- China

- /

- Construction

- /

- SZSE:300977

Earnings Tell The Story For Shenzhen Ridge Engineering Consulting Co., Ltd. (SZSE:300977) As Its Stock Soars 26%

Those holding Shenzhen Ridge Engineering Consulting Co., Ltd. (SZSE:300977) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.6% in the last twelve months.

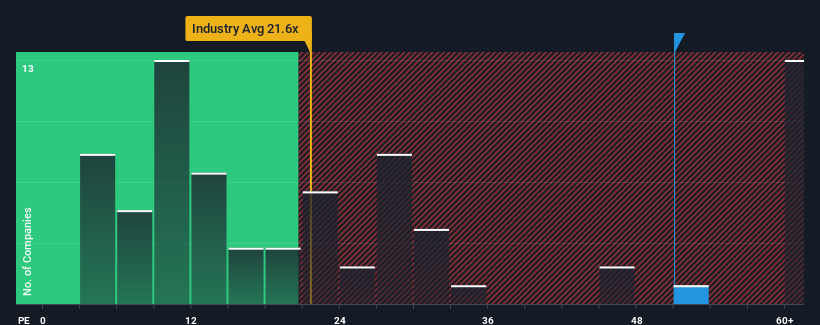

After such a large jump in price, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 30x, you may consider Shenzhen Ridge Engineering Consulting as a stock to avoid entirely with its 51x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Shenzhen Ridge Engineering Consulting as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Shenzhen Ridge Engineering Consulting

Is There Enough Growth For Shenzhen Ridge Engineering Consulting?

The only time you'd be truly comfortable seeing a P/E as steep as Shenzhen Ridge Engineering Consulting's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 16% last year. Still, incredibly EPS has fallen 71% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 122% over the next year. Meanwhile, the rest of the market is forecast to only expand by 41%, which is noticeably less attractive.

In light of this, it's understandable that Shenzhen Ridge Engineering Consulting's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Shenzhen Ridge Engineering Consulting's P/E?

Shenzhen Ridge Engineering Consulting's P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Shenzhen Ridge Engineering Consulting maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Shenzhen Ridge Engineering Consulting that you need to be mindful of.

If you're unsure about the strength of Shenzhen Ridge Engineering Consulting's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300977

Shenzhen Ridge Engineering Consulting

Shenzhen Ridge Engineering Consulting Co., Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives