Exploring Undiscovered Gems on None Exchange This December 2024

Reviewed by Simply Wall St

As global markets continue to reach new heights, with small-cap indices like the Russell 2000 hitting record intraday highs, investors are increasingly interested in the potential of lesser-known stocks that could benefit from current economic trends. In this environment, identifying promising small-cap companies requires a focus on those with robust fundamentals and resilience in the face of geopolitical and economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Hangzhou Turbine Power Group (SZSE:200771)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hangzhou Turbine Power Group Co., Ltd. designs, manufactures, and sells industrial steam turbines, gas turbines, and spare parts in China with a market cap of HK$12.49 billion.

Operations: Hangzhou Turbine Power Group generates revenue primarily from the sale of industrial steam turbines, gas turbines, and spare parts. The company's financial performance includes a notable net profit margin trend.

Hangzhou Turbine Power Group, a niche player in the electrical industry, has shown a notable earnings growth of 17.6% over the past year, outpacing the industry's 1.1%. Despite this positive trend, its debt-to-equity ratio has climbed from 3.2% to 9.2% over five years, indicating rising leverage concerns. The company's price-to-earnings ratio stands at an attractive 27x compared to the broader CN market's 36.9x, suggesting potential value for investors exploring this sector. Recent earnings reveal sales of CNY 4.26 billion but a dip in net income to CNY 189.62 million from last year's CNY 274.16 million highlights profitability challenges amidst growth efforts.

Xiamen Voke Mold & Plastic Engineering (SZSE:301196)

Simply Wall St Value Rating: ★★★★★★

Overview: Xiamen Voke Mold & Plastic Engineering Co., Ltd. specializes in the production and sales of high-precision molds, injection products, and health products, with a market cap of CN¥4.60 billion.

Operations: Voke Mold & Plastic Engineering generates revenue primarily from the production and sales of high-precision molds, injection products, and health products, totaling CN¥1.76 billion.

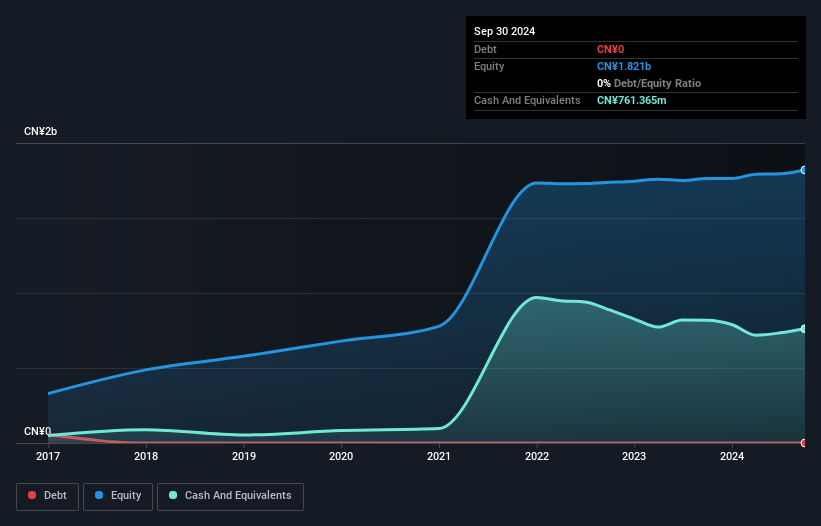

Xiamen Voke Mold & Plastic Engineering, a smaller player in the machinery sector, has shown impressive earnings growth of 50.8% over the past year, outpacing its industry peers. The company's debt-to-equity ratio improved from 2.7% to 1.7% over five years, indicating prudent financial management. A significant one-off gain of CN¥63.7 million impacted recent results, while their price-to-earnings ratio stands attractively at 19.5x compared to the CN market's 36.9x average. Recent buybacks saw them repurchase shares worth CN¥43.34 million, reflecting confidence in their valuation and future prospects despite free cash flow challenges.

MH Robot & Automation (SZSE:301199)

Simply Wall St Value Rating: ★★★★★★

Overview: MH Robot & Automation Co., Ltd. specializes in providing intelligent equipment systems, Internet of Things solutions, planning and design, as well as EPC services both in China and internationally, with a market cap of CN¥4.06 billion.

Operations: MH Robot & Automation generates revenue through intelligent equipment systems, IoT solutions, and EPC services. The company's market cap stands at CN¥4.06 billion.

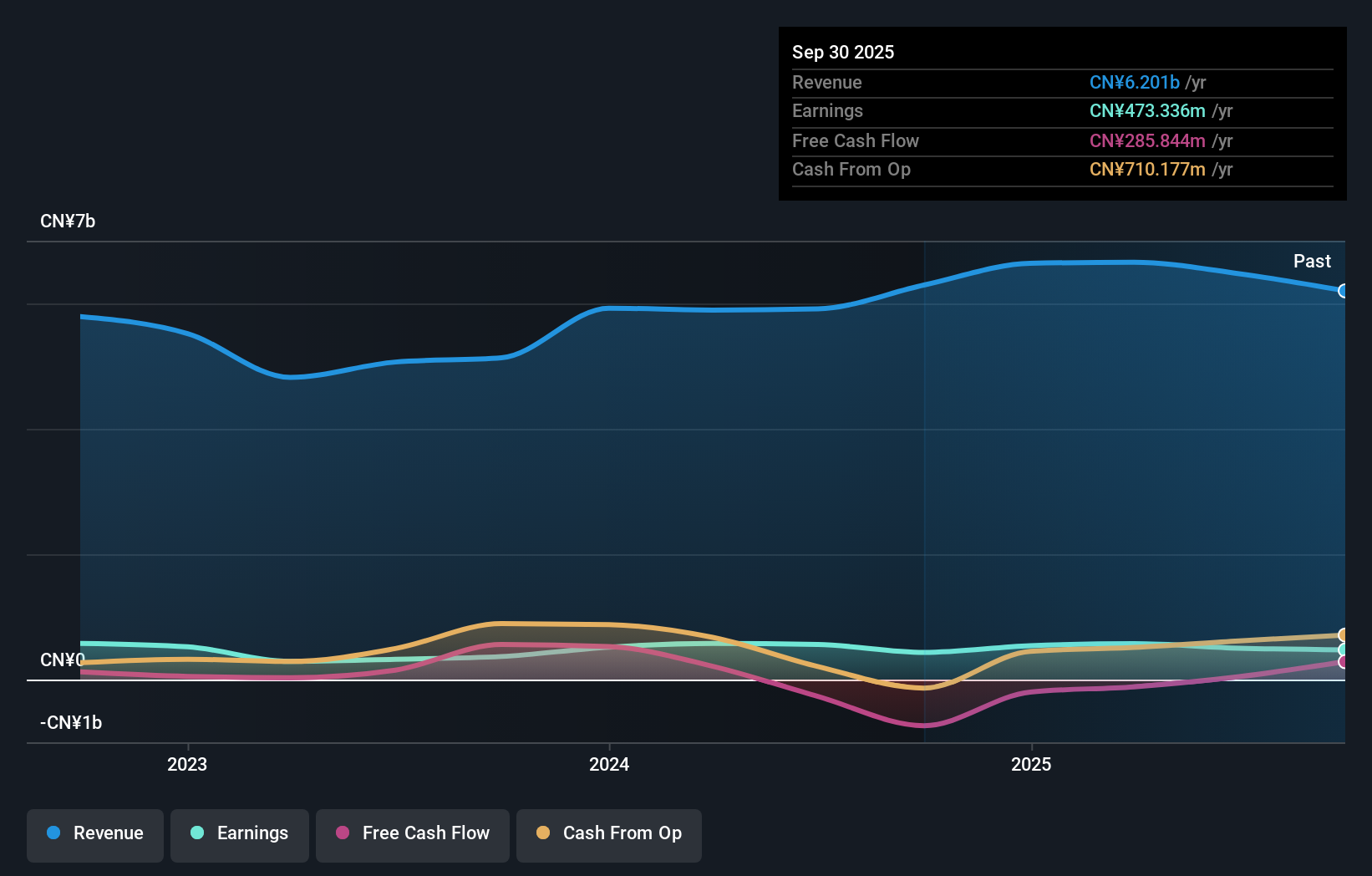

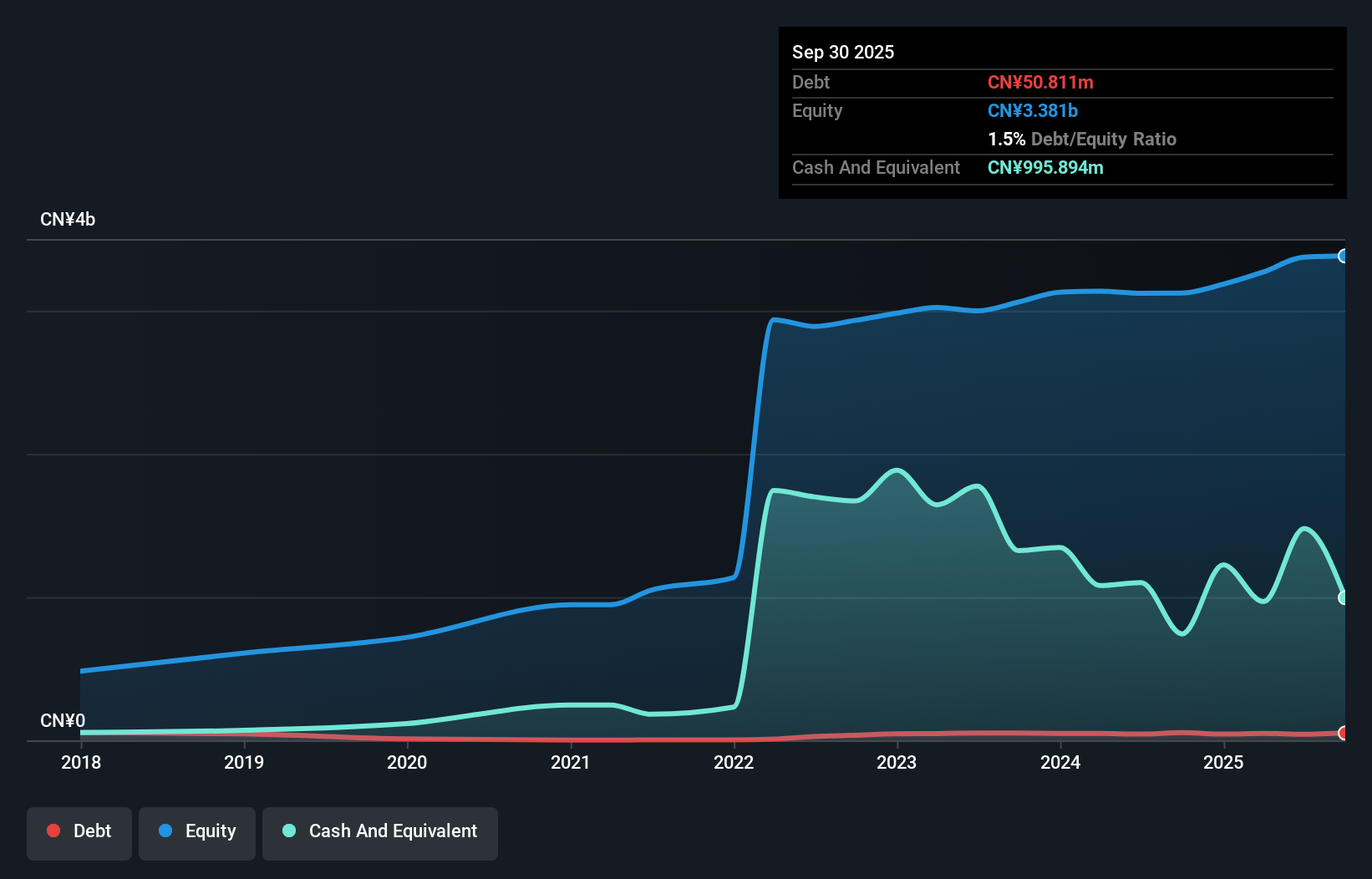

MH Robot & Automation, a nimble player in the automation sector, has shown impressive earnings growth of 96% over the past year, outpacing the broader machinery industry. With no debt on its books for five years and trading at 17.7% below estimated fair value, it positions itself as an attractive investment opportunity. Recent financials reveal a notable rise in net income to CNY 67 million from CNY 26.71 million year-over-year, reflecting robust operational performance. Despite historical declines in earnings over five years by 22.9%, current profitability and high-quality earnings suggest potential for future stability and growth within its niche market space.

- Delve into the full analysis health report here for a deeper understanding of MH Robot & Automation.

Assess MH Robot & Automation's past performance with our detailed historical performance reports.

Taking Advantage

- Navigate through the entire inventory of 4645 Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301199

MH Robot & Automation

Provides intelligent equipment systems, Internet of Things system, planning and design, and EPC services in China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives