There's No Escaping Cscec Scimee Sci.&Tech. Co.,Ltd's (SZSE:300425) Muted Earnings

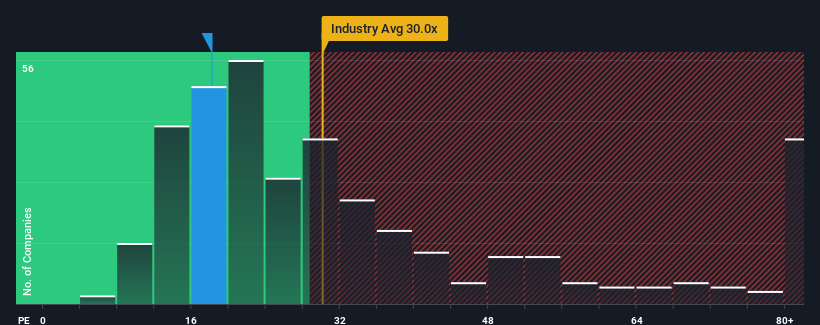

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may consider Cscec Scimee Sci.&Tech. Co.,Ltd (SZSE:300425) as an attractive investment with its 18.2x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Cscec Scimee Sci.&Tech.Ltd has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Cscec Scimee Sci.&Tech.Ltd

How Is Cscec Scimee Sci.&Tech.Ltd's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Cscec Scimee Sci.&Tech.Ltd's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 38%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 36% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that Cscec Scimee Sci.&Tech.Ltd's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Cscec Scimee Sci.&Tech.Ltd maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Cscec Scimee Sci.&Tech.Ltd that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300425

Cscec Scimee Sci.&Tech.Ltd

Manufactures and sells environmental protection equipment and services in China.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives