- China

- /

- Electronic Equipment and Components

- /

- SZSE:302132

Global Market Stocks Estimated Below Intrinsic Value In October 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of lower-than-expected U.S. inflation, volatile trade relations, and fluctuating oil prices, investors are keenly observing shifts in economic indicators such as business activity and consumer confidence. In this environment of cautious optimism and market fluctuations, identifying stocks that are potentially undervalued can provide opportunities for those looking to invest strategically based on intrinsic value assessments.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ülker Bisküvi Sanayi (IBSE:ULKER) | TRY106.60 | TRY212.44 | 49.8% |

| Teikoku Sen-i (TSE:3302) | ¥3400.00 | ¥6732.90 | 49.5% |

| Talgo (BME:TLGO) | €2.57 | €5.12 | 49.8% |

| Takara Bio (TSE:4974) | ¥912.00 | ¥1798.04 | 49.3% |

| Pandora (CPSE:PNDORA) | DKK881.80 | DKK1749.66 | 49.6% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.36 | CN¥26.41 | 49.4% |

| COVER (TSE:5253) | ¥1856.00 | ¥3688.86 | 49.7% |

| Arcoma (OM:ARCOMA) | SEK8.66 | SEK17.15 | 49.5% |

| Andes Technology (TWSE:6533) | NT$268.50 | NT$529.55 | 49.3% |

| Aecc Aero Science and TechnologyLtd (SHSE:600391) | CN¥27.38 | CN¥54.14 | 49.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

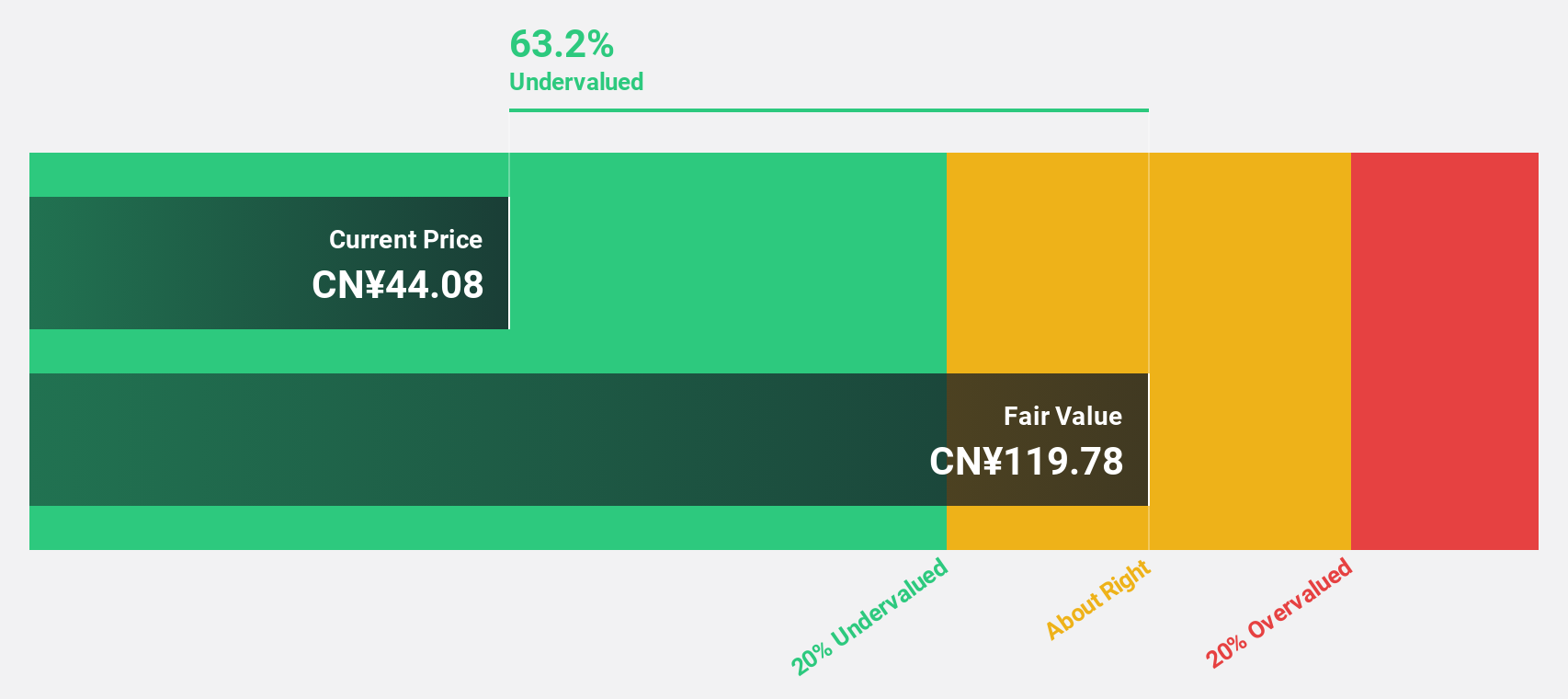

EVE Energy (SZSE:300014)

Overview: EVE Energy Co., Ltd. is involved in the research, development, production, and sales of lithium batteries both in China and internationally, with a market cap of CN¥158.07 billion.

Operations: The company's revenue primarily comes from its electronic component manufacturing segment, which generated CN¥59.57 billion.

Estimated Discount To Fair Value: 48.4%

EVE Energy is trading significantly below its estimated fair value, presenting a potential undervaluation opportunity. Despite high debt levels and volatile share prices, the company forecasts robust annual earnings growth of over 40%, surpassing market averages. Recent financials show increased revenue but decreased net income. Strategic agreements in Europe highlight its innovative energy storage solutions, potentially enhancing future cash flows despite current dividend coverage concerns.

- The analysis detailed in our EVE Energy growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of EVE Energy.

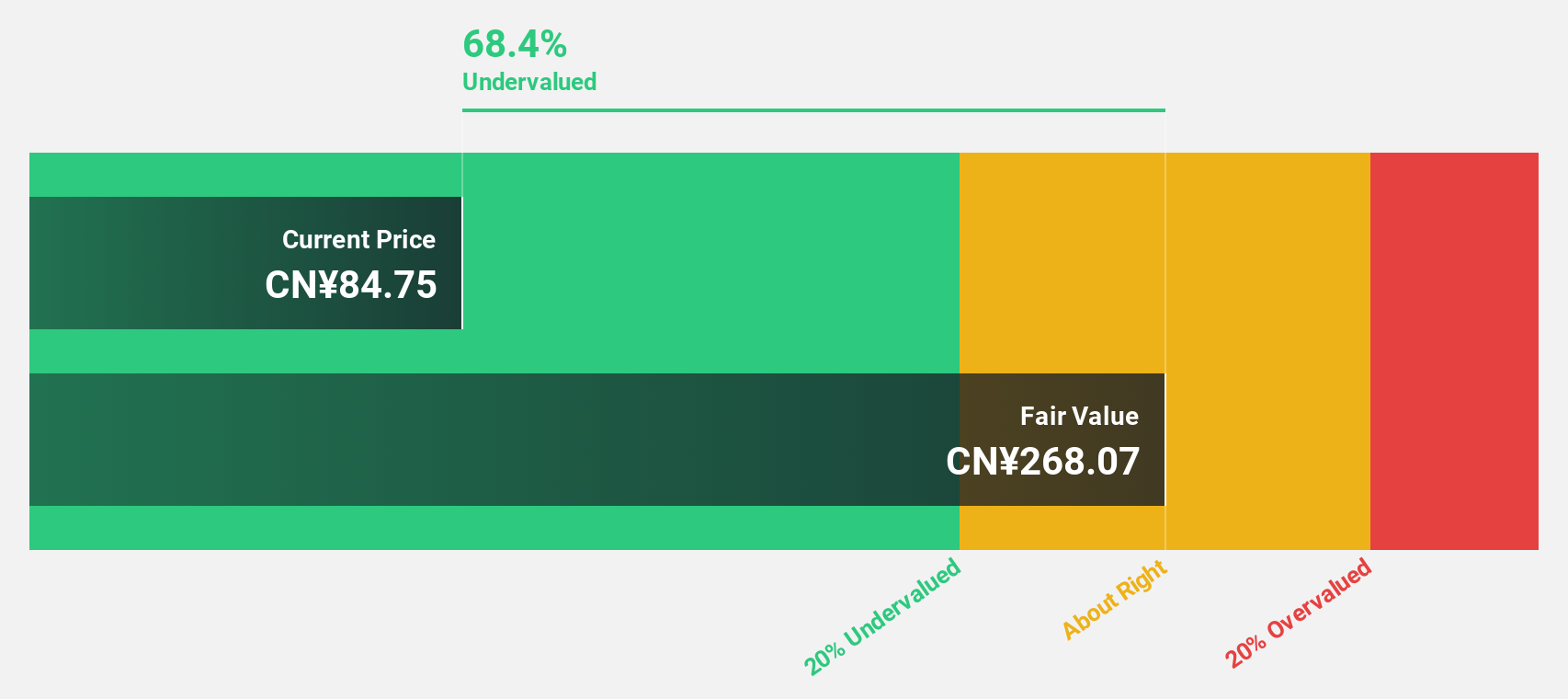

AVIC Chengdu Aircraft (SZSE:302132)

Overview: AVIC Chengdu Aircraft Company Limited offers intelligent measurement and control products for both military and civilian sectors in China and internationally, with a market cap of CN¥240.46 billion.

Operations: AVIC Chengdu Aircraft generates revenue through the provision of intelligent measurement and control products catering to both military and civilian markets domestically and abroad.

Estimated Discount To Fair Value: 22%

AVIC Chengdu Aircraft is trading at CN¥88.68, below its estimated fair value of CN¥113.72, suggesting potential undervaluation based on cash flows. Despite recent earnings showing a decline in net income to CN¥2.17 billion from the previous year's CN¥3.35 billion, revenue growth is forecasted at 34% per year, outpacing the market's 14.2%. However, volatility and past shareholder dilution present risks that investors should consider alongside growth prospects.

- Insights from our recent growth report point to a promising forecast for AVIC Chengdu Aircraft's business outlook.

- Delve into the full analysis health report here for a deeper understanding of AVIC Chengdu Aircraft.

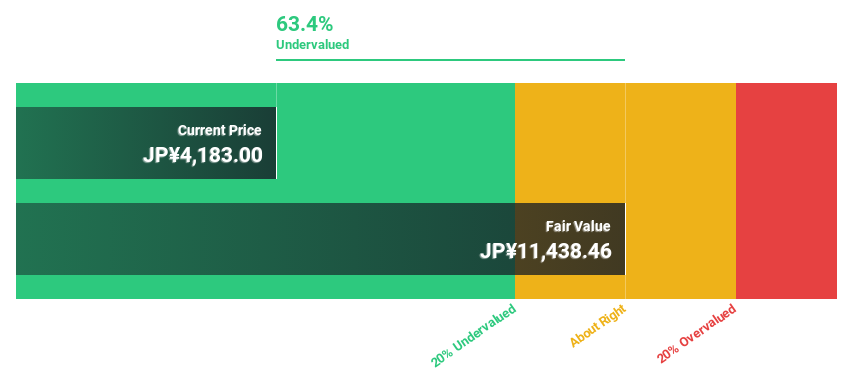

IbidenLtd (TSE:4062)

Overview: Ibiden Co., Ltd. and its subsidiaries manufacture and sell electronic and ceramic products across Japan, Asia, North America, and internationally, with a market cap of ¥1.76 trillion.

Operations: The company's revenue is primarily derived from its Electronics segment, contributing ¥208.58 billion, and its Ceramics segment, contributing ¥80.25 billion.

Estimated Discount To Fair Value: 49%

Ibiden Ltd. is trading at ¥13,570, significantly below its estimated fair value of ¥26,608.18, highlighting potential undervaluation based on cash flows. The company recently raised its earnings guidance for the fiscal year ending March 2026 due to strong demand for high-value-added products in generative AI. While earnings are expected to grow 20.1% annually over the next three years—outpacing market expectations—investors should note the stock's recent volatility and low forecasted return on equity of 11.6%.

- Upon reviewing our latest growth report, IbidenLtd's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in IbidenLtd's balance sheet health report.

Summing It All Up

- Delve into our full catalog of 512 Undervalued Global Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:302132

AVIC Chengdu Aircraft

Provides intelligent measurement and control products for military and civilian fields in China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives