Seegene And 2 Additional Growth Leaders With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rising inflation and potential tariff negotiations, U.S. stock indexes are climbing toward record highs, with growth stocks outperforming value shares. In this environment, companies with strong insider ownership can be particularly appealing to investors seeking alignment of interests and confidence in long-term growth strategies.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.9% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Findi (ASX:FND) | 35.8% | 118.5% |

We'll examine a selection from our screener results.

Seegene (KOSDAQ:A096530)

Simply Wall St Growth Rating: ★★★★☆☆

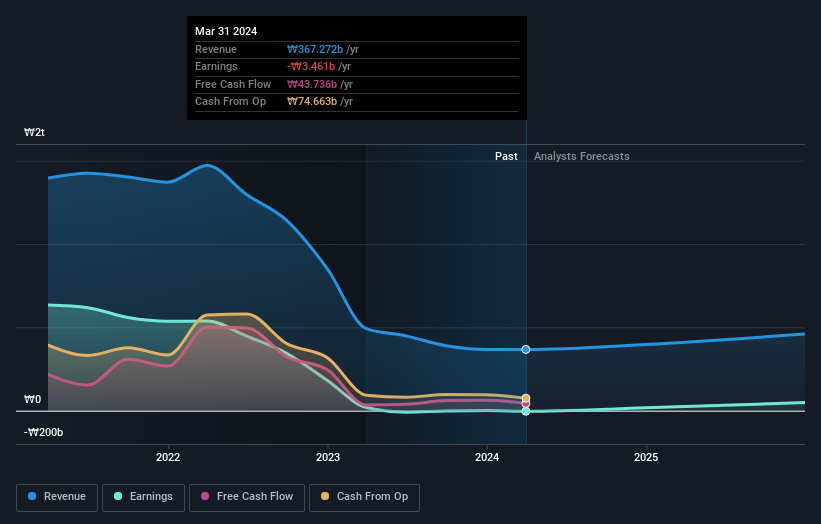

Overview: Seegene, Inc. is a company that manufactures and sells molecular diagnostics products globally, with a market cap of approximately ₩1.07 trillion.

Operations: The company's revenue primarily comes from its Diagnostic Kits and Equipment segment, totaling approximately ₩399.42 billion.

Insider Ownership: 33.1%

Revenue Growth Forecast: 15.7% p.a.

Seegene's earnings are forecast to grow significantly at 35.21% annually, outpacing the Korean market's 26% growth rate. However, its revenue growth of 15.7% lags behind the ideal threshold of 20%, though it still surpasses the market average of 9%. Despite becoming profitable this year, Seegene faces challenges with a low projected return on equity of 5.5%. No substantial insider trading activity has been reported in recent months.

- Click here to discover the nuances of Seegene with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Seegene shares in the market.

OKE Precision Cutting Tools (SHSE:688308)

Simply Wall St Growth Rating: ★★★★☆☆

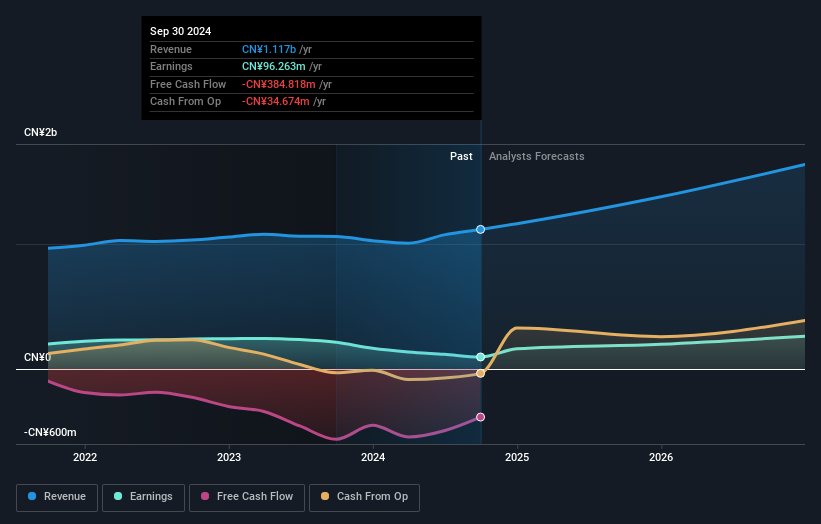

Overview: OKE Precision Cutting Tools Co., Ltd. specializes in the research, development, production, and sale of CNC tools and cemented carbide products with a market cap of CN¥2.77 billion.

Operations: The company's revenue is primarily derived from its Metal Processors and Fabrication segment, which generated CN¥1.12 billion.

Insider Ownership: 25.2%

Revenue Growth Forecast: 17.3% p.a.

OKE Precision Cutting Tools is poised for robust growth, with earnings expected to rise significantly at 36.23% annually, surpassing the Chinese market's 25% rate. However, its return on equity forecast remains modest at 8.4%. The company's price-to-earnings ratio of 30.9x indicates a good value compared to the market average of 36.5x, despite profit margins dropping from last year's figures. Recent events included a Special Shareholders Meeting in February 2025 without notable insider trading activity reported recently.

- Click to explore a detailed breakdown of our findings in OKE Precision Cutting Tools' earnings growth report.

- Our valuation report unveils the possibility OKE Precision Cutting Tools' shares may be trading at a premium.

Guangzhou Goaland Energy Conservation Tech (SZSE:300499)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Goaland Energy Conservation Tech, with a market cap of CN¥5.56 billion, specializes in energy conservation technologies and solutions.

Operations: Guangzhou Goaland Energy Conservation Tech's revenue segments are not provided in the available text.

Insider Ownership: 21.2%

Revenue Growth Forecast: 34.9% p.a.

Guangzhou Goaland Energy Conservation Tech is set for strong revenue growth, forecasted at 34.9% annually, outpacing the Chinese market's average. The company is expected to become profitable within three years, although its projected return on equity remains low at 6.6%. Despite no significant insider trading activity in recent months, the company's high insider ownership aligns with its growth trajectory and potential for above-market profit expansion.

- Navigate through the intricacies of Guangzhou Goaland Energy Conservation Tech with our comprehensive analyst estimates report here.

- Our valuation report here indicates Guangzhou Goaland Energy Conservation Tech may be overvalued.

Where To Now?

- Explore the 1466 names from our Fast Growing Companies With High Insider Ownership screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300499

Guangzhou Goaland Energy Conservation Tech

Guangzhou Goaland Energy Conservation Tech.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives