- China

- /

- Electrical

- /

- SZSE:300593

3 Asian Growth Companies With High Insider Ownership Seeing 103% Earnings Growth

Reviewed by Simply Wall St

As Asian markets experience a resurgence, with technology-focused shares leading the charge in China and Japan's proactive fiscal policies boosting investor confidence, growth companies are capturing attention for their potential to thrive amidst these favorable conditions. In this environment, stocks with high insider ownership often stand out as they signal strong internal confidence and alignment of interests between management and shareholders, making them compelling candidates for those seeking robust earnings growth.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Techwing (KOSDAQ:A089030) | 19% | 84.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36.1% | 26.6% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's explore several standout options from the results in the screener.

Beijing Relpow Technology (SZSE:300593)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Relpow Technology Co., Ltd manufactures and sells power supply products both in China and internationally, with a market cap of CN¥12.57 billion.

Operations: Beijing Relpow Technology Co., Ltd generates its revenue primarily from the manufacturing and sale of power supply products, serving both domestic and international markets.

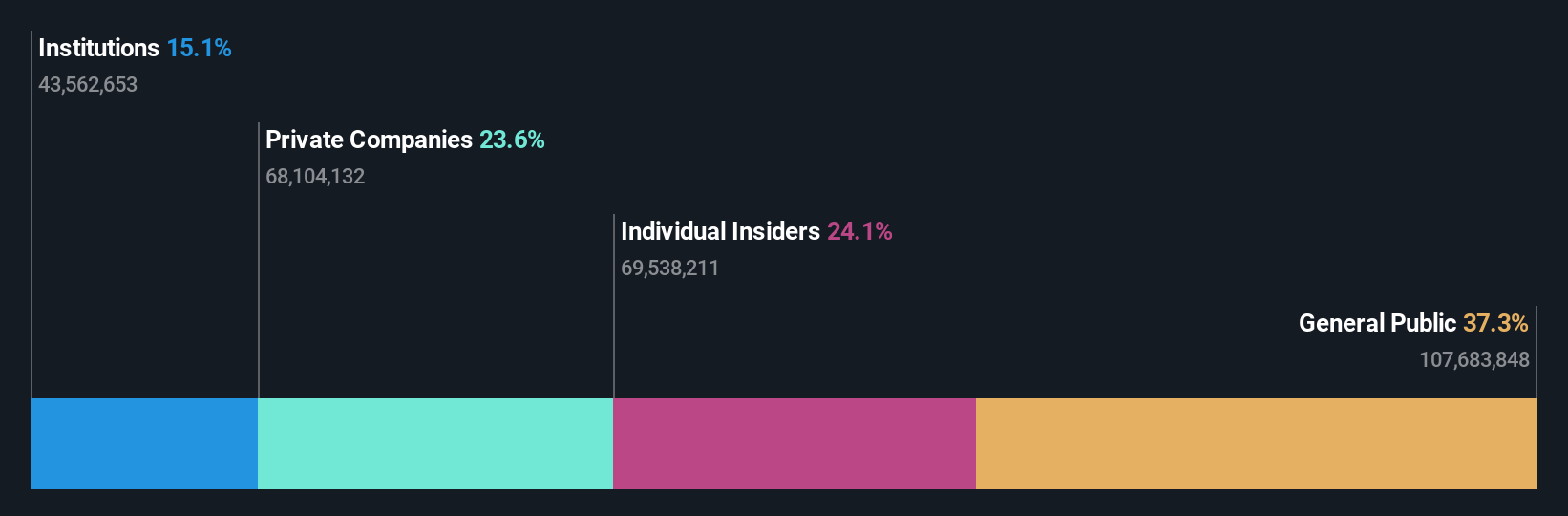

Insider Ownership: 28.5%

Earnings Growth Forecast: 103.6% p.a.

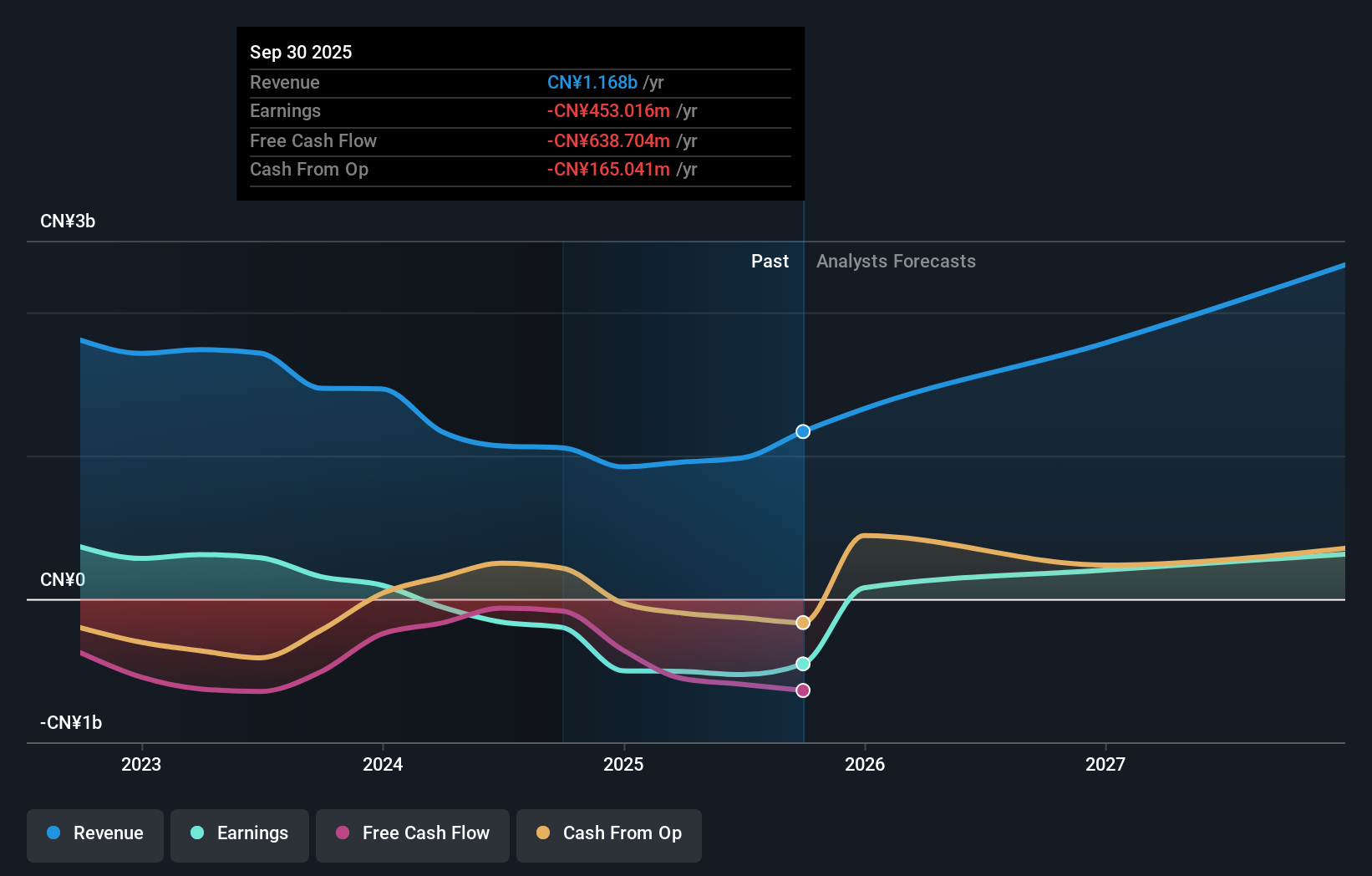

Beijing Relpow Technology is poised for significant growth, with revenue expected to increase by 32.7% annually, surpassing the Chinese market average. Despite a recent net loss of CNY 95.14 million for H1 2025, the company is forecasted to achieve profitability within three years, indicating robust potential in its sector. The upcoming shareholder meeting on October 29 will address stock incentive plans and employee ownership strategies, reflecting a focus on aligning management interests with long-term growth objectives.

- Dive into the specifics of Beijing Relpow Technology here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Beijing Relpow Technology is priced higher than what may be justified by its financials.

Maxscend Microelectronics (SZSE:300782)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Maxscend Microelectronics Company Limited specializes in the research, development, production, and sale of radio frequency integrated circuits in China, with a market cap of CN¥41.89 billion.

Operations: Maxscend Microelectronics focuses on the research, development, production, and sale of radio frequency integrated circuits in China.

Insider Ownership: 26.8%

Earnings Growth Forecast: 55.4% p.a.

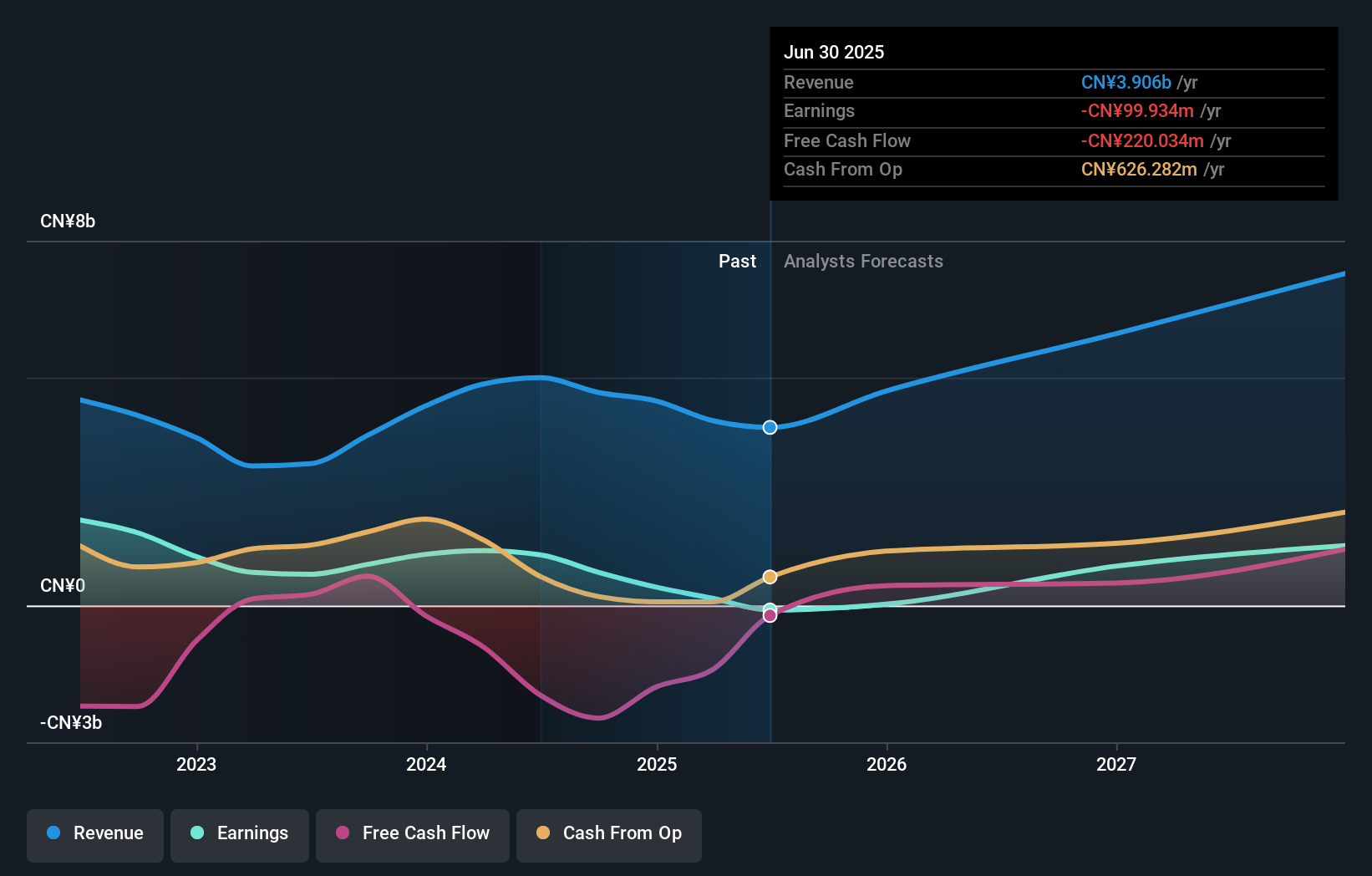

Maxscend Microelectronics is navigating a challenging period with half-year sales and revenue declining to CNY 1.70 billion, resulting in a net loss of CNY 147.39 million. Despite this, the company is projected to achieve profitability within three years, with earnings expected to grow at 55.35% annually, outpacing the Chinese market's average profit growth. The absence of significant insider trading activity suggests stable insider confidence amidst these financial adjustments.

- Navigate through the intricacies of Maxscend Microelectronics with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Maxscend Microelectronics' shares may be trading at a premium.

POCO Holding (SZSE:300811)

Simply Wall St Growth Rating: ★★★★★☆

Overview: POCO Holding Co., Ltd. specializes in the development, production, and sale of alloy soft magnetic powder and related components for electronic equipment, with a market cap of CN¥23.81 billion.

Operations: The company generates revenue from the sale of alloy soft magnetic powder and alloy soft magnetic core, along with related inductance components for electronic equipment users.

Insider Ownership: 24%

Earnings Growth Forecast: 29.7% p.a.

POCO Holding demonstrates potential for growth, with earnings projected to rise by 29.7% annually, outpacing the Chinese market average. Recent earnings show a modest increase in net income to CNY 293.58 million over nine months. Despite a volatile share price recently, insider ownership remains significant, indicating confidence in the company's trajectory. Revenue is expected to grow at 24.8% per year, surpassing industry benchmarks and reflecting robust business expansion prospects amidst ongoing corporate governance updates.

- Click here to discover the nuances of POCO Holding with our detailed analytical future growth report.

- The valuation report we've compiled suggests that POCO Holding's current price could be inflated.

Key Takeaways

- Access the full spectrum of 620 Fast Growing Asian Companies With High Insider Ownership by clicking on this link.

- Curious About Other Options? Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Relpow Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300593

Beijing Relpow Technology

Manufactures and sells power supply products in China and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives