- China

- /

- Electrical

- /

- SZSE:300068

Investors Give ZHEJIANG NARADA POWER SOURCE Co. , Ltd. (SZSE:300068) Shares A 30% Hiding

ZHEJIANG NARADA POWER SOURCE Co. , Ltd. (SZSE:300068) shares have retraced a considerable 30% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 29%, which is great even in a bull market.

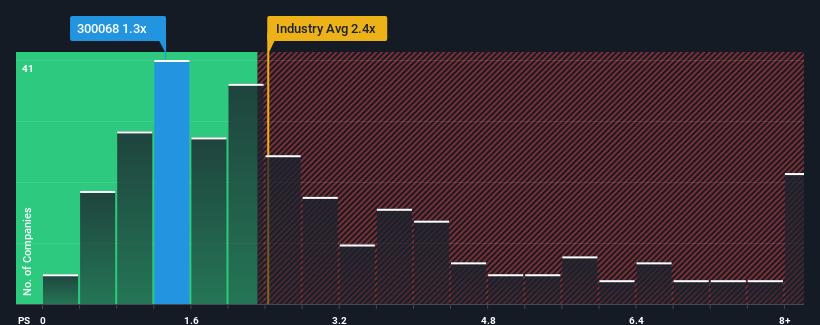

After such a large drop in price, ZHEJIANG NARADA POWER SOURCE may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.3x, since almost half of all companies in the Electrical industry in China have P/S ratios greater than 2.4x and even P/S higher than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for ZHEJIANG NARADA POWER SOURCE

How ZHEJIANG NARADA POWER SOURCE Has Been Performing

ZHEJIANG NARADA POWER SOURCE could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ZHEJIANG NARADA POWER SOURCE.How Is ZHEJIANG NARADA POWER SOURCE's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as ZHEJIANG NARADA POWER SOURCE's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 20%. As a result, revenue from three years ago have also fallen 11% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 48% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 25%, which is noticeably less attractive.

In light of this, it's peculiar that ZHEJIANG NARADA POWER SOURCE's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From ZHEJIANG NARADA POWER SOURCE's P/S?

The southerly movements of ZHEJIANG NARADA POWER SOURCE's shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems ZHEJIANG NARADA POWER SOURCE currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for ZHEJIANG NARADA POWER SOURCE that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if ZHEJIANG NARADA POWER SOURCE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300068

ZHEJIANG NARADA POWER SOURCE

Engages in the research, development, manufacture, sale, and service of lithium-ion batteries and systems, lead-acid batteries and systems, fuel cells and lithium products, and lead resource regeneration products in China.

High growth potential and good value.

Market Insights

Community Narratives