As global markets navigate a landscape marked by solid corporate earnings and fluctuating inflation rates, small-cap stocks have shown resilience, with the Russell 2000 index posting positive movements. Amid this backdrop, investors often seek out undiscovered gems—stocks that may not yet be on the radar but possess potential due to strong fundamentals or strategic positioning in their respective industries.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| DINE. de | NA | 35.52% | -13.75% | ★★★★★★ |

| Taiyo KagakuLtd | 0.69% | 5.32% | -0.36% | ★★★★★☆ |

| Top Union Electronics | 2.12% | 8.34% | 19.44% | ★★★★★☆ |

| Chongqing Machinery & Electric | 25.60% | 7.97% | 18.73% | ★★★★★☆ |

| TSTE | 36.22% | 3.96% | -8.49% | ★★★★★☆ |

| Palasino Holdings | 9.75% | 10.88% | -14.54% | ★★★★★☆ |

| VCREDIT Holdings | 115.47% | 25.47% | 30.34% | ★★★★☆☆ |

| Pizu Group Holdings | 41.45% | -2.37% | -15.01% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Silvery Dragon Prestressed MaterialsLTD Tianjin (SHSE:603969)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Silvery Dragon Prestressed Materials Co., LTD Tianjin, along with its subsidiaries, focuses on the manufacturing and sale of prestressed steel products both in China and internationally, with a market cap of CN¥7.08 billion.

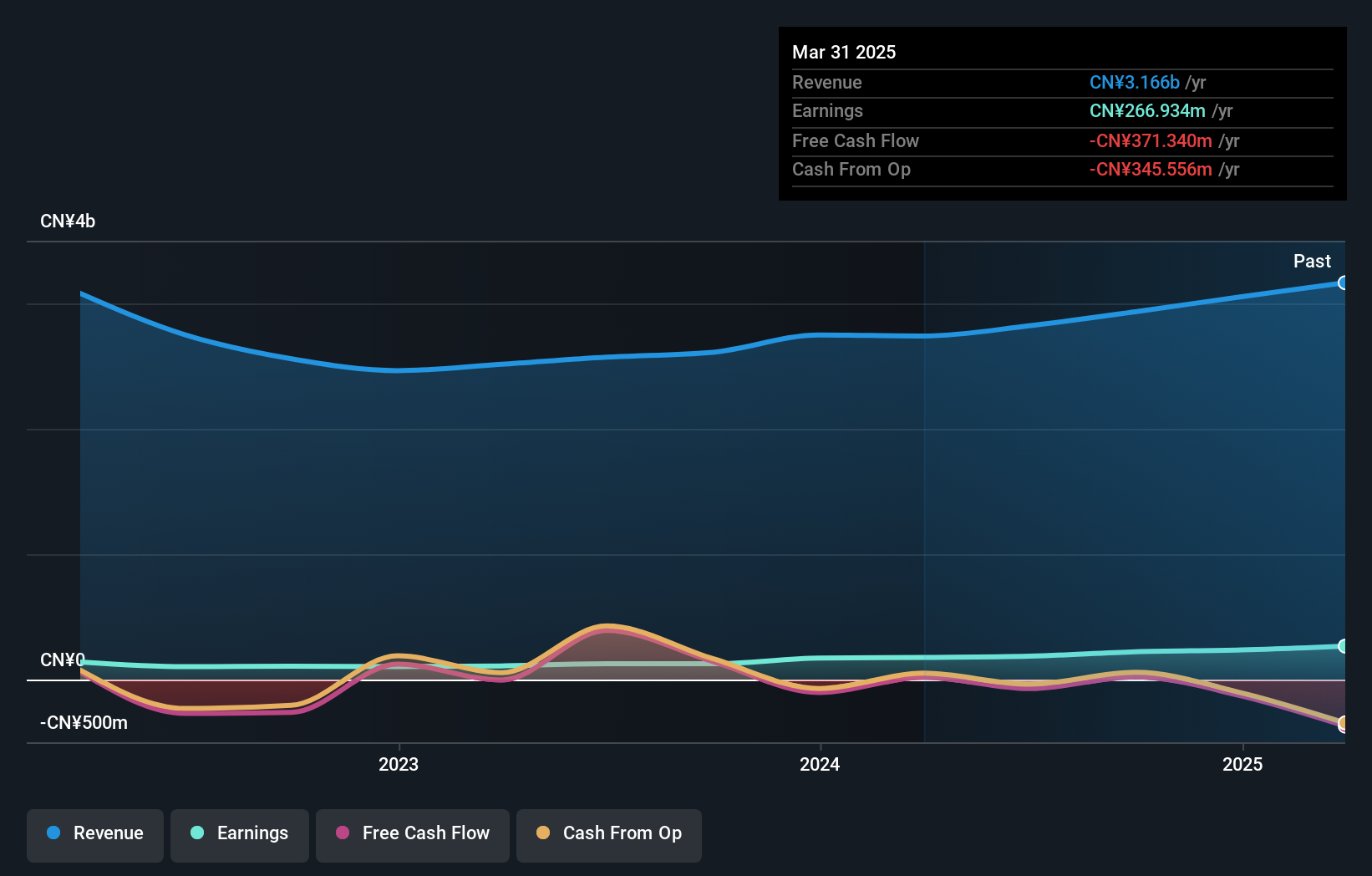

Operations: Silvery Dragon generates revenue primarily from its Metal Processors and Fabrication segment, amounting to CN¥3.17 billion. The financial performance is highlighted by a focus on this core revenue stream without detailing cost breakdowns or profit margins.

Silvery Dragon, operating in the prestressed materials sector, is making waves with its robust financial performance. Recent earnings showed a net income of CNY 69.63 million for Q1 2025, up from CNY 39.35 million the previous year, while revenue rose to CNY 584.78 million from CNY 472.75 million last year. The company boasts a price-to-earnings ratio of 29x, undercutting the broader CN market's average of 42x, suggesting potential undervaluation. Earnings have surged by over half in the past year and outpaced industry averages significantly; however, free cash flow remains negative despite satisfactory debt levels and strong interest coverage at over twenty times EBIT.

Zhejiang Jindun Fans (SZSE:300411)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Jindun Fans Co., Ltd focuses on the research, development, production, and sale of ventilation system equipment in China with a market capitalization of CN¥5.45 billion.

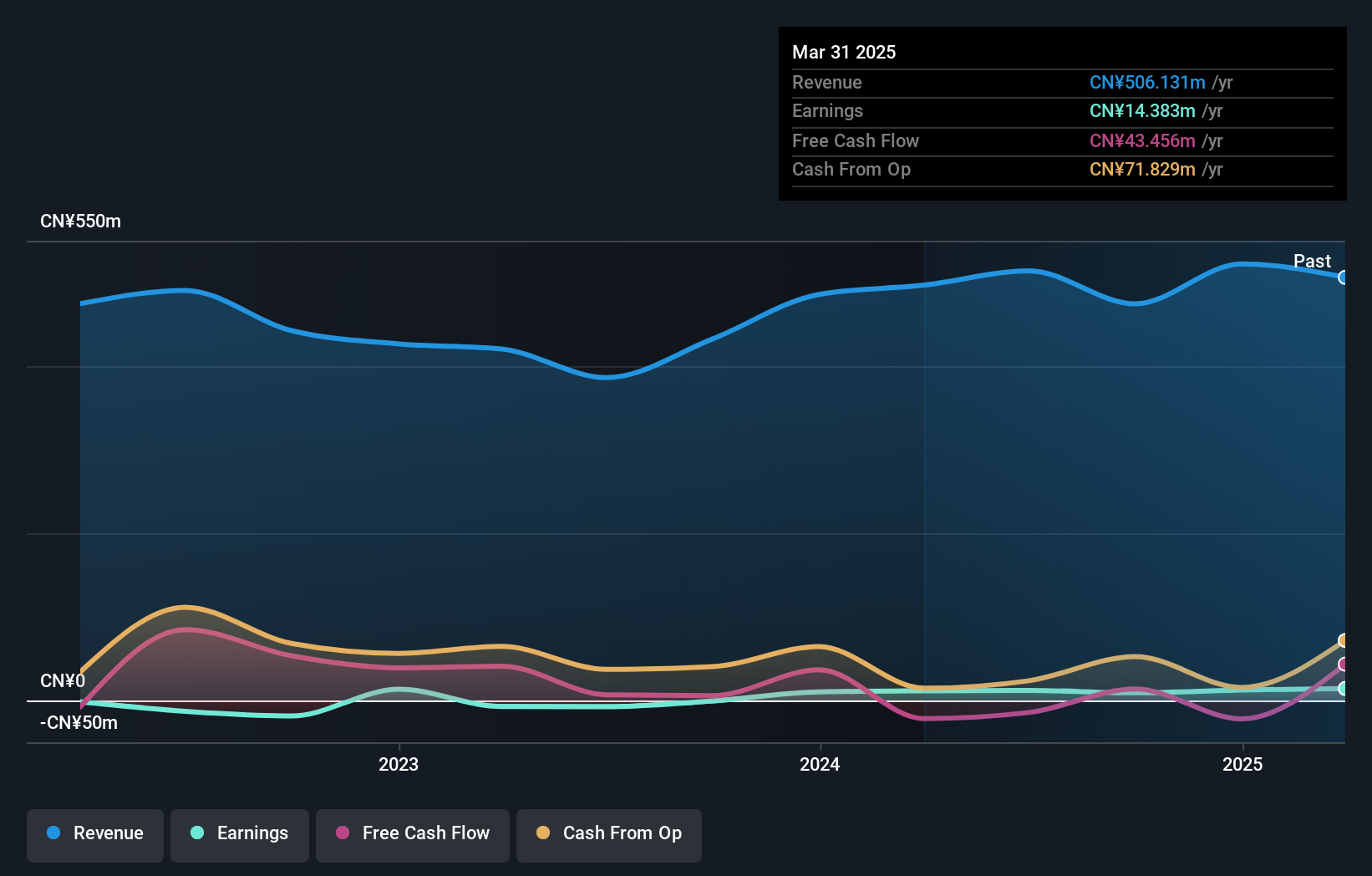

Operations: Jindun Fans generates revenue primarily from the sale of ventilation system equipment. The company's gross profit margin has shown variability, reflecting changes in production costs and pricing strategies.

Zhejiang Jindun Fans, a smaller player in the machinery industry, has shown promising financial resilience. Over the past year, earnings rose by 23.8%, outpacing the industry's 1% growth rate. Despite a one-off loss of CN¥5.4 million impacting recent results, the company remains profitable with free cash flow positivity and adequate interest coverage. The debt to equity ratio improved significantly from 2.5 to 0.8 over five years, while net income increased to CN¥12.53 million from CN¥10.29 million last year, suggesting effective cost management and operational efficiency amidst challenging conditions in its sector.

Voneseals Technology (Shanghai) (SZSE:301161)

Simply Wall St Value Rating: ★★★★★★

Overview: Voneseals Technology (Shanghai) Inc. specializes in the research, development, production, and sale of hydraulic and pneumatic sealing products in China, with a market capitalization of CN¥3.55 billion.

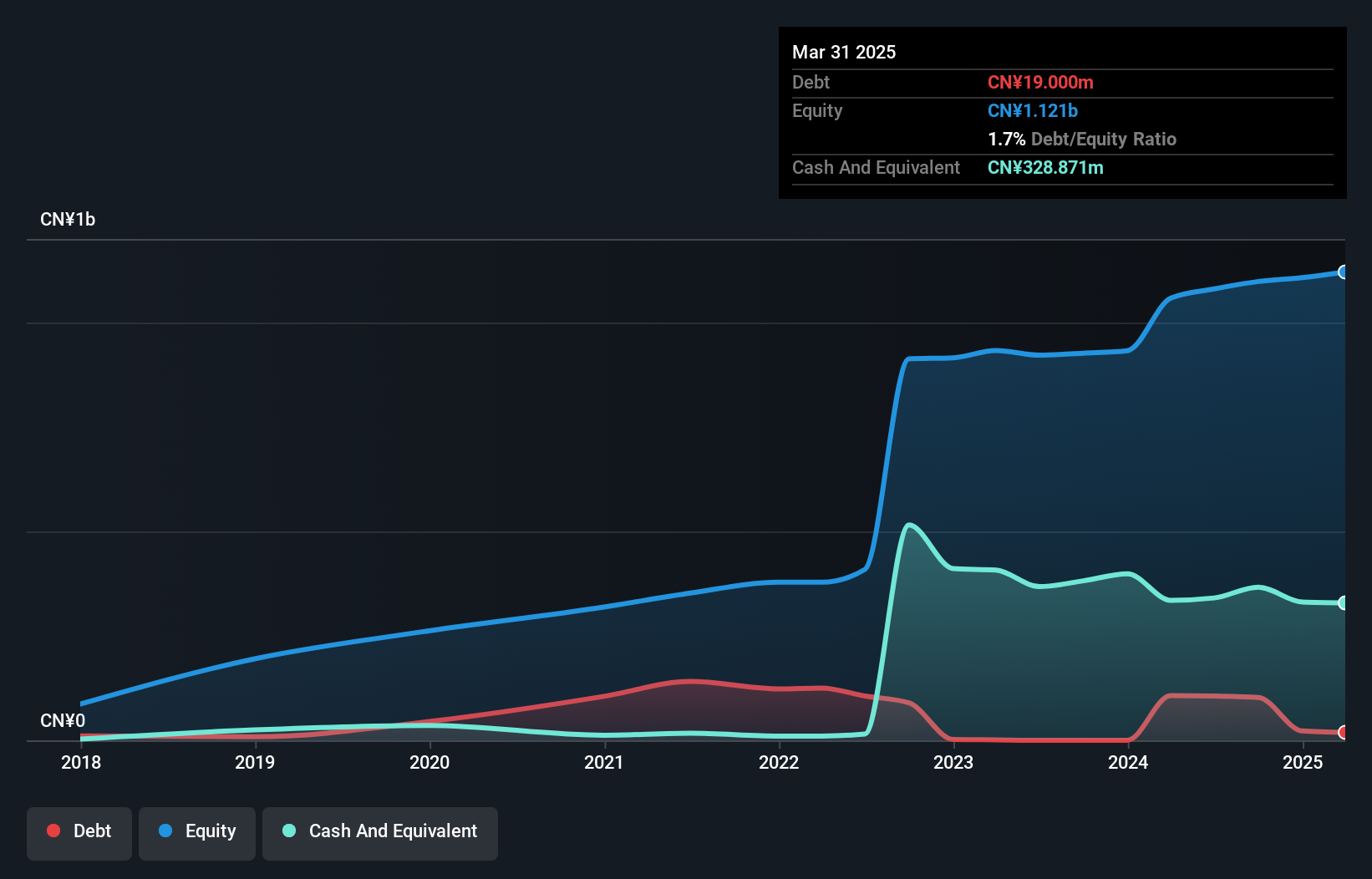

Operations: Voneseals Technology generates revenue primarily from the sale of hydraulic and pneumatic sealing products. The company's financial performance is highlighted by a notable trend in its gross profit margin, which reflects its cost management and pricing strategies.

Voneseals Technology, a smaller player in the tech industry, has shown notable financial resilience. Recent earnings reveal a net income of CNY 24.77 million for Q1 2025, up from CNY 18.56 million the previous year, with sales climbing to CNY 181.28 million from CNY 142.83 million. The company's debt to equity ratio impressively decreased from 21.7% to just 1.7% over five years, indicating prudent financial management and reduced leverage risk while trading at a significant discount of around 71% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities in this volatile market segment.

Seize The Opportunity

- Delve into our full catalog of 3164 Global Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301161

Voneseals Technology (Shanghai)

Engages in the research, development, production, and sale of hydraulic and pneumatic sealing products in the People’s Republic of China.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives