- China

- /

- Electrical

- /

- SZSE:300207

3 Asian Growth Companies With Insider Ownership Up To 28%

Reviewed by Simply Wall St

As Asian markets experience a notable upswing, particularly in technology-focused shares and broader indices like the CSI 300 and Hang Seng, investors are keenly observing the region's growth potential amidst varied economic signals. In this environment, companies with high insider ownership often attract interest due to their perceived alignment of management interests with shareholders, suggesting confidence in their long-term prospects.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36.1% | 26.6% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| M31 Technology (TPEX:6643) | 26.3% | 98.2% |

| Laopu Gold (SEHK:6181) | 35.5% | 34.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Underneath we present a selection of stocks filtered out by our screen.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kuaishou Technology is an investment holding company offering live streaming, online marketing, and other services in the People's Republic of China with a market cap of approximately HK$324.01 billion.

Operations: The company's revenue segments consist of Domestic operations generating CN¥128.93 billion and Overseas operations contributing CN¥5.24 billion.

Insider Ownership: 19.4%

Kuaishou Technology demonstrates significant growth potential, driven by its robust insider ownership and strategic advancements in AI technology. The recent launch of the Kling AI 2.5 Turbo Video Model highlights Kuaishou's commitment to innovation, offering enhanced video generation capabilities at reduced costs. Despite no substantial insider trading activity recently, Kuaishou's earnings are forecasted to grow faster than the Hong Kong market at 16.4% annually, supported by strong revenue and profit growth from previous years.

- Get an in-depth perspective on Kuaishou Technology's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Kuaishou Technology shares in the market.

Horizon Robotics (SEHK:9660)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Horizon Robotics, an investment holding company, offers automotive solutions for passenger vehicles in China with a market cap of HK$130.11 billion.

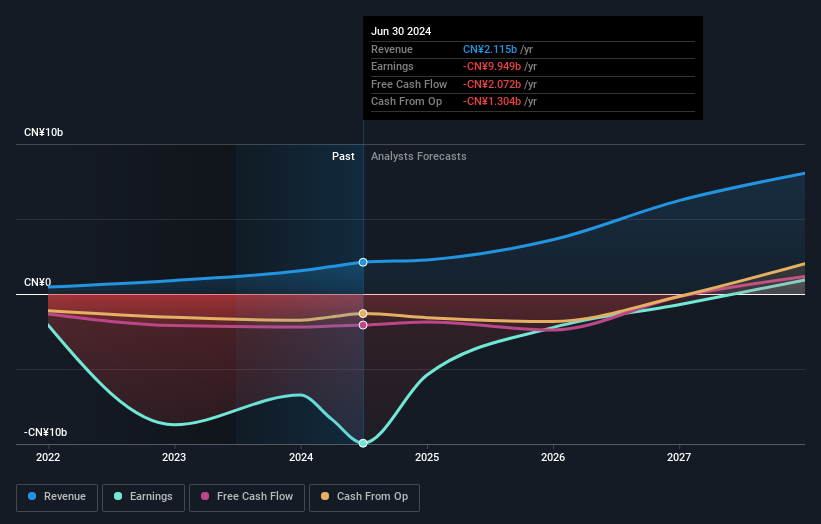

Operations: The company's revenue segments include CN¥2.91 billion from automotive solutions and CN¥100.77 million from non-automotive solutions.

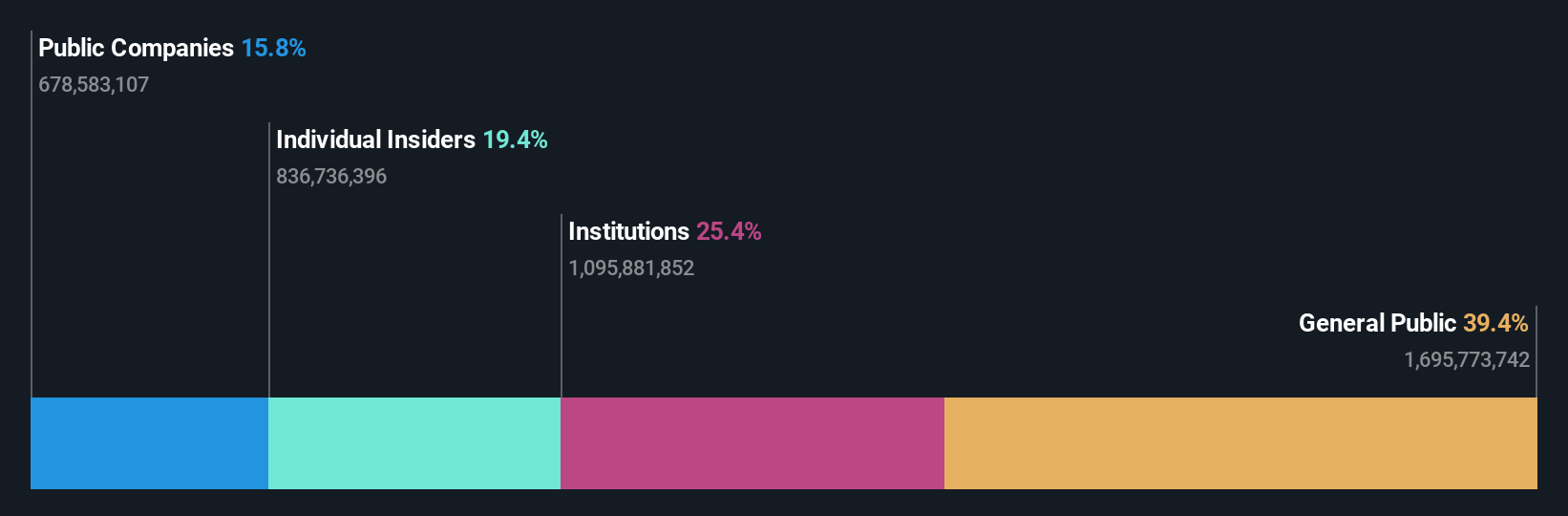

Insider Ownership: 15.8%

Horizon Robotics shows promising growth potential with high insider ownership, despite recent leadership changes. The company's revenue is forecast to grow significantly faster than the Hong Kong market at 32.2% annually. Although the firm remains unprofitable, its earnings are expected to increase by 17% per year. Recent equity offerings raised HK$6.38 billion, potentially supporting expansion efforts. Minimal insider trading activity was observed in the past three months, indicating stable internal confidence amidst strategic shifts.

- Navigate through the intricacies of Horizon Robotics with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Horizon Robotics' share price might be too optimistic.

Sunwoda ElectronicLtd (SZSE:300207)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sunwoda Electronic Co., Ltd specializes in the research, development, design, production, and sale of lithium-ion battery modules with a market cap of CN¥57.37 billion.

Operations: Sunwoda Electronic Co., Ltd generates revenue through its activities in the research, development, design, production, and sale of lithium-ion battery modules.

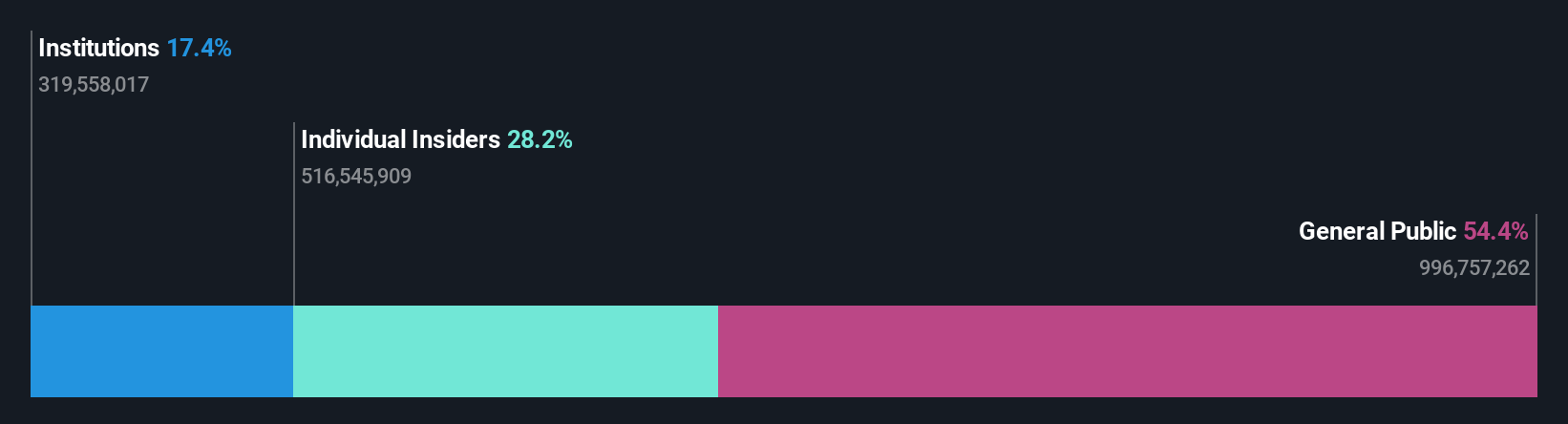

Insider Ownership: 28.2%

Sunwoda Electronic Ltd demonstrates solid growth potential with significant insider ownership. The company's earnings are projected to grow substantially at 29.8% annually, outpacing the broader Chinese market. Recent financials revealed a modest increase in net income to CNY 855.85 million for the half-year ending June 2025, despite high share price volatility and low return on equity forecasts. Trading well below estimated fair value suggests attractive relative valuation compared to peers and industry standards.

- Click to explore a detailed breakdown of our findings in Sunwoda ElectronicLtd's earnings growth report.

- Our comprehensive valuation report raises the possibility that Sunwoda ElectronicLtd is priced lower than what may be justified by its financials.

Next Steps

- Click this link to deep-dive into the 620 companies within our Fast Growing Asian Companies With High Insider Ownership screener.

- Searching for a Fresh Perspective? Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300207

Sunwoda ElectronicLtd

Engages in the research and development, design, production, and sale of lithium-ion battery modules.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives