- China

- /

- Auto Components

- /

- SZSE:300432

Asian Growth Companies With High Insider Ownership In September 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate expectations and technological advancements, Asian economies are experiencing their own unique set of dynamics. Amidst this backdrop, growth companies with high insider ownership in Asia present intriguing opportunities for investors seeking alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Tongguan Gold Group (SEHK:340) | 30.1% | 29.5% |

| Techwing (KOSDAQ:A089030) | 19.1% | 63.9% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Samyang Foods (KOSE:A003230) | 11.7% | 28.6% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 104.1% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Hunan Meihu Intelligent Manufacturing (SHSE:603319)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hunan Meihu Intelligent Manufacturing Co., Ltd. operates in the intelligent manufacturing sector and has a market cap of CN¥15.42 billion.

Operations: Unfortunately, the revenue segment information for Hunan Meihu Intelligent Manufacturing Co., Ltd. is not provided in the text you shared.

Insider Ownership: 27.9%

Earnings Growth Forecast: 28.0% p.a.

Hunan Meihu Intelligent Manufacturing is experiencing significant earnings growth, forecasted at 28% annually, outpacing the Chinese market's 26.6%. Despite a slower revenue growth rate of 17.8%, it surpasses the market average of 14%. Recent earnings showed an increase in net income to CNY 101.11 million and stable EPS from continuing operations at CNY 0.44. However, shareholders faced dilution over the past year, and its share price has been highly volatile recently.

- Click to explore a detailed breakdown of our findings in Hunan Meihu Intelligent Manufacturing's earnings growth report.

- In light of our recent valuation report, it seems possible that Hunan Meihu Intelligent Manufacturing is trading beyond its estimated value.

Guangdong Create Century Intelligent Equipment Group (SZSE:300083)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangdong Create Century Intelligent Equipment Group Corporation Limited, with a market cap of CN¥18.43 billion, is involved in the research, development, production, and sale of high-end intelligent equipment in China.

Operations: Guangdong Create Century Intelligent Equipment Group Corporation Limited generates revenue through its high-end intelligent equipment business operations in China.

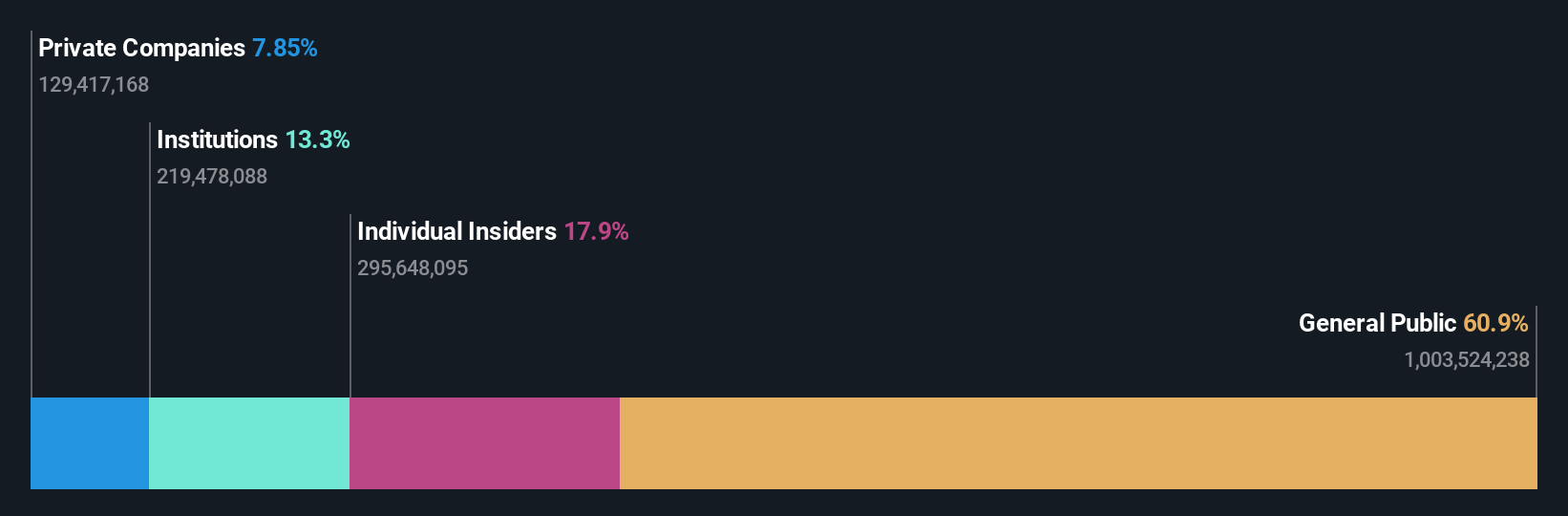

Insider Ownership: 17.9%

Earnings Growth Forecast: 31.6% p.a.

Guangdong Create Century Intelligent Equipment Group is experiencing substantial earnings growth, with a forecasted annual increase of 31.6%, surpassing the Chinese market's average. Revenue growth is also expected to outpace the market at 16.1% annually. Recent amendments to company bylaws indicate active governance adjustments, while recent results showed net income rising to CNY 233.19 million from CNY 158.23 million last year, highlighting robust financial performance amidst ongoing share buybacks totaling CNY 118.29 million.

- Take a closer look at Guangdong Create Century Intelligent Equipment Group's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Guangdong Create Century Intelligent Equipment Group is priced higher than what may be justified by its financials.

Fulin Precision (SZSE:300432)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fulin Precision Co., Ltd. focuses on the research, development, manufacture, and sale of automotive engine parts in China, with a market cap of CN¥27.90 billion.

Operations: Fulin Precision Co., Ltd.'s revenue is primarily derived from its activities in the research, development, manufacture, and sale of automotive engine parts within China.

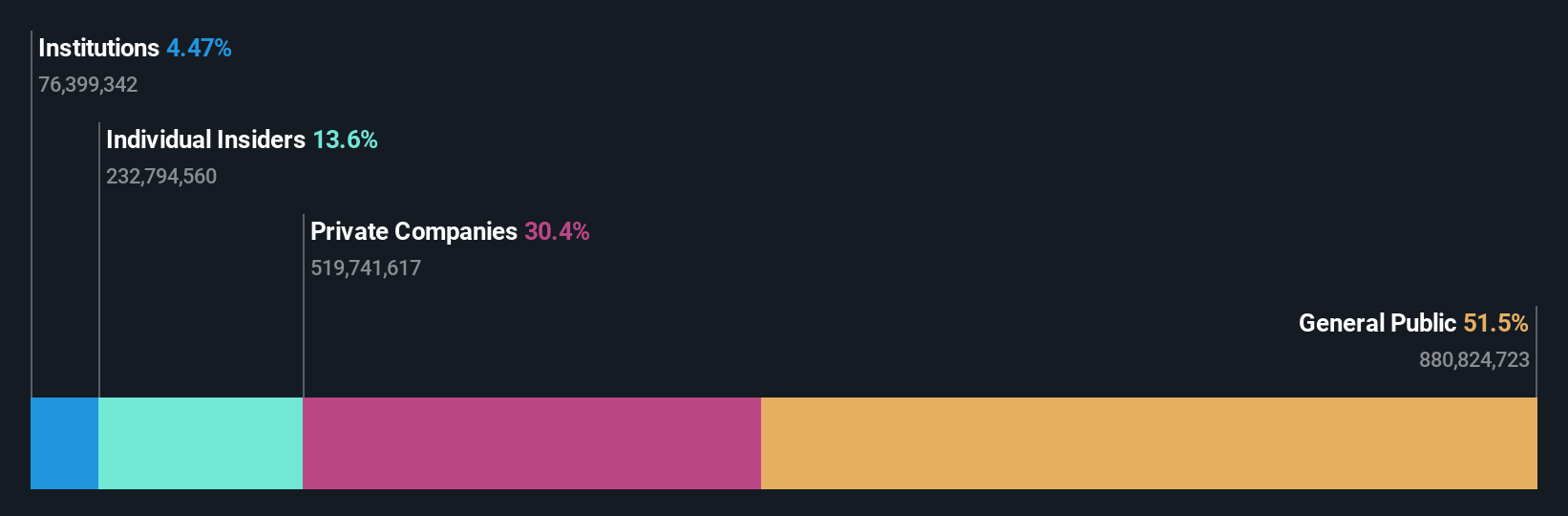

Insider Ownership: 11.8%

Earnings Growth Forecast: 50.7% p.a.

Fulin Precision has demonstrated strong financial performance, with recent half-year revenue reaching CNY 5.81 billion, up from CNY 3.59 billion a year ago, and net income increasing to CNY 174.46 million from CNY 131.76 million. The company is forecasted to achieve significant earnings growth of over 50% annually, outpacing the Chinese market average of 26.6%. Despite this growth trajectory, its dividend yield of 0.44% is not well-supported by free cash flow.

- Navigate through the intricacies of Fulin Precision with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Fulin Precision's current price could be inflated.

Taking Advantage

- Embark on your investment journey to our 615 Fast Growing Asian Companies With High Insider Ownership selection here.

- Curious About Other Options? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300432

Fulin Precision

Engages in the research and development, manufacture, and sale of automotive engine parts in China.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives