- Switzerland

- /

- Machinery

- /

- SWX:VACN

3 Compelling Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

In a week marked by record highs across major indices, the global markets have shown resilience despite geopolitical tensions and tariff announcements. As investors navigate this evolving landscape, growth stocks with strong insider ownership present intriguing opportunities due to their potential alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Underneath we present a selection of stocks filtered out by our screen.

Dongyue Group (SEHK:189)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dongyue Group Limited is an investment holding company engaged in the manufacturing, distribution, and sale of polymers, organic silicone, refrigerants, dichloromethane, PVC, liquid alkali, and other products both in China and internationally with a market capitalization of approximately HK$12.48 billion.

Operations: The company generates revenue from various segments, including CN¥4.31 billion from polymers, CN¥5.53 billion from refrigerants, CN¥5.12 billion from organic silicon, and CN¥1.12 billion from dichloromethane PVC and liquid alkali.

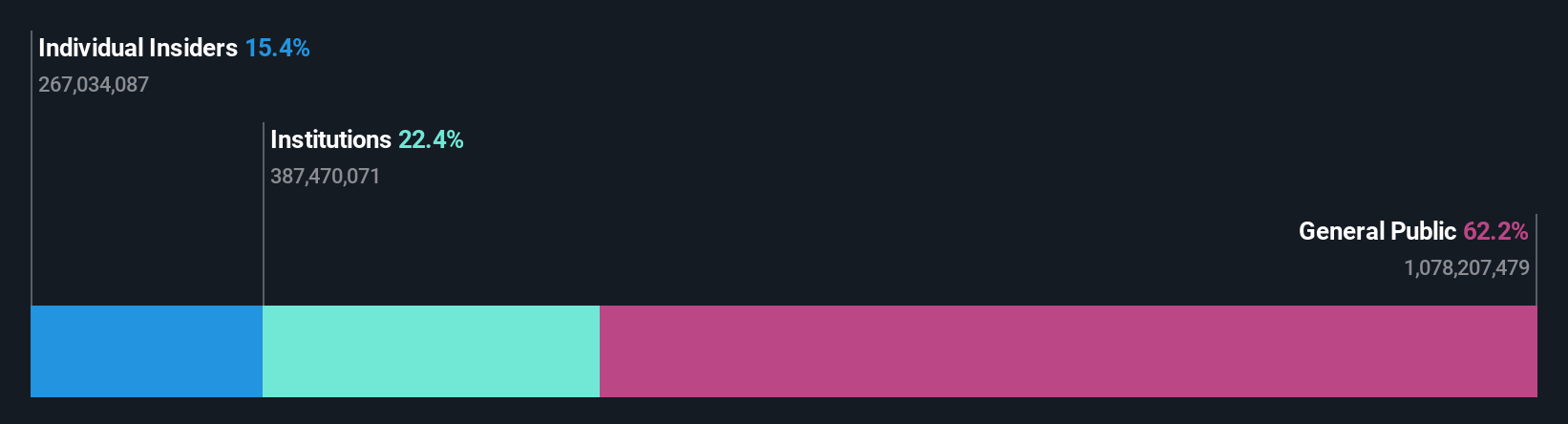

Insider Ownership: 15.4%

Earnings Growth Forecast: 42.6% p.a.

Dongyue Group's earnings are forecast to grow significantly at 42.59% annually, outpacing the Hong Kong market's growth rate of 11.4%. However, revenue is expected to increase by only 10.5% per year, which is slower than the desired high-growth benchmark but still above the market average of 7.8%. Despite a decline in profit margins from last year, insider ownership remains stable with no substantial trading activity reported in recent months.

- Take a closer look at Dongyue Group's potential here in our earnings growth report.

- Our valuation report unveils the possibility Dongyue Group's shares may be trading at a premium.

VAT Group (SWX:VACN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VAT Group AG, with a market cap of CHF10.52 billion, develops, manufactures, and supplies vacuum valves and related products across Switzerland, Europe, the United States, Asia, and internationally.

Operations: The company's revenue segments consist of Valves at CHF783.51 million and Global Service at CHF163.83 million.

Insider Ownership: 10.2%

Earnings Growth Forecast: 21.7% p.a.

VAT Group's earnings are projected to grow significantly at 21.7% annually, surpassing the Swiss market's growth rate of 11.4%. Revenue is expected to rise by 17.7% per year, also outpacing the market average of 4.3%, though not reaching high-growth benchmarks. The stock trades at a considerable discount, approximately 32.3% below its estimated fair value, with no substantial insider trading activity reported recently. Recent events include a Q3 sales call and conference presentation in Munich.

- Click here to discover the nuances of VAT Group with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that VAT Group is trading beyond its estimated value.

Tongyu Heavy Industry (SZSE:300185)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tongyu Heavy Industry Co., Ltd. focuses on the research, development, manufacture, and sale of forgings and castings with a market cap of CN¥11.61 billion.

Operations: Tongyu Heavy Industry generates revenue primarily from its General Equipment Manufacturing segment, which accounts for CN¥5.14 billion.

Insider Ownership: 10%

Earnings Growth Forecast: 104.2% p.a.

Tongyu Heavy Industry's earnings are forecast to grow significantly at 104.23% annually, outpacing the Chinese market's growth rate of 26.3%. Revenue is projected to increase by 23% per year, exceeding the market average of 13.9%. Despite trading at a substantial discount, approximately 82.4% below its estimated fair value, recent earnings show a decline in net income and profit margins compared to last year. The company's financial position shows interest payments are not well covered by earnings.

- Click to explore a detailed breakdown of our findings in Tongyu Heavy Industry's earnings growth report.

- Upon reviewing our latest valuation report, Tongyu Heavy Industry's share price might be too pessimistic.

Next Steps

- Click through to start exploring the rest of the 1511 Fast Growing Companies With High Insider Ownership now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:VACN

VAT Group

Develops, manufactures, and supplies vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows in Switzerland, rest of Europe, the United States, Japan, Korea, Singapore, China, rest of Asia, and internationally.

Flawless balance sheet with high growth potential.