High Growth Tech Stocks Including Shanghai BOCHU Electronic Technology

Reviewed by Simply Wall St

In a week marked by significant economic reports and earnings data, global markets experienced volatility, with major indices such as the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating. Amidst this backdrop of cautious optimism in small-cap stocks holding stronger than their large-cap counterparts, investors are keenly observing high-growth tech companies like Shanghai BOCHU Electronic Technology for their potential to navigate these dynamic conditions. A good stock in this sector often demonstrates resilience through innovative capabilities and adaptability to market shifts, which can be crucial during periods of economic uncertainty.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| TG Therapeutics | 34.69% | 57.41% | ★★★★★★ |

| Alkami Technology | 21.90% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.17% | 70.49% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 71.73% | ★★★★★★ |

Click here to see the full list of 1291 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Shanghai BOCHU Electronic Technology (SHSE:688188)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shanghai BOCHU Electronic Technology Corporation Limited operates in the electronic technology sector and has a market capitalization of CN¥39.39 billion.

Operations: The company generates revenue through its operations in the electronic technology sector. With a market capitalization of CN¥39.39 billion, it focuses on developing and providing electronic components and solutions.

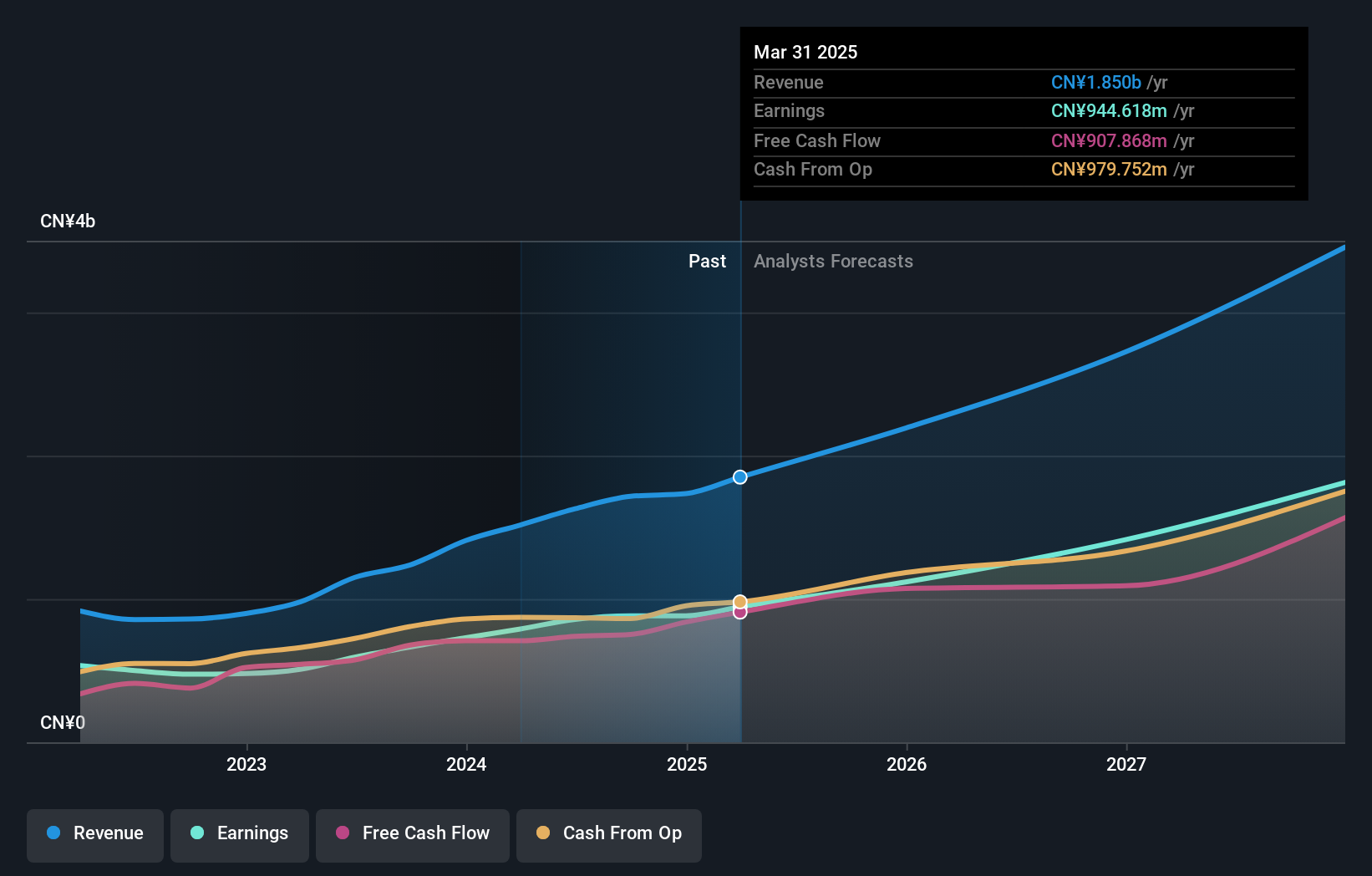

Shanghai BOCHU Electronic Technology has demonstrated robust growth, with its earnings surging by 32.7% over the past year, outpacing the electronic industry's average of 1.6%. This trend is supported by a significant R&D investment strategy that fosters innovation and maintains competitive edge in technology development. The company's revenue is projected to grow at an impressive rate of 27.8% annually, surpassing the Chinese market forecast of 14%. Furthermore, Shanghai BOCHU’s commitment to reinvesting in its core capabilities is evident from its R&D expenses which are strategically aligned to propel future earnings growth expected at 29.6% per year. Recent financial disclosures reveal a strong performance with sales reaching CNY 1.3 billion for the nine months ended September 2024, up from CNY 991.5 million in the previous year period; net income also rose significantly to CNY 725.74 million from CNY 572.16 million. These figures underscore Shanghai BOCHU’s ability not only to enhance shareholder value through effective operational strategies but also indicate potential for sustained growth amidst evolving technological landscapes.

Chongqing Zhifei Biological Products (SZSE:300122)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chongqing Zhifei Biological Products Co., Ltd. is a company involved in the development, production, and sale of vaccines and other biological products with a market capitalization of CN¥68.75 billion.

Operations: Zhifei Biological Products generates revenue primarily from its biochemical product segment, which accounts for CN¥36.43 billion. The company focuses on the production and sale of vaccines and other biological products.

Chongqing Zhifei Biological Products, amidst a challenging fiscal year, has demonstrated resilience with a notable revenue growth forecast of 17.3% annually, outpacing the broader Chinese market expectation of 14%. This growth is underpinned by substantial R&D investments that have strategically positioned the company for future advancements in biotechnology. Despite a downturn in net income from CNY 6.53 billion to CNY 2.15 billion over the past nine months, the firm's commitment to innovation is evident with an aggressive R&D expenditure accounting for a significant portion of its revenue. Moreover, anticipated earnings growth at an impressive rate of 45.1% per year highlights potential recovery and expansion prospects, signaling robust internal capabilities to navigate market fluctuations effectively.

Thunder Software TechnologyLtd (SZSE:300496)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Thunder Software Technology Co., Ltd. offers operating-system products globally, with a market capitalization of CN¥25.49 billion.

Operations: Thunder Software Technology Co., Ltd. specializes in providing operating-system solutions across China, Europe, the United States, Japan, and other international markets. The company derives its revenue primarily from these software products and services.

Thunder Software Technology Co., Ltd. faces challenges with a recent dip in net income to CNY 151.97 million from CNY 605.98 million year-over-year, yet maintains a promising growth trajectory with expected annual revenue increases of 18.1%. The firm's commitment to innovation is underscored by substantial R&D spending, which has strategically positioned it for future advancements in the software sector. Despite current volatility, Thunder Software's aggressive approach to R&D could enhance its competitive edge in an industry increasingly reliant on technological innovation.

Next Steps

- Access the full spectrum of 1291 High Growth Tech and AI Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thunder Software TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300496

Thunder Software TechnologyLtd

Provides operating-system products in China, Europe, the United States, Japan, and internationally.

Undervalued with excellent balance sheet.