- China

- /

- Consumer Durables

- /

- SZSE:301004

Undiscovered Gems In Asia June 2025

Reviewed by Simply Wall St

As of mid-2025, the Asian markets have been navigating a complex landscape marked by trade negotiations and economic policy shifts, with smaller-cap indexes showing resilience despite broader market fluctuations. Amidst these dynamics, discerning investors may find opportunities in stocks that demonstrate strong fundamentals and adaptability to changing market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| MSC | 30.39% | 6.56% | 14.62% | ★★★★★★ |

| Sinotherapeutics | NA | 25.52% | -7.66% | ★★★★★★ |

| Shangri-La Hotel | NA | 23.33% | 39.56% | ★★★★★★ |

| Ampire | NA | -2.21% | 8.00% | ★★★★★★ |

| Zhejiang Chinastars New Materials Group | 38.79% | 0.20% | 4.21% | ★★★★★☆ |

| CMC | 1.18% | 2.73% | 9.22% | ★★★★★☆ |

| FCE | 7.92% | 26.91% | 26.05% | ★★★★★☆ |

| BIOBIJOULtd | 6.87% | 72.99% | 117.16% | ★★★★★☆ |

| VCREDIT Holdings | 115.47% | 25.47% | 30.34% | ★★★★☆☆ |

| Nippon Sharyo | 53.44% | -0.74% | -11.37% | ★★★★☆☆ |

We'll examine a selection from our screener results.

GDH Supertime Group (SZSE:001338)

Simply Wall St Value Rating: ★★★★★☆

Overview: GDH Supertime Group Company Limited focuses on the research, development, production, and sale of malt for beer brewing in China with a market capitalization of approximately CN¥6.67 billion.

Operations: The primary revenue stream for GDH Supertime Group comes from its beer-making segment, generating approximately CN¥4.17 billion. The company has a segment adjustment of CN¥215.40 million impacting overall financial results.

GDH Supertime Group, a smaller player in its sector, has shown notable earnings growth of 30.7% over the past year, outpacing the beverage industry average of 3.5%. The company trades at an impressive 86.9% below estimated fair value, suggesting potential for appreciation. Despite a rise in debt to equity from 0.9 to 5.4 over five years, interest payments are well covered by EBIT at a multiple of 63x. Recent financials reveal sales of CNY1 billion for Q1 2025 with net income reaching CNY71 million, though slightly lower than the previous year's CNY82 million.

Zhejiang Zhaolong Interconnect TechnologyLtd (SZSE:300913)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Zhaolong Interconnect Technology Co., Ltd. operates in the digital communication cable industry and has a market capitalization of approximately CN¥13.27 billion.

Operations: Zhaolong Interconnect generates revenue primarily from the digital communication cable industry, amounting to approximately CN¥1.91 billion. The company's financial performance is highlighted by its net profit margin trend, which provides insight into its profitability dynamics over time.

Zhejiang Zhaolong Interconnect Technology has been making waves with its impressive earnings growth of 68% over the past year, outpacing the electrical industry significantly. The company reported a net income of CNY 32.59 million for Q1 2025, up from CNY 17.61 million in the same period last year, reflecting its robust performance. With no debt on its books and a history of reducing debt from a debt-to-equity ratio of 38.2% five years ago to zero now, it stands on solid financial ground. However, recent volatility in share prices suggests some market uncertainty despite strong fundamentals and positive free cash flow trends.

Zhejiang Cayi Vacuum Container (SZSE:301004)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Cayi Vacuum Container Co., Ltd. specializes in the research, development, design, production, and sale of beverage and food containers made from various materials for both domestic and international markets, with a market capitalization of CN¥11.11 billion.

Operations: Zhejiang Cayi generates revenue primarily from the production and sale of beverage and food containers. The company's net profit margin has shown variability, reflecting changes in cost structures and pricing strategies.

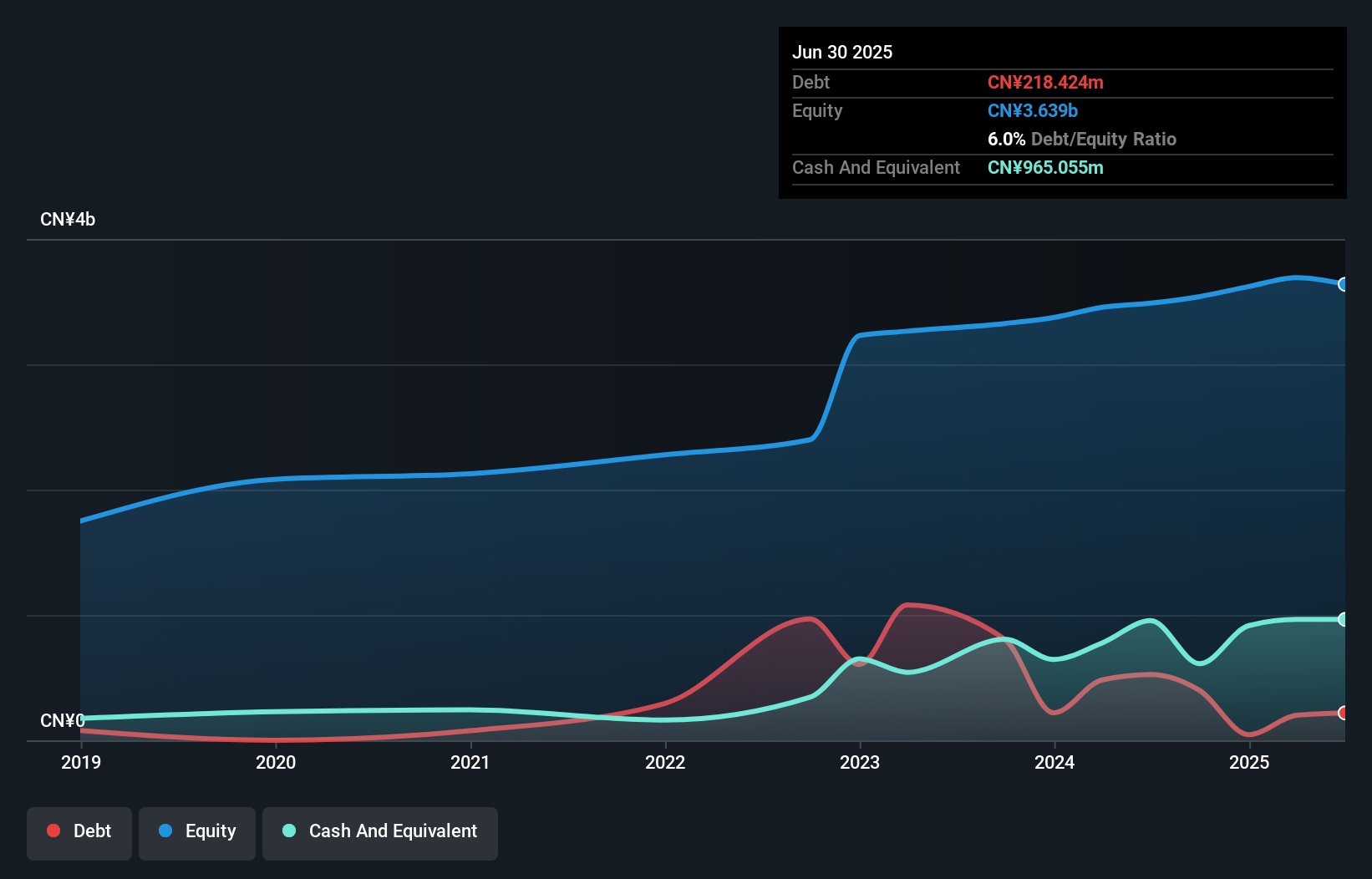

Zhejiang Cayi Vacuum Container, a small player in the industry, has shown promising growth with earnings increasing by 47.7% over the past year, outpacing its sector's performance. Its price-to-earnings ratio of 14.3x is attractively below the Chinese market average of 38.4x, suggesting potential value for investors. The company's first-quarter sales for 2025 reached CNY 719.51 million, up from CNY 432.08 million the previous year, while net income rose to CNY 151.82 million from CNY 107.48 million a year ago. Additionally, a robust share repurchase program and dividend increase reflect strong shareholder returns and confidence in future prospects.

Summing It All Up

- Navigate through the entire inventory of 2604 Asian Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Cayi Vacuum Container might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301004

Zhejiang Cayi Vacuum Container

Engages in the research, development, design, production, and sale of beverage and food containers of various materials in China and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives