- China

- /

- Semiconductors

- /

- SZSE:300842

Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

In a week marked by busy earnings reports and economic data, small-cap stocks have shown resilience amidst broader market fluctuations, as major indices like the S&P 500 and Nasdaq Composite experienced declines. While growth stocks lagged behind value shares due to cautious earnings from tech giants, small-caps held up better than their larger counterparts, highlighting potential opportunities for investors seeking undiscovered gems in the market. Identifying promising stocks often involves looking beyond current headlines to find companies with strong fundamentals and potential for growth despite prevailing economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Jetwell Computer | 57.20% | 6.93% | 24.36% | ★★★★★☆ |

| Standard Chartered Bank Kenya | 40.67% | 10.19% | 19.02% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Kinergy Advancement Berhad | 60.88% | 6.26% | 33.33% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.07% | 35.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Shenzhen Bluetrum Technology (SHSE:688332)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Bluetrum Technology Co., Ltd. focuses on the research, development, design, and sale of wireless audio SOC chips with a market capitalization of CN¥8.84 billion.

Operations: Bluetrum Technology generates revenue primarily from the sale of wireless audio SOC chips. The company's financial performance is highlighted by a net profit margin that has shown significant variation over recent periods, reflecting changes in cost structures and market conditions.

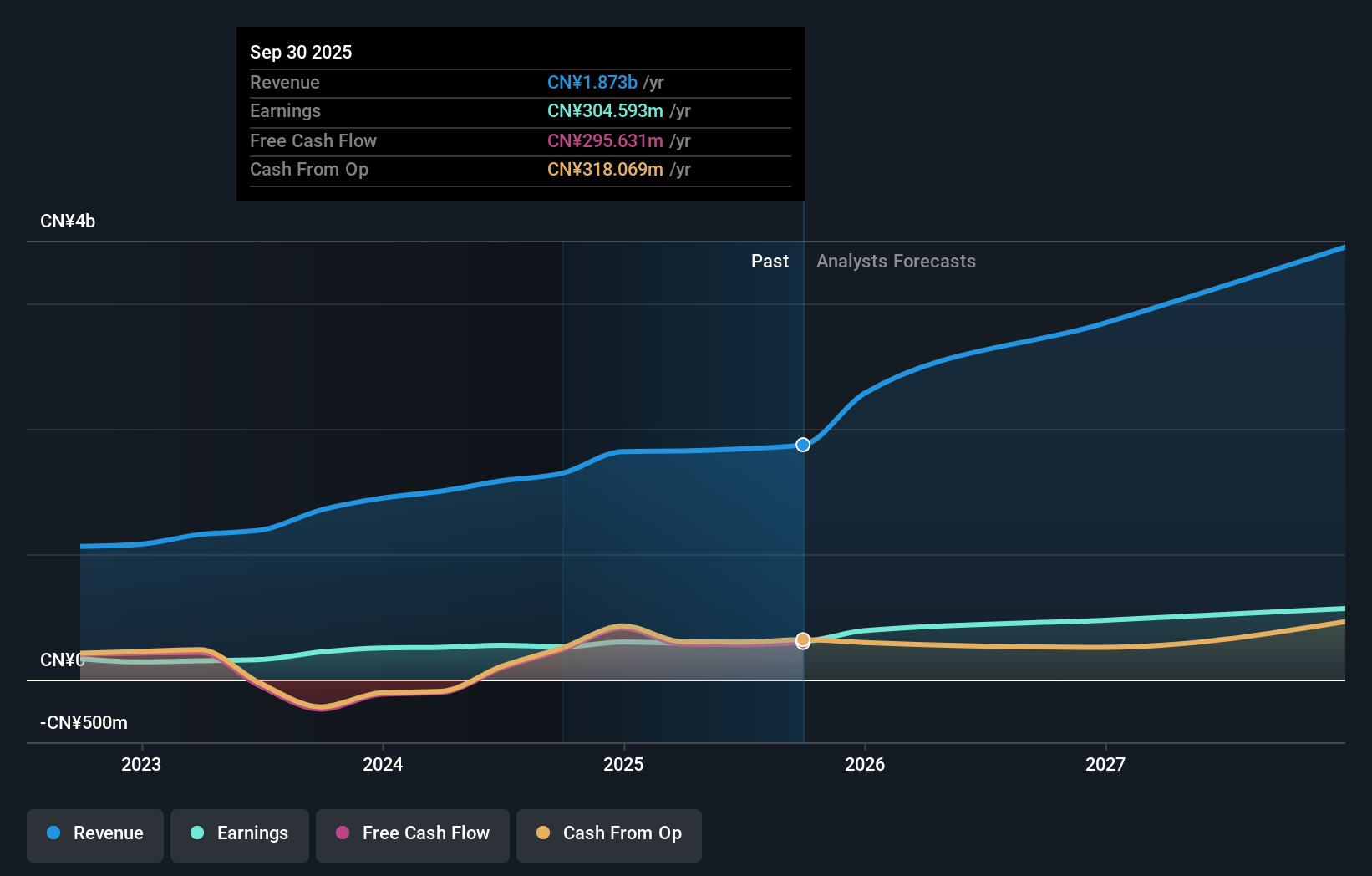

Shenzhen Bluetrum Technology, a notable player in the semiconductor industry, has shown impressive financial growth with earnings up 18.7% over the past year, surpassing the industry's 12.9%. The company reported sales of CNY 1.25 billion for nine months ending September 2024, an increase from CNY 1.05 billion last year, and net income rose to CNY 206.71 million from CNY 197.25 million previously. With a price-to-earnings ratio of 37x below the industry average of 63x and high-quality earnings reported, Bluetrum seems well-positioned for continued growth as it joins the S&P Global BMI Index.

Shenzhen Changhong Technology (SZSE:300151)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Changhong Technology Co., Ltd. specializes in the design, manufacture, and sale of plastic molds and precision injection molded parts both domestically and internationally, with a market cap of CN¥11.10 billion.

Operations: Shenzhen Changhong Technology generates revenue primarily through the sale of plastic molds and precision injection molded parts. The company operates both in China and internationally, contributing to its market cap of CN¥11.10 billion.

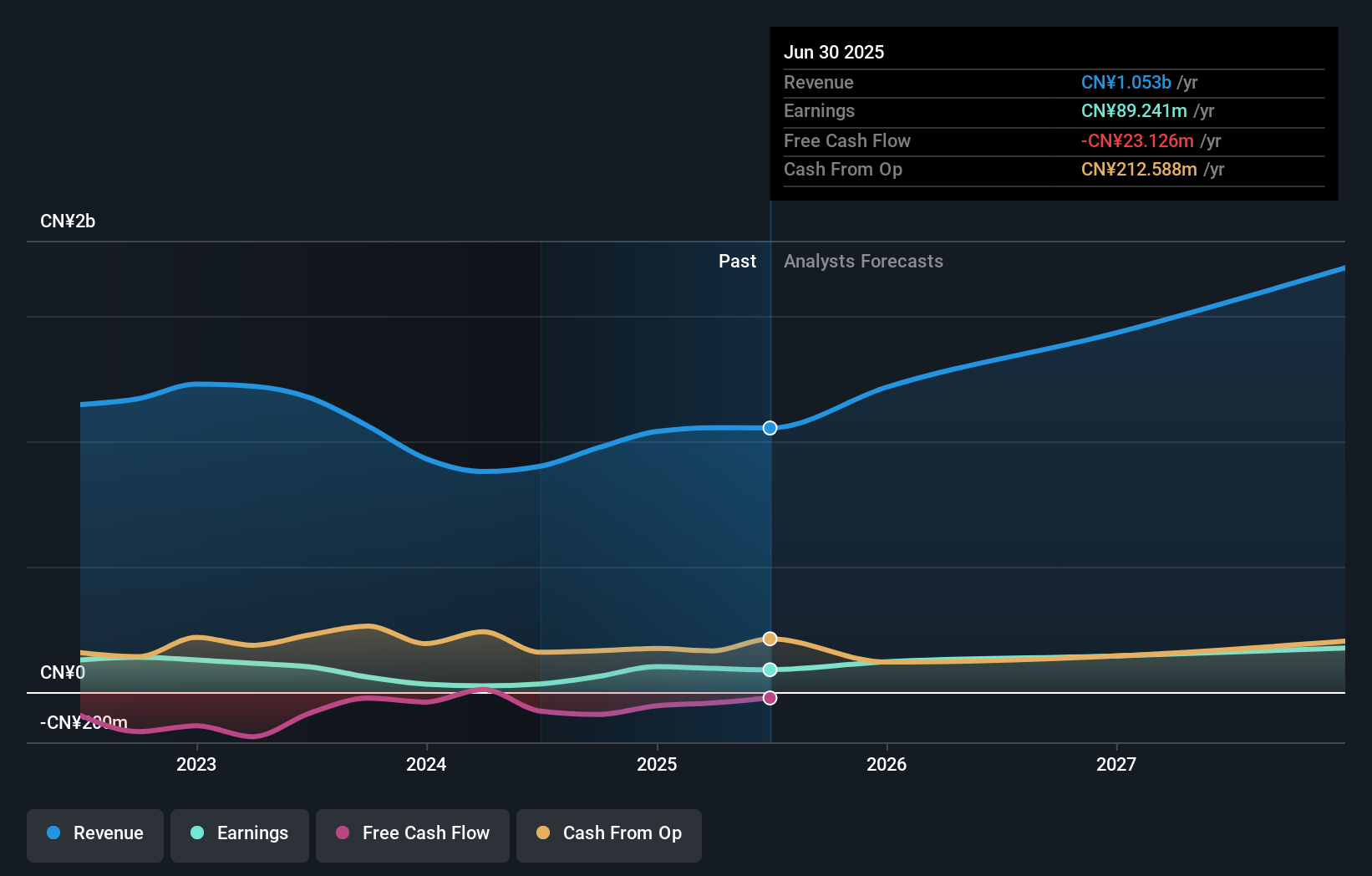

Shenzhen Changhong Technology, a smaller player in its industry, reported impressive earnings growth of 4.3% over the past year, surpassing the Machinery industry's -0.4%. The company boasts high-quality earnings and maintains more cash than its total debt, reflecting sound financial health. Despite an increase in its debt-to-equity ratio to 36.1% over five years, it remains profitable with no concerns about covering interest payments. Recent sales figures for nine months ended September 2024 reached CNY 782 million compared to CNY 739 million last year, while net income rose to CNY 81 million from CNY 51 million previously.

- Delve into the full analysis health report here for a deeper understanding of Shenzhen Changhong Technology.

Understand Shenzhen Changhong Technology's track record by examining our Past report.

Wuxi DK Electronic MaterialsLtd (SZSE:300842)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wuxi DK Electronic Materials Co., Ltd. is a technology company focused on the research, development, production, and sale of performance electronic materials for solar photovoltaic, display, lighting, and semiconductor applications in China with a market capitalization of approximately CN¥6.29 billion.

Operations: The company generates revenue through the sale of performance electronic materials tailored for solar photovoltaic, display, lighting, and semiconductor sectors. It operates with a focus on optimizing its cost structure to enhance profitability. The net profit margin reflects the company's efficiency in converting revenue into actual profit after accounting for all expenses.

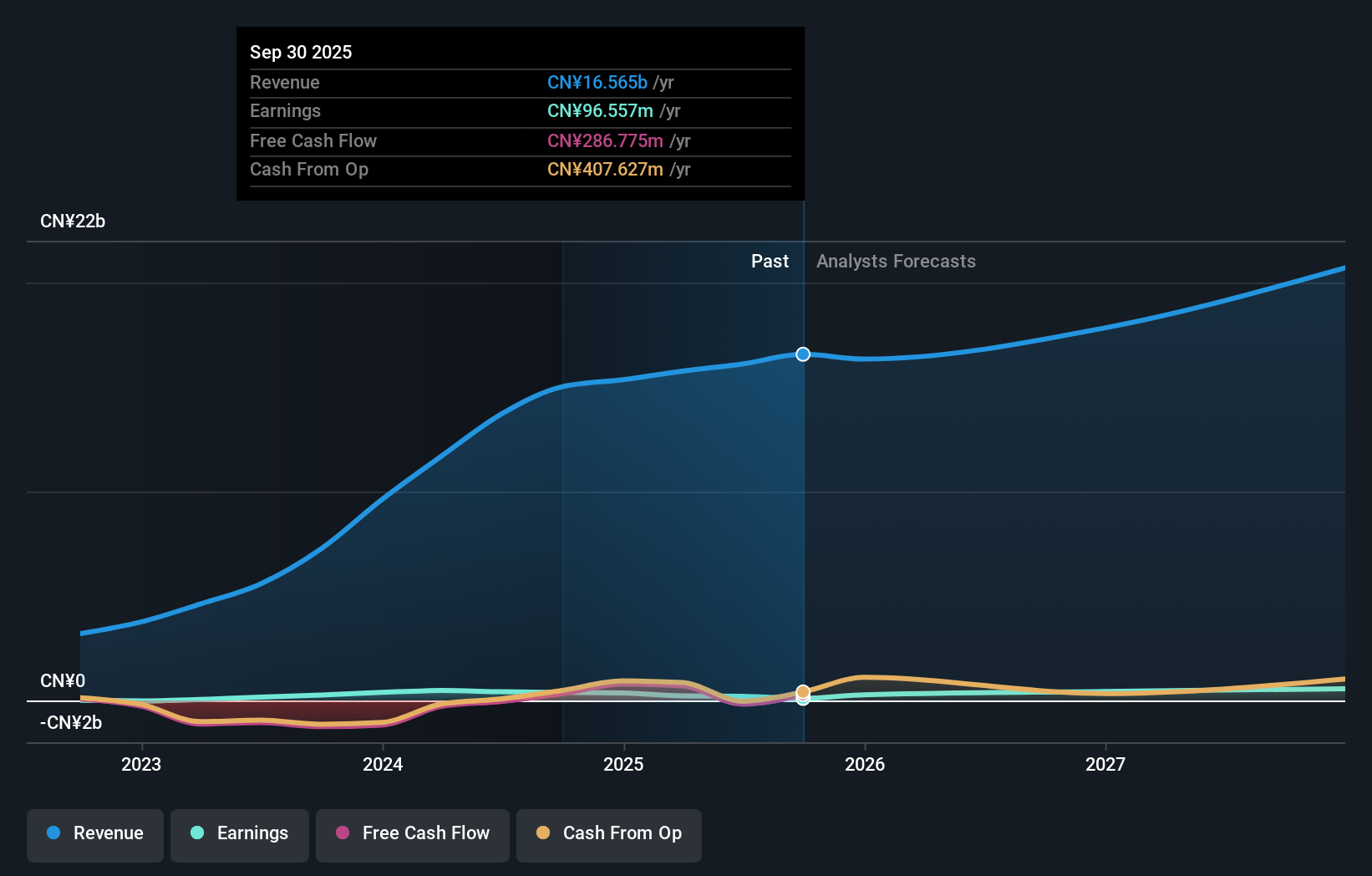

Wuxi DK Electronic Materials, a smaller player in the semiconductor industry, shows promise with earnings growth of 47.7% over the past year, outpacing the industry average of 12.9%. Despite a large one-off loss of CN¥188.8 million affecting recent results, it continues to trade at an attractive price-to-earnings ratio of 18.4x compared to the market's 34.4x. The company's net debt to equity ratio stands at a satisfactory 30.6%, and its interest payments are well covered by EBIT at 15.5x coverage, indicating solid financial health despite recent volatility in its share price.

Seize The Opportunity

- Embark on your investment journey to our 4738 Undiscovered Gems With Strong Fundamentals selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi DK Electronic MaterialsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300842

Wuxi DK Electronic MaterialsLtd

A technology company, engages in the research and development, production, and sale of performance electronic materials for solar photovoltaic, display, lighting, and semiconductor in China.

High growth potential and fair value.