Be Wary Of Zhejiang TaitanLtd (SZSE:003036) And Its Returns On Capital

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. However, after investigating Zhejiang TaitanLtd (SZSE:003036), we don't think it's current trends fit the mold of a multi-bagger.

Return On Capital Employed (ROCE): What Is It?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Zhejiang TaitanLtd:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.082 = CN¥127m ÷ (CN¥2.9b - CN¥1.3b) (Based on the trailing twelve months to September 2023).

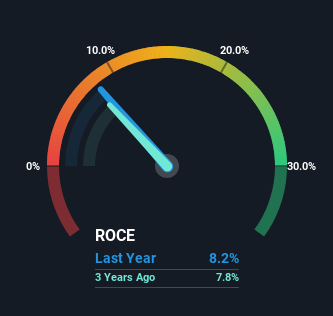

Thus, Zhejiang TaitanLtd has an ROCE of 8.2%. On its own that's a low return, but compared to the average of 6.1% generated by the Machinery industry, it's much better.

View our latest analysis for Zhejiang TaitanLtd

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Zhejiang TaitanLtd's past further, check out this free graph covering Zhejiang TaitanLtd's past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

On the surface, the trend of ROCE at Zhejiang TaitanLtd doesn't inspire confidence. Around five years ago the returns on capital were 11%, but since then they've fallen to 8.2%. Given the business is employing more capital while revenue has slipped, this is a bit concerning. This could mean that the business is losing its competitive advantage or market share, because while more money is being put into ventures, it's actually producing a lower return - "less bang for their buck" per se.

Another thing to note, Zhejiang TaitanLtd has a high ratio of current liabilities to total assets of 46%. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

What We Can Learn From Zhejiang TaitanLtd's ROCE

We're a bit apprehensive about Zhejiang TaitanLtd because despite more capital being deployed in the business, returns on that capital and sales have both fallen. It should come as no surprise then that the stock has fallen 57% over the last three years, so it looks like investors are recognizing these changes. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

If you'd like to know about the risks facing Zhejiang TaitanLtd, we've discovered 1 warning sign that you should be aware of.

While Zhejiang TaitanLtd may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang TaitanLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:003036

Zhejiang TaitanLtd

Engages in the research and development, manufacture, sale, and service of textile machinery in China and internationally.

Adequate balance sheet slight.

Market Insights

Community Narratives