- China

- /

- Electrical

- /

- SZSE:300068

Market Cool On ZHEJIANG NARADA POWER SOURCE Co. , Ltd.'s (SZSE:300068) Revenues Pushing Shares 26% Lower

The ZHEJIANG NARADA POWER SOURCE Co. , Ltd. (SZSE:300068) share price has fared very poorly over the last month, falling by a substantial 26%. For any long-term shareholders, the last month ends a year to forget by locking in a 57% share price decline.

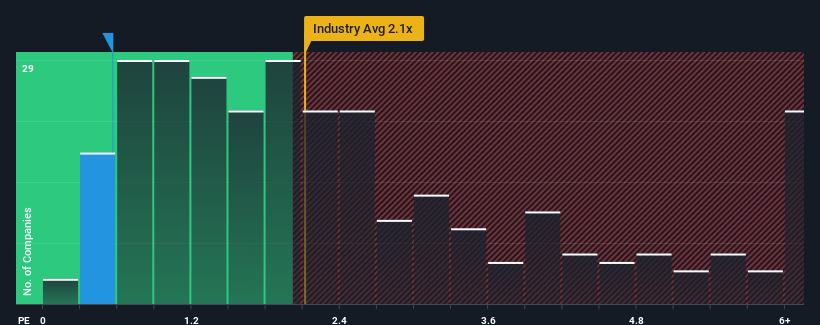

Although its price has dipped substantially, when close to half the companies operating in China's Electrical industry have price-to-sales ratios (or "P/S") above 2.1x, you may still consider ZHEJIANG NARADA POWER SOURCE as an enticing stock to check out with its 0.6x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for ZHEJIANG NARADA POWER SOURCE

How ZHEJIANG NARADA POWER SOURCE Has Been Performing

ZHEJIANG NARADA POWER SOURCE certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on ZHEJIANG NARADA POWER SOURCE will help you uncover what's on the horizon.How Is ZHEJIANG NARADA POWER SOURCE's Revenue Growth Trending?

In order to justify its P/S ratio, ZHEJIANG NARADA POWER SOURCE would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 40% last year. The strong recent performance means it was also able to grow revenue by 43% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 39% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 23%, which is noticeably less attractive.

With this information, we find it odd that ZHEJIANG NARADA POWER SOURCE is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

ZHEJIANG NARADA POWER SOURCE's P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at ZHEJIANG NARADA POWER SOURCE's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for ZHEJIANG NARADA POWER SOURCE that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if ZHEJIANG NARADA POWER SOURCE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300068

ZHEJIANG NARADA POWER SOURCE

Engages in the research, development, manufacture, sale, and service of lithium-ion batteries and systems, lead-acid batteries and systems, fuel cells and lithium products, and lead resource regeneration products in China.

High growth potential and good value.

Market Insights

Community Narratives