- China

- /

- Electrical

- /

- SZSE:300602

Exploring 3 Undiscovered Gems In Global Markets

Reviewed by Simply Wall St

In the current global market landscape, smaller-cap indexes have faced significant challenges, with the Russell 2000 and S&P MidCap 400 experiencing notable declines amid trade policy uncertainties and economic data revisions. Despite these headwinds, opportunities can still be found by focusing on stocks that demonstrate resilience through strong fundamentals or unique market positions.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anpec Electronics | NA | 1.77% | 4.97% | ★★★★★★ |

| PSC | 15.34% | 1.17% | 10.86% | ★★★★★★ |

| Nanfang Black Sesame GroupLtd | 45.53% | -12.49% | 10.72% | ★★★★★★ |

| Savior Lifetec | NA | -10.66% | 5.06% | ★★★★★★ |

| Taiyo KagakuLtd | 0.69% | 5.32% | -0.36% | ★★★★★☆ |

| Union Gas Holdings | 16.96% | 6.54% | -13.07% | ★★★★★☆ |

| TSTE | 36.22% | 3.96% | -8.49% | ★★★★★☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Forth Smart Service | 51.94% | -6.63% | -7.91% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Guilin Sanjin Pharmaceutical (SZSE:002275)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guilin Sanjin Pharmaceutical Co., Ltd. focuses on the research, production, and sale of traditional Chinese and natural medicines in China, with a market cap of CN¥9.28 billion.

Operations: Guilin Sanjin Pharmaceutical generates revenue primarily from the sale of traditional Chinese and natural medicines. The company has a market cap of CN¥9.28 billion.

Guilin Sanjin, a nimble player in the pharmaceutical sector, has shown impressive earnings growth of 49.5% over the past year, outpacing the industry average of -2.6%. Trading at 39% below its estimated fair value suggests potential for investors seeking undervalued opportunities. The company earned more interest than it paid and maintained profitability despite a significant one-off gain of CN¥149M impacting recent results. While cash exceeds total debt, indicating financial stability, its debt to equity ratio has risen from 8.9% to 20.3% over five years, which might warrant attention moving forward.

- Navigate through the intricacies of Guilin Sanjin Pharmaceutical with our comprehensive health report here.

Gain insights into Guilin Sanjin Pharmaceutical's past trends and performance with our Past report.

Shenzhen FRD Science & Technology (SZSE:300602)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen FRD Science & Technology Co., Ltd. operates in the electronic components manufacturing industry and has a market cap of CN¥14.35 billion.

Operations: The company generates revenue primarily from its electronic components manufacturing segment, totaling CN¥5.18 billion.

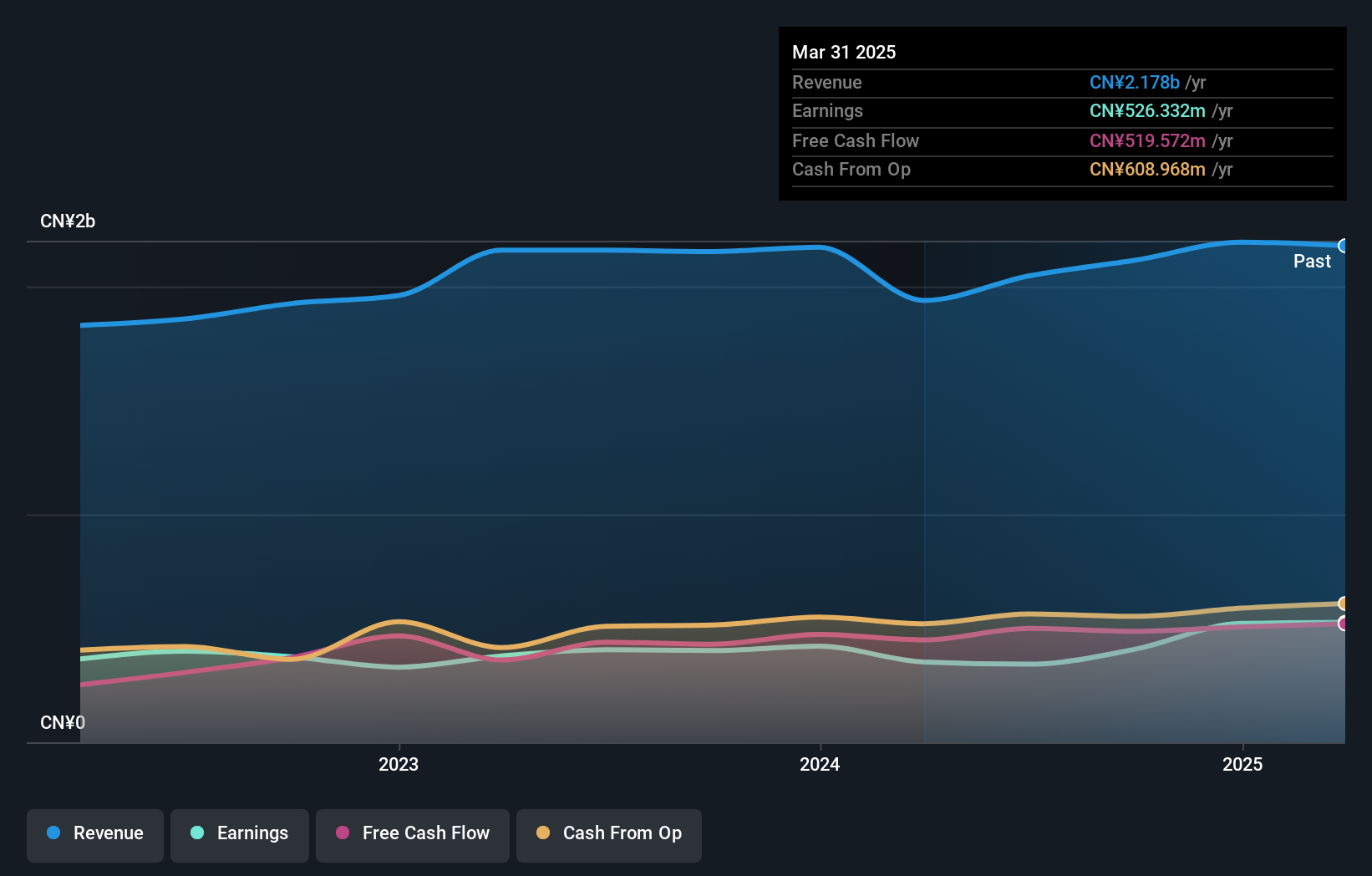

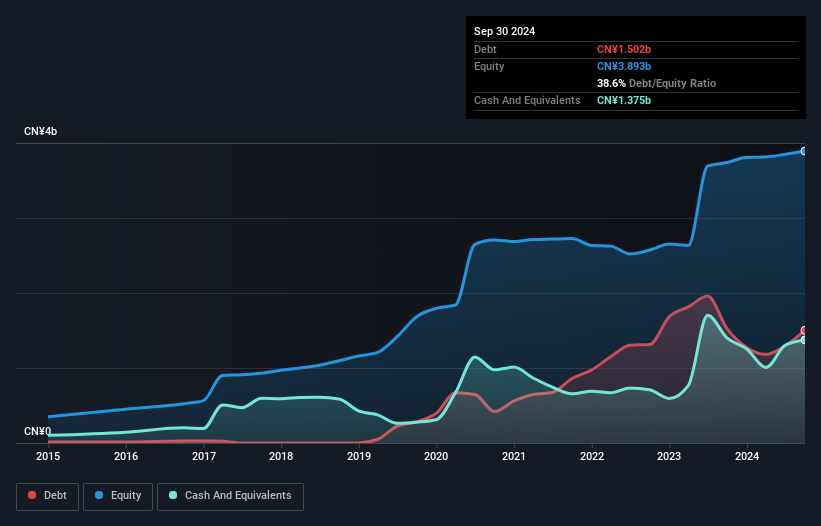

Shenzhen FRD Science & Technology, a smaller player in the tech space, has shown resilience with earnings growing 35% over the past year, outpacing its industry. Despite a satisfactory net debt to equity ratio of 13%, its free cash flow remains negative. The company's interest payments are well covered by EBIT at 14.9 times coverage, indicating strong financial management. A recent dividend increase to CNY 0.38 per ten shares suggests confidence in future performance, although an acquisition deal was canceled in May 2025. Earnings have dipped by nearly 13% annually over five years but are forecasted to grow significantly at over 23% annually moving forward.

- Get an in-depth perspective on Shenzhen FRD Science & Technology's performance by reading our health report here.

Learn about Shenzhen FRD Science & Technology's historical performance.

Sanhe Tongfei Refrigeration (SZSE:300990)

Simply Wall St Value Rating: ★★★★★★

Overview: Sanhe Tongfei Refrigeration Co., Ltd. specializes in the manufacturing and sale of industrial temperature control products in China, with a market capitalization of CN¥9.90 billion.

Operations: Sanhe Tongfei generates revenue primarily from the sale of industrial temperature control products. The company's financial data reveals a focus on optimizing its cost structure to enhance profitability. Notably, there are observable trends in the net profit margin over recent periods, which reflect ongoing efforts to balance costs and revenues effectively.

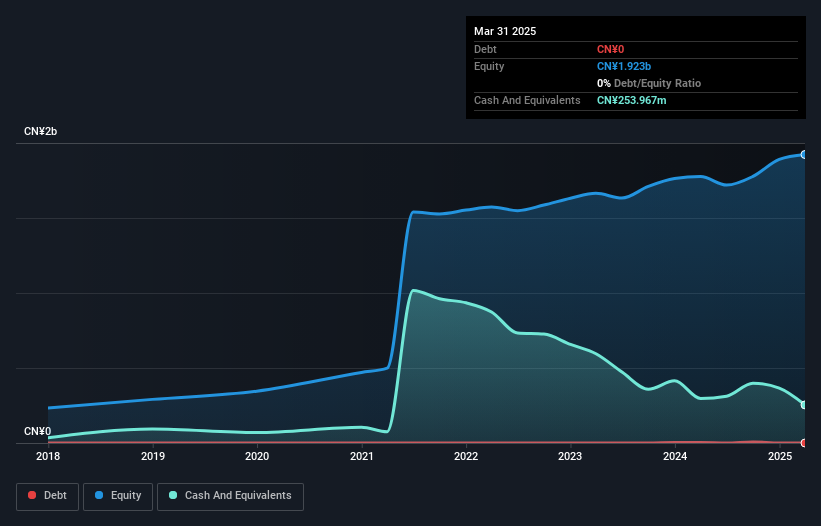

Sanhe Tongfei Refrigeration, with its nimble market presence, showcases robust financial health by maintaining a debt-free status, contrasting its position five years ago when it had a minor debt-to-equity ratio of 0.02%. The company has achieved impressive earnings growth of 32.1% in the last year, outpacing the broader Machinery industry’s modest 1% rise. Despite facing challenges with negative levered free cash flow at CNY -179.59 million as of December 2023, recent dividends signal management's confidence in future prospects. Looking ahead, earnings are anticipated to grow annually by over 32%, suggesting potential for continued value creation.

Turning Ideas Into Actions

- Dive into all 3123 of the Global Undiscovered Gems With Strong Fundamentals we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300602

Shenzhen FRD Science & Technology

Shenzhen FRD Science & Technology Co., Ltd.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives