- China

- /

- Commercial Services

- /

- SHSE:603600

Asian Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances and cautious optimism following the U.S.-China trade truce, investors are increasingly looking towards Asia for opportunities. In this context, dividend stocks offer a compelling option for those seeking stability and income, as they can provide steady returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.46% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.81% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.96% | ★★★★★★ |

| NCD (TSE:4783) | 4.28% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.96% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.60% | ★★★★★★ |

| Daicel (TSE:4202) | 4.53% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.56% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.70% | ★★★★★★ |

Click here to see the full list of 1051 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Industrial Bank (SHSE:601166)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Industrial Bank Co., Ltd. offers banking services in the People’s Republic of China and has a market cap of CN¥449.08 billion.

Operations: Industrial Bank Co., Ltd. generates revenue from its Commercial Bank segment, amounting to CN¥153.49 billion.

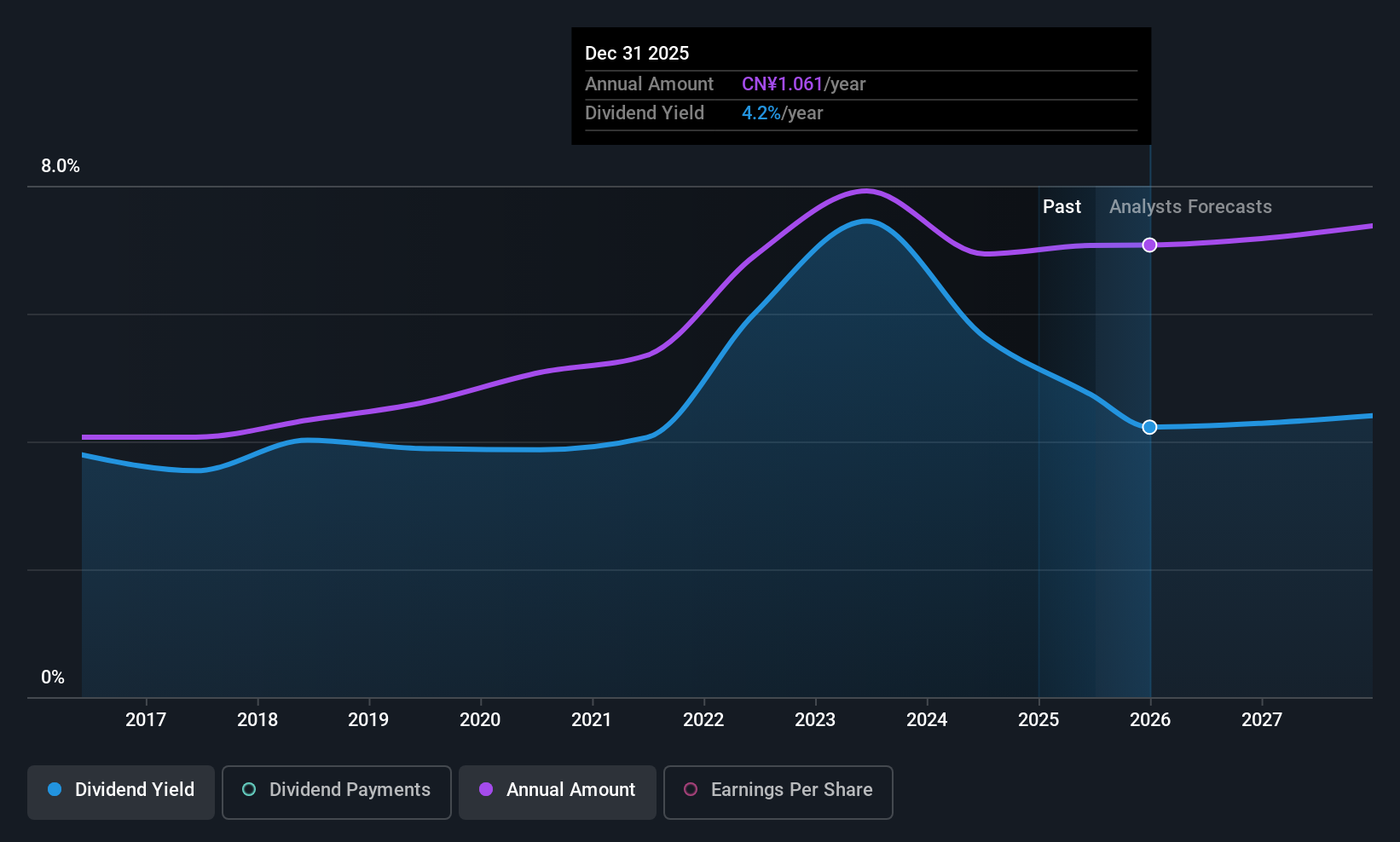

Dividend Yield: 5%

Industrial Bank offers a compelling dividend profile with stable payments over the past decade and a current yield of 5%, placing it in the top 25% of CN market dividend payers. Despite recent earnings showing slight declines, its payout ratio remains low at 30.6%, ensuring dividends are well-covered by earnings. Moreover, trading at a significant discount to fair value enhances its attractiveness for investors seeking reliable income in Asia's financial sector.

- Navigate through the intricacies of Industrial Bank with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Industrial Bank shares in the market.

UE Furniture (SHSE:603600)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UE Furniture Co., Ltd. is involved in the research, development, production, and sale of healthy seating solutions both in China and internationally, with a market cap of CN¥3.90 billion.

Operations: UE Furniture Co., Ltd. generates its revenue primarily through the research, development, production, and sale of healthy seating solutions across domestic and international markets.

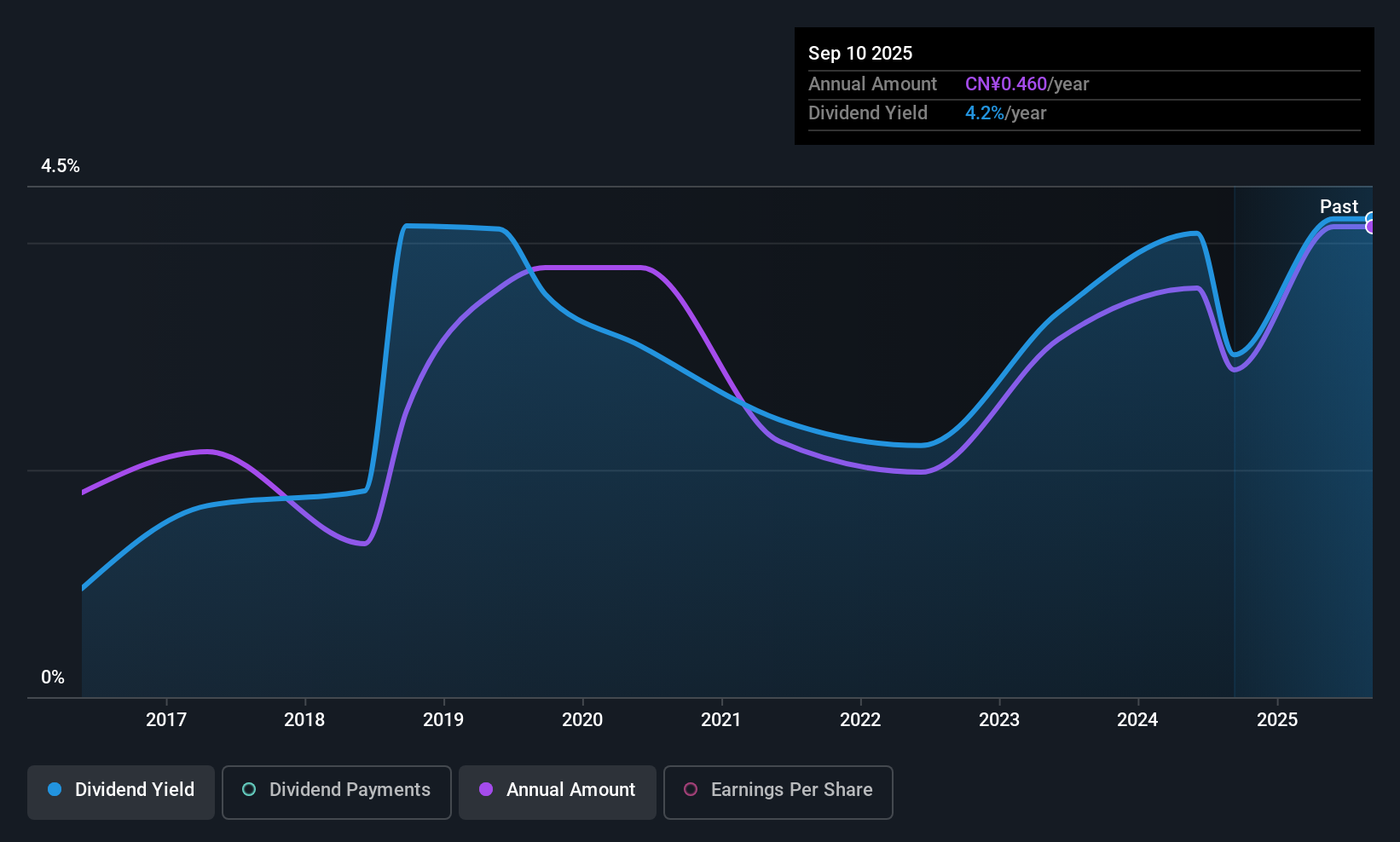

Dividend Yield: 3.9%

UE Furniture's dividend yield of 3.9% ranks it among the top 25% of dividend payers in the CN market. However, its dividend history is marked by volatility and unreliability, with significant annual drops over the past decade. Despite this, dividends have grown over ten years and are well-covered by earnings (payout ratio: 58.2%) and cash flows (cash payout ratio: 44.9%). The stock trades at a substantial discount to estimated fair value, offering potential value for investors.

- Click here and access our complete dividend analysis report to understand the dynamics of UE Furniture.

- According our valuation report, there's an indication that UE Furniture's share price might be on the cheaper side.

eBASELtd (TSE:3835)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: eBase Co., Ltd. specializes in the planning, development, sale, and maintenance of content management software in Japan, with a market capitalization of ¥21.25 billion.

Operations: eBase Co., Ltd. generates revenue primarily through its operations in planning, developing, selling, and maintaining content management software within Japan.

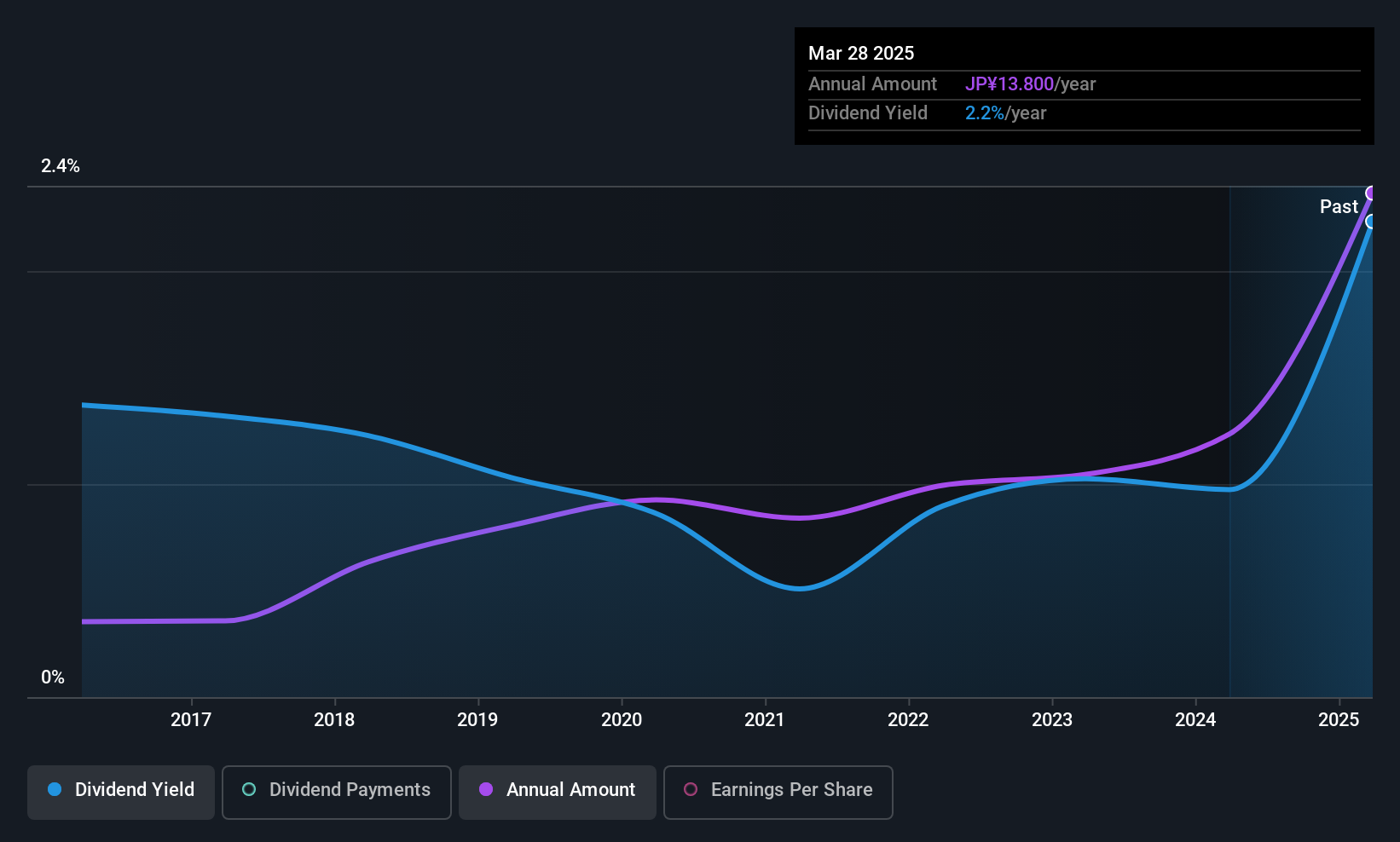

Dividend Yield: 3.2%

eBASE Ltd.'s dividend payments are supported by earnings (payout ratio: 54.4%) and cash flows (cash payout ratio: 64.2%), though its dividend history is marked by volatility and unreliability over the past decade. The recent share buyback program, valued at ¥500 million, aims to enhance shareholder returns, yet lowered earnings guidance reflects challenges in adapting business models and optimizing sales frameworks. Despite these hurdles, dividends have grown over ten years.

- Unlock comprehensive insights into our analysis of eBASELtd stock in this dividend report.

- Our expertly prepared valuation report eBASELtd implies its share price may be lower than expected.

Key Takeaways

- Delve into our full catalog of 1051 Top Asian Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603600

UE Furniture

Engages in the research, development, production, and sale of healthy seats in China and Internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives