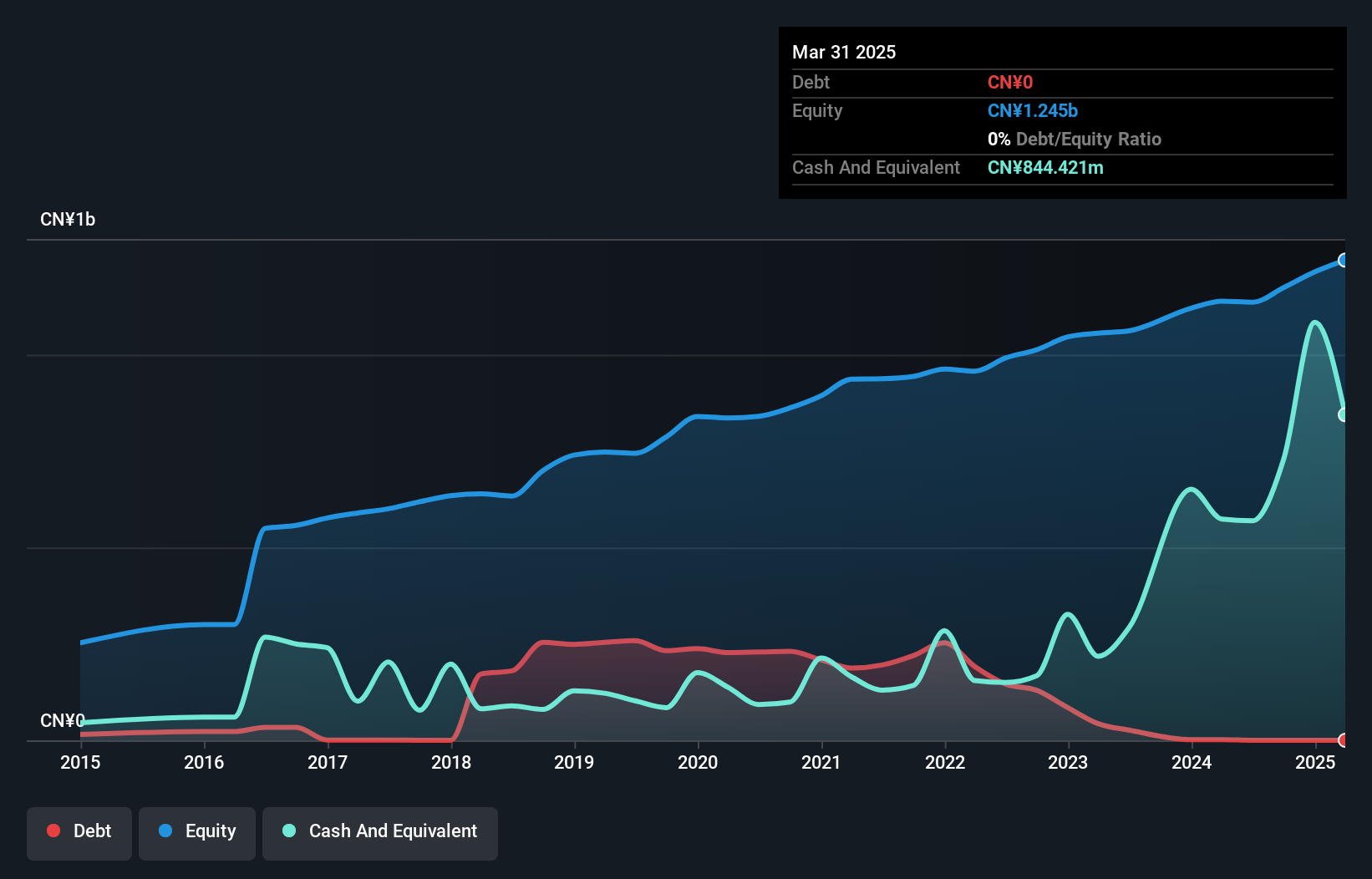

C&D Holsin Engineering Consulting shines with its impressive earnings growth of 66.1% over the past year, outpacing the Professional Services industry, which saw a -2.8% change. Despite a dip in profit margins to 1.5% from last year's 2.3%, it's trading at a significant discount—74.2% below estimated fair value—making it an intriguing option for investors seeking undervalued opportunities. The company is debt-free now, having reduced its debt to equity ratio from 29.5% five years ago, and maintains positive free cash flow, reflecting robust financial health and operational efficiency without concerns over interest payments or cash runway issues.

DongGuan Winnerway Industry Zone (SZSE:000573)

Simply Wall St Value Rating: ★★★★☆☆

Overview: DongGuan Winnerway Industry Zone LTD. operates in the real estate development sector in China, with a market capitalization of CN¥1.91 billion.

Operations: Winnerway Industry Zone generates revenue primarily from its real estate development activities in China. The company's financial performance is influenced by its net profit margin, which reflects the efficiency of its operations and cost management.

DongGuan Winnerway Industry Zone, a smaller player in its sector, has shown some promising signs recently. The company reported a significant increase in sales for the nine months ending September 2024, reaching ¥416.83 million from ¥272.08 million the previous year. Despite this growth, it recorded a net loss of ¥38.76 million, an improvement from the previous year's loss of ¥68.31 million. Its price-to-earnings ratio stands at 20x, which is below the broader CN market average of 34.8x, suggesting potential value for investors seeking opportunities in emerging markets with high-quality earnings despite ongoing challenges.

Wenzhou Yuanfei pet toy products (SZSE:001222)

Simply Wall St Value Rating: ★★★★★★

Overview: Wenzhou Yuanfei Pet Toy Products Co., Ltd. is a company specializing in the design, manufacture, and sale of pet toys, with a market cap of CN¥2.98 billion.

Operations: The company generates revenue through the design, manufacture, and sale of pet toys. It has a market capitalization of CN¥2.98 billion.

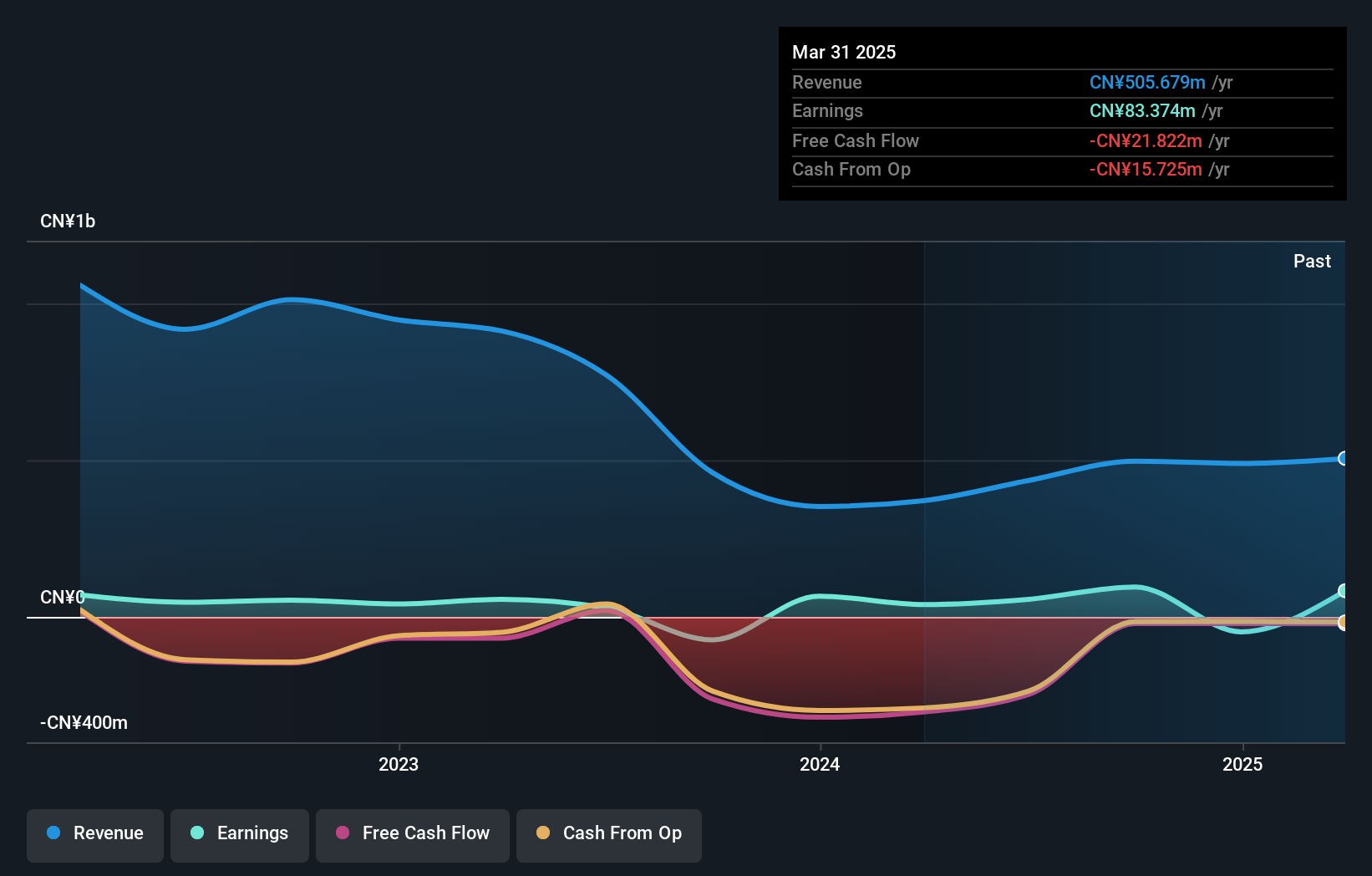

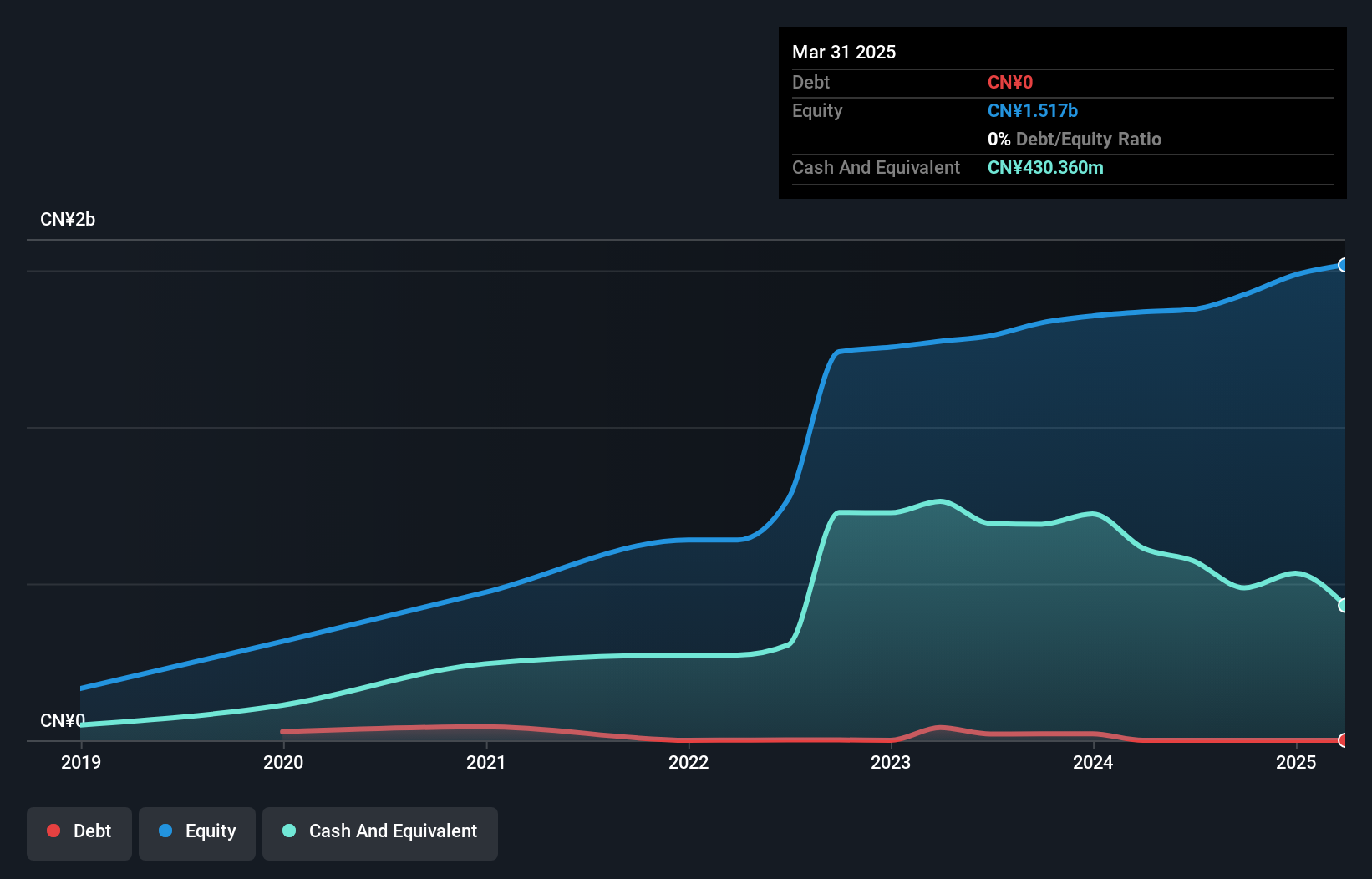

Wenzhou Yuanfei, a player in the pet toy industry, demonstrates robust growth with earnings up by 13.6% over the past year. This growth surpasses the leisure industry's average of -0.7%, indicating competitive strength. The company reported sales of CNY 930.79 million for the first nine months of 2024, a jump from CNY 731.25 million last year, reflecting solid demand and market presence. Despite not being free cash flow positive recently, its debt-free status enhances financial stability and flexibility for future investments or expansions without interest burden concerns. With a P/E ratio at 21x below China's market average of 34x, it presents an attractive valuation perspective amidst continued earnings growth projections at 16.87% annually.

Taking Advantage

- Delve into our full catalog of 4638 Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wenzhou Yuanfei pet toy products might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001222

Wenzhou Yuanfei pet toy products

Wenzhou Yuanfei pet toy products Co., Ltd.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives