- China

- /

- Electrical

- /

- SZSE:301023

Discovering Undiscovered Gems With Potential In January 2025

Reviewed by Simply Wall St

As global markets navigate a mixed start to the year, with key indices reflecting varied performances and economic indicators like the Chicago PMI showing contraction, investors are keenly observing trends that could impact small-cap stocks. In this dynamic environment, identifying potential "undiscovered gems" involves looking for companies that demonstrate resilience and adaptability amid shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Suraj | 37.84% | 15.84% | 63.29% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Shenzhen Injoinic TechnologyLtd (SHSE:688209)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Injoinic Technology Co., Ltd. is an IC design company that focuses on designing, developing, manufacturing, and selling digital-analog hybrid chips, with a market cap of CN¥7.28 billion.

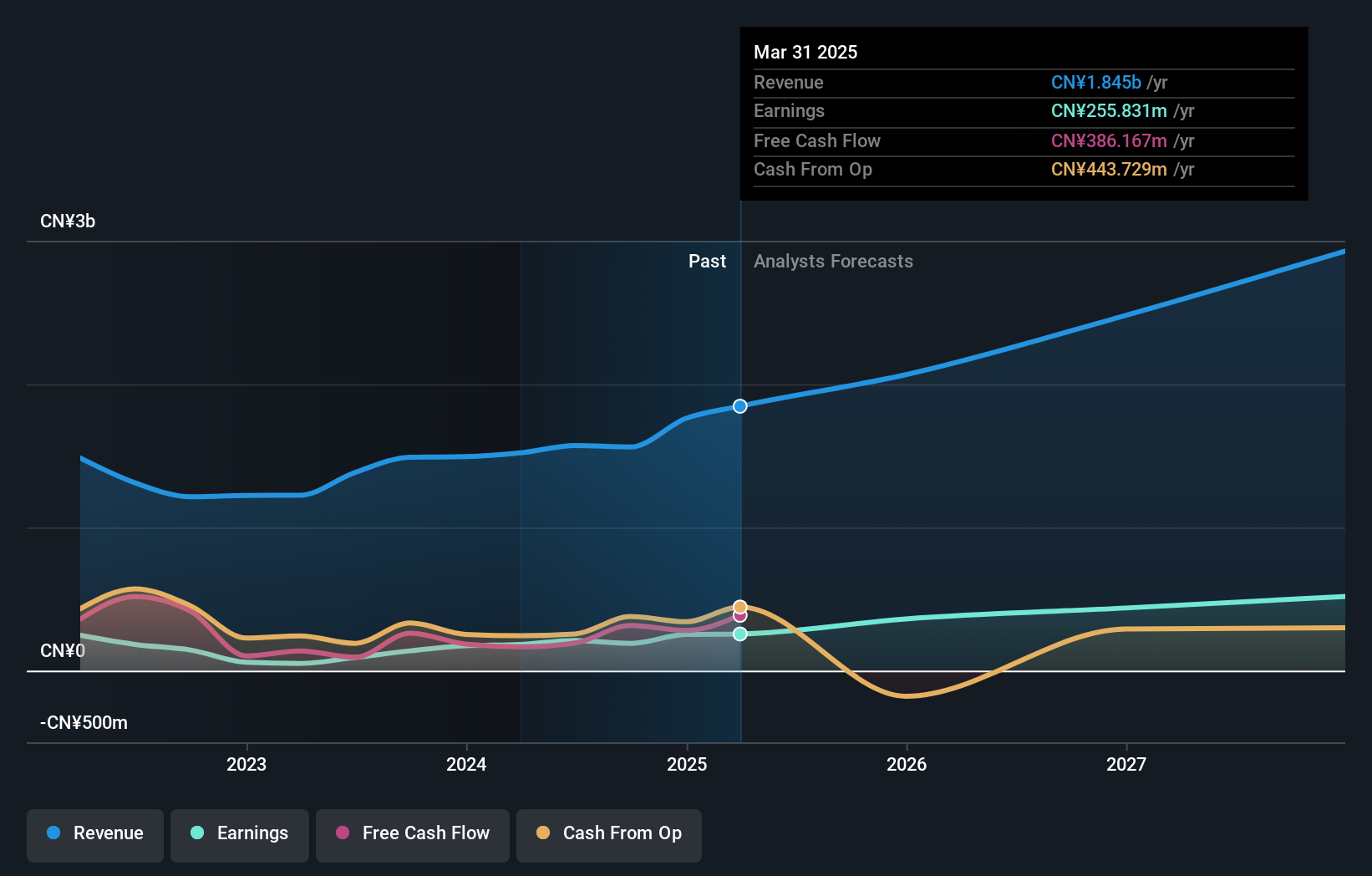

Operations: Injoinic Technology generates revenue primarily from its integrated circuit segment, amounting to CN¥1.40 billion.

Shenzhen Injoinic Technology, a nimble player in the semiconductor space, has been making waves with its impressive earnings growth of 88.2% over the past year, outpacing the industry average of 12.9%. Despite a challenging five-year period marked by a 6.3% annual decline in earnings, recent performance shows promise with net income rising to CNY 89 million for nine months ending September 2024 from CNY 16 million previously. The company remains debt-free and boasts high-quality past earnings, suggesting financial stability and operational efficiency amidst an evolving market landscape.

Changgao Electric Group (SZSE:002452)

Simply Wall St Value Rating: ★★★★★★

Overview: Changgao Electric Group Co., Ltd. focuses on the research, development, manufacture, and sale of power transmission equipment in China with a market capitalization of approximately CN¥4.50 billion.

Operations: Changgao Electric Group generates revenue primarily from the sale of power transmission equipment within China. The company's financial performance is reflected in its market capitalization of approximately CN¥4.50 billion, indicating its position in the industry.

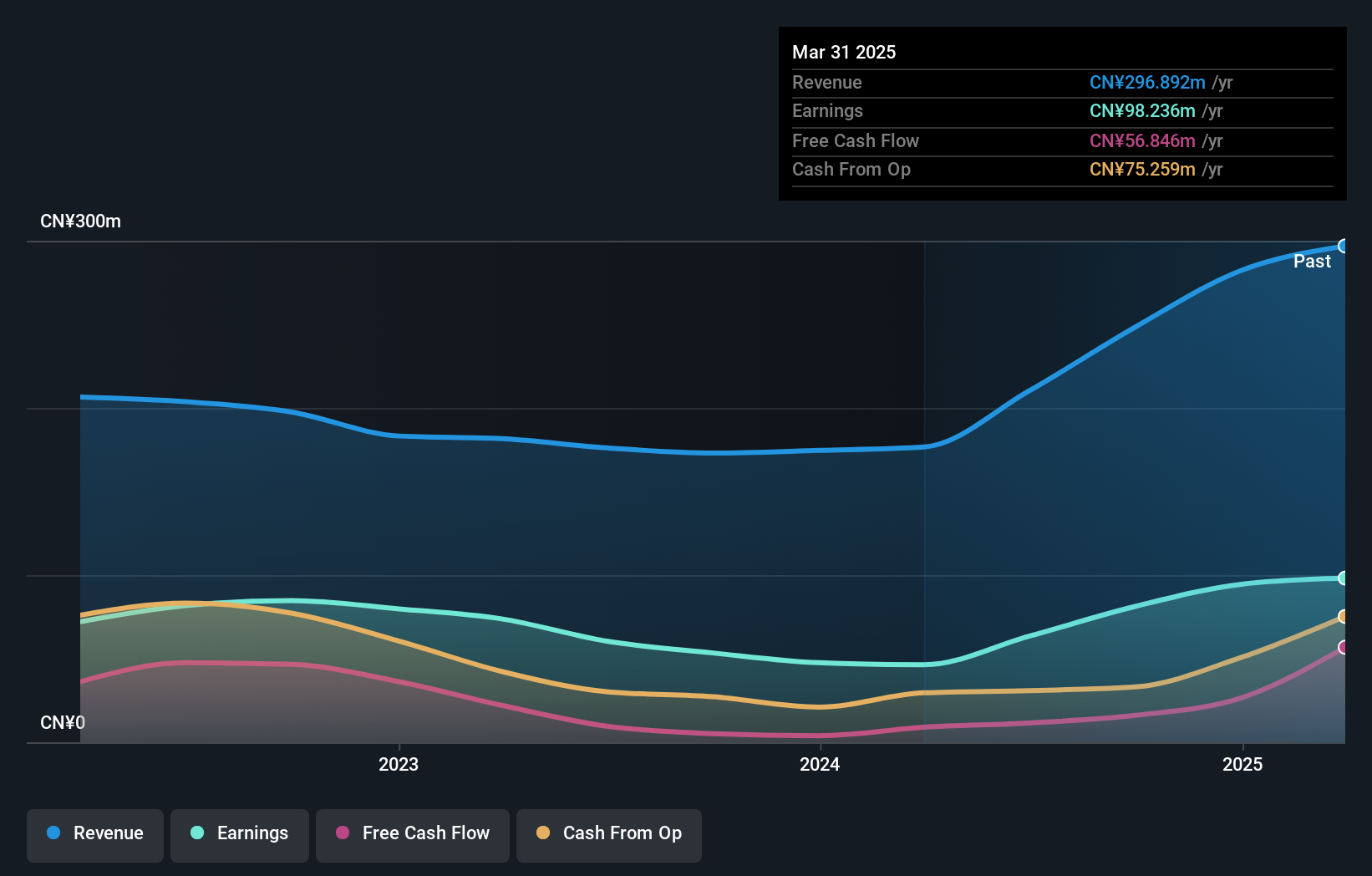

Changgao Electric Group seems to be carving a niche in the electrical industry with its impressive earnings growth of 37.8% over the past year, outpacing the industry's mere 1.1%. The company reported sales of CNY 1.13 billion for the nine months ending September 2024, up from CNY 1.06 billion in the previous year, and net income rose to CNY 181 million from CNY 164 million. Trading at a price-to-earnings ratio of 23.7x, it appears undervalued compared to the CN market average of 33.2x, and its debt-to-equity ratio has significantly decreased from 28.9% to just 6.3% over five years.

- Take a closer look at Changgao Electric Group's potential here in our health report.

Learn about Changgao Electric Group's historical performance.

Jiangnan Yifan MotorLtd (SZSE:301023)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangnan Yifan Motor Co., Ltd specializes in the design, development, manufacture, and sale of gear energy storage motors and operating mechanisms for medium and high voltage switch circuit breaker equipment, with a market cap of CN¥2.59 billion.

Operations: Jiangnan Yifan Motor generates revenue primarily from the sale of gear energy storage motors and operating mechanisms for medium and high voltage switch circuit breaker equipment. The company has a market capitalization of CN¥2.59 billion.

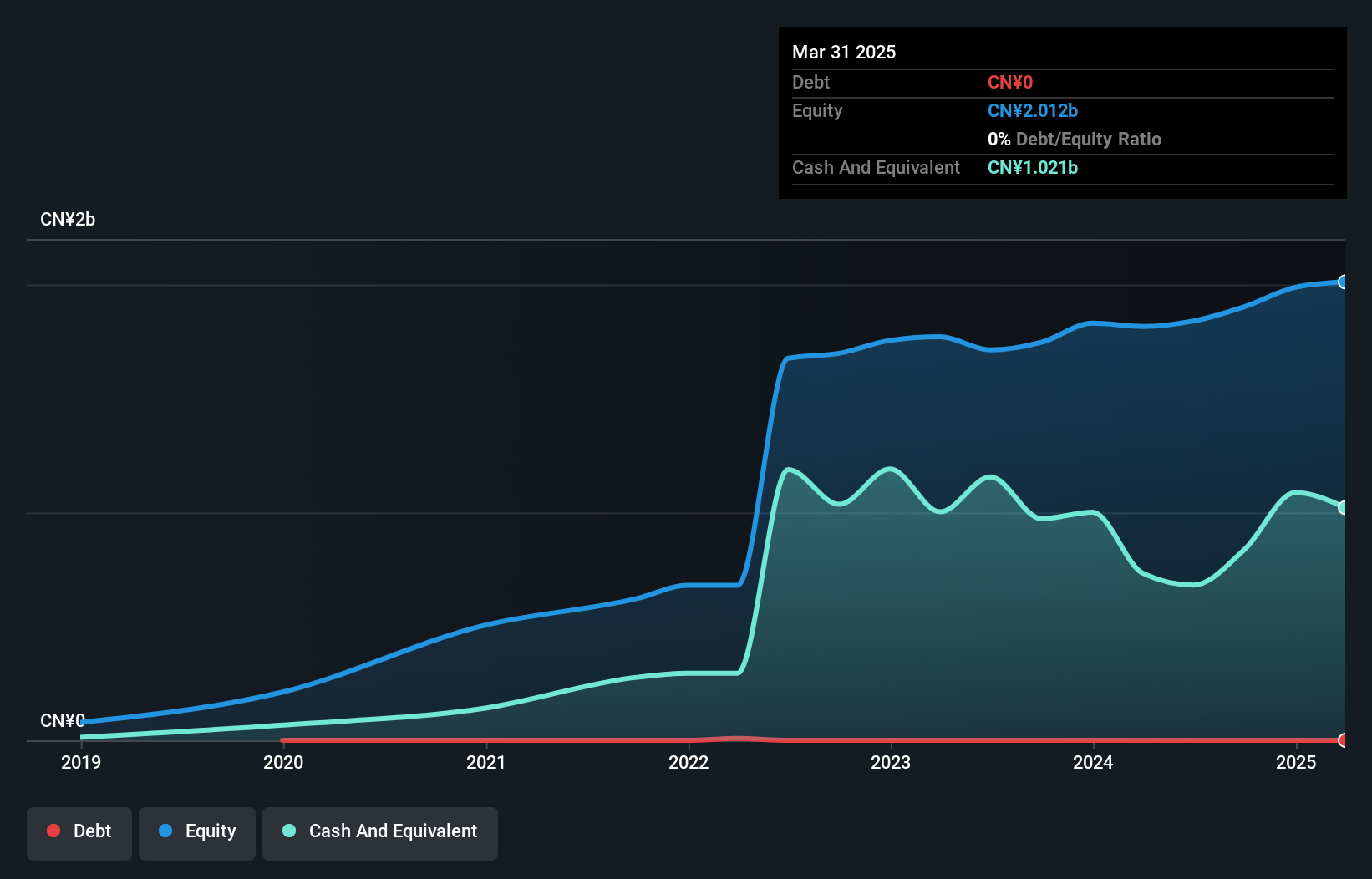

Jiangnan Yifan Motor, a smaller player in the electrical industry, has shown impressive earnings growth of 52.1% over the past year, far surpassing the industry average of 1.1%. With no debt on its books for five years and a price-to-earnings ratio at 31.9x below the CN market average of 33.2x, it appears financially robust and undervalued relative to peers. Recent dividend affirmations highlight its commitment to shareholder returns with CNY 5 per ten shares distributed in November 2024. Despite a decline in earnings by an annual rate of 2.3% over five years, its strong recent performance suggests potential for future value appreciation.

- Dive into the specifics of Jiangnan Yifan MotorLtd here with our thorough health report.

Understand Jiangnan Yifan MotorLtd's track record by examining our Past report.

Where To Now?

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4654 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301023

Jiangnan Yifan MotorLtd

Engages in the design, development, manufacture, and sale of gear energy storage motors and operating mechanisms with medium and high voltage switch circuit breaker equipment in China and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives