Exploring Jiangsu Yangdian Science & Technology And 2 Other Promising Small Cap Discoveries

Reviewed by Simply Wall St

In the wake of a significant rally in U.S. stocks, driven by optimism surrounding potential growth and tax reforms, small-cap stocks have shown notable momentum with the Russell 2000 Index leading gains. As investors navigate these dynamic market conditions, identifying promising small-cap companies like Jiangsu Yangdian Science & Technology becomes crucial for those seeking opportunities that align with current economic trends and policy shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Bank Ganesha | NA | 25.03% | 70.72% | ★★★★★★ |

| Suraj | 37.84% | 15.84% | 63.29% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Network People Services Technologies | 0.11% | 84.31% | 84.48% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| S J Logistics (India) | 34.96% | 59.89% | 51.25% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Jiangsu Yangdian Science & Technology (SZSE:301012)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Yangdian Science & Technology Co. operates in the technology sector and has a market capitalization of CN¥3.53 billion.

Operations: The company generates revenue primarily from its technology-related products and services. It has a market capitalization of CN¥3.53 billion, reflecting its position in the industry.

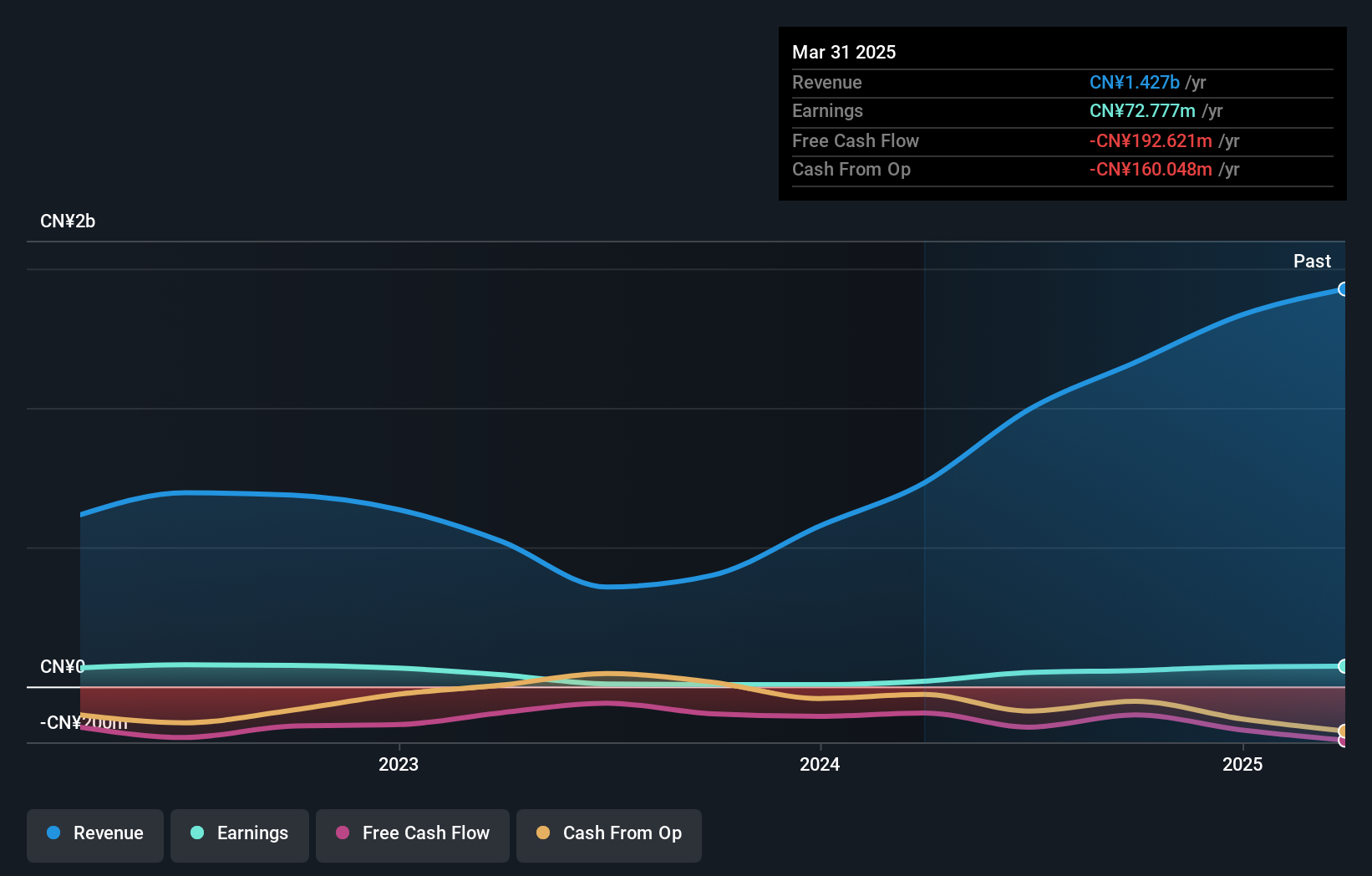

Jiangsu Yangdian Science & Technology showcases impressive growth, with earnings surging by 696% over the past year, far outpacing the Electrical industry's modest 0.8% rise. The company's debt is well-managed, as evidenced by a reduction in its debt-to-equity ratio from 33.6% to 25.2% over five years and interest payments covered 73.9 times by EBIT. Recent financials highlight a significant jump in sales to CNY 893 million for the nine months ending September 2024, compared to CNY 305 million last year, alongside net income of CNY 53.6 million up from CNY 2.78 million previously reported.

Seiko Group (TSE:8050)

Simply Wall St Value Rating: ★★★★★☆

Overview: Seiko Group Corporation operates in various sectors including watches, device solutions, system solutions, apparel, clocks, and fashion accessories both in Japan and internationally with a market capitalization of ¥158.81 billion.

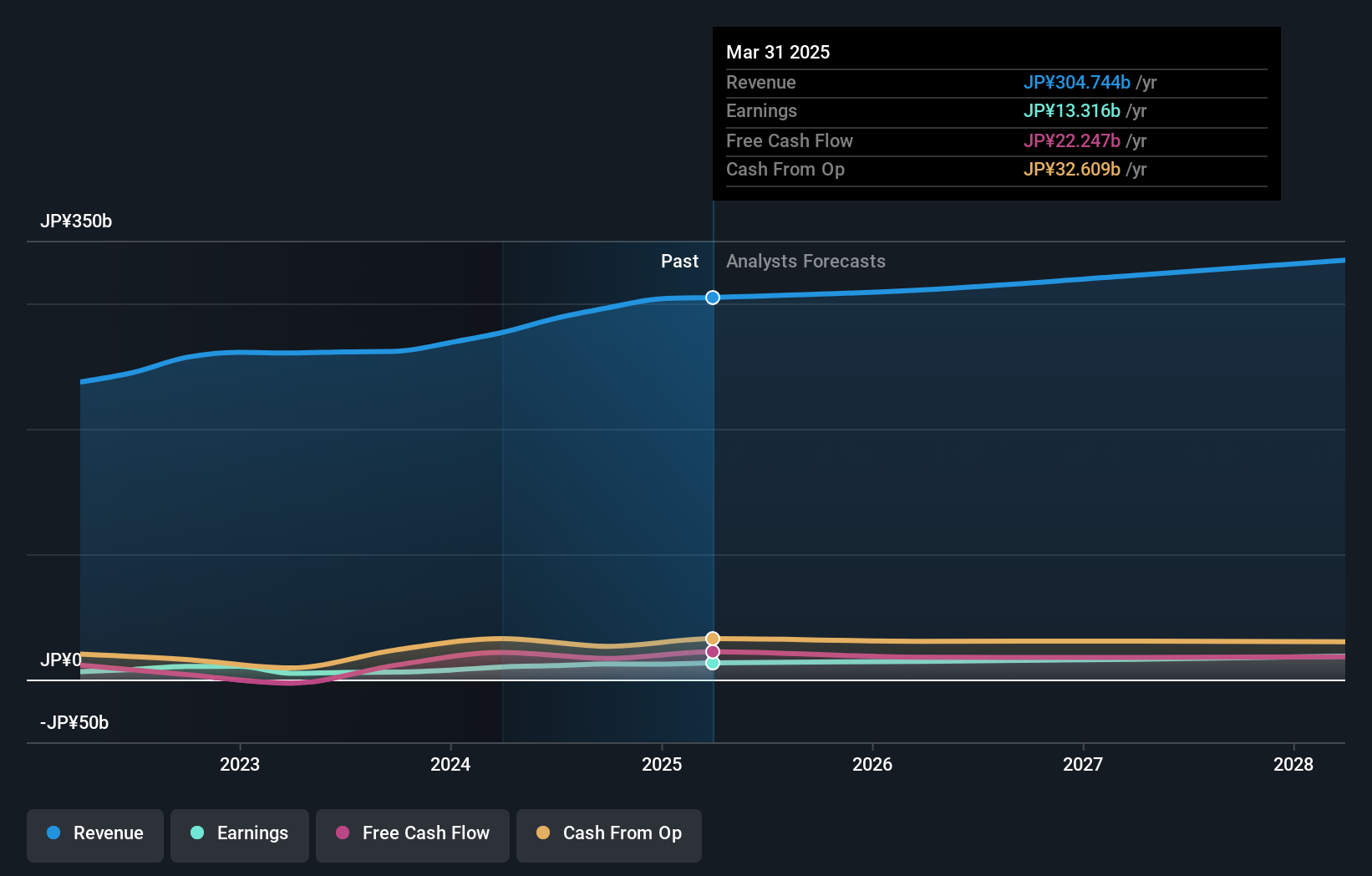

Operations: Seiko Group's revenue streams are primarily driven by the Emotional Value Solutions Business and Devices Solutions, generating ¥196.02 billion and ¥59.52 billion respectively. The System Solution Business contributes ¥42.59 billion to the overall revenue.

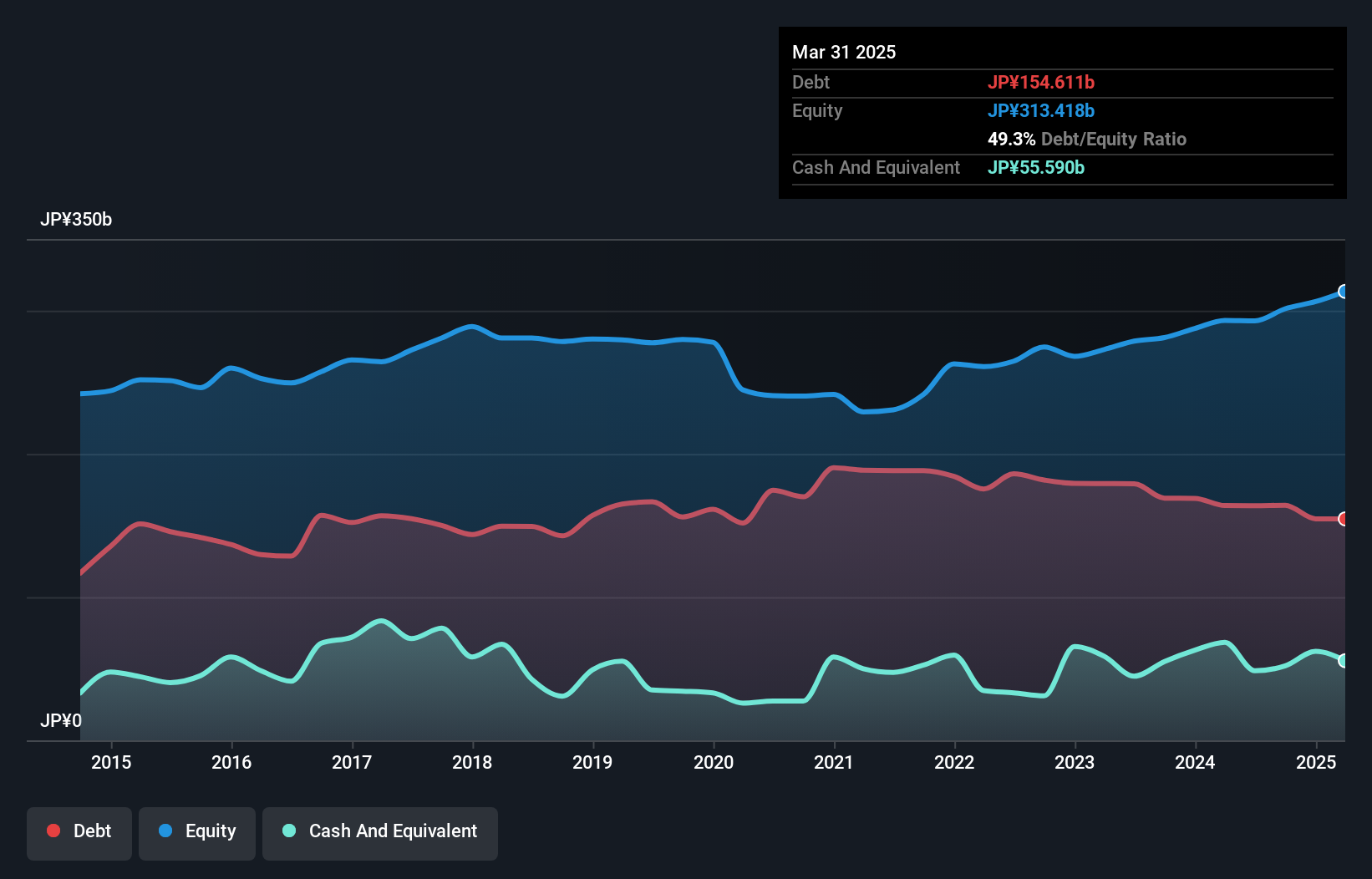

Seiko, a notable player in the luxury sector, is trading at 19.9% below its estimated fair value, which might catch investors' eyes. The company's earnings have surged by 94.2% over the past year, outpacing the industry average of 16.7%. Despite this impressive growth, Seiko carries a high net debt to equity ratio of 54.8%, although interest payments are well covered with EBIT coverage at 340 times. Recent guidance for fiscal year ending March 2025 projects net sales of ¥306 billion (US$), with operating and ordinary profits both expected to reach ¥18 billion (US$).

- Unlock comprehensive insights into our analysis of Seiko Group stock in this health report.

Evaluate Seiko Group's historical performance by accessing our past performance report.

H2O Retailing (TSE:8242)

Simply Wall St Value Rating: ★★★★☆☆

Overview: H2O Retailing Corporation operates department stores, supermarkets, and shopping centers in Japan with a market capitalization of ¥208.53 billion.

Operations: H2O Retailing generates revenue primarily through its department stores, supermarkets, and shopping centers. The company focuses on optimizing its cost structure to enhance profitability.

H2O Retailing, a nimble player in the retail sector, has seen its earnings surge by 115% over the past year, significantly outpacing the industry average of 15%. The company's net debt to equity ratio is at a satisfactory 37%, indicating prudent financial management. Recently, H2O completed a share buyback worth ¥754 million for 384,200 shares. Despite this positive momentum, earnings are forecasted to decline by an average of 21% annually over the next three years. Additionally, H2O's recent dividend increase to ¥20 per share reflects its commitment to shareholder returns amidst fluctuating market conditions.

- Click to explore a detailed breakdown of our findings in H2O Retailing's health report.

Review our historical performance report to gain insights into H2O Retailing's's past performance.

Seize The Opportunity

- Delve into our full catalog of 4667 Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8050

Seiko Group

Engages in watches, devices solutions, systems solutions, apparels, clocks, fashion accessories, and other businesses in Japan and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives