- China

- /

- Commercial Services

- /

- SZSE:300779

3 Global Growth Companies With Up To 31% Insider Ownership

Reviewed by Simply Wall St

As global markets navigate through a period of mixed economic signals and geopolitical tensions, investors are closely watching the Federal Reserve's interest rate decisions and their potential impact on growth forecasts. In this uncertain environment, companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 59.9% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 24.3% |

| Pharma Mar (BME:PHM) | 11.8% | 44.9% |

| Laopu Gold (SEHK:6181) | 35.5% | 40.1% |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

Underneath we present a selection of stocks filtered out by our screen.

Shanghai Allist Pharmaceuticals (SHSE:688578)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Allist Pharmaceuticals Co., Ltd. (SHSE:688578) operates in the pharmaceutical industry, focusing on the development and production of innovative drugs, with a market cap of CN¥42.09 billion.

Operations: The company generates its revenue primarily from the research and development of drugs, amounting to CN¥3.91 billion.

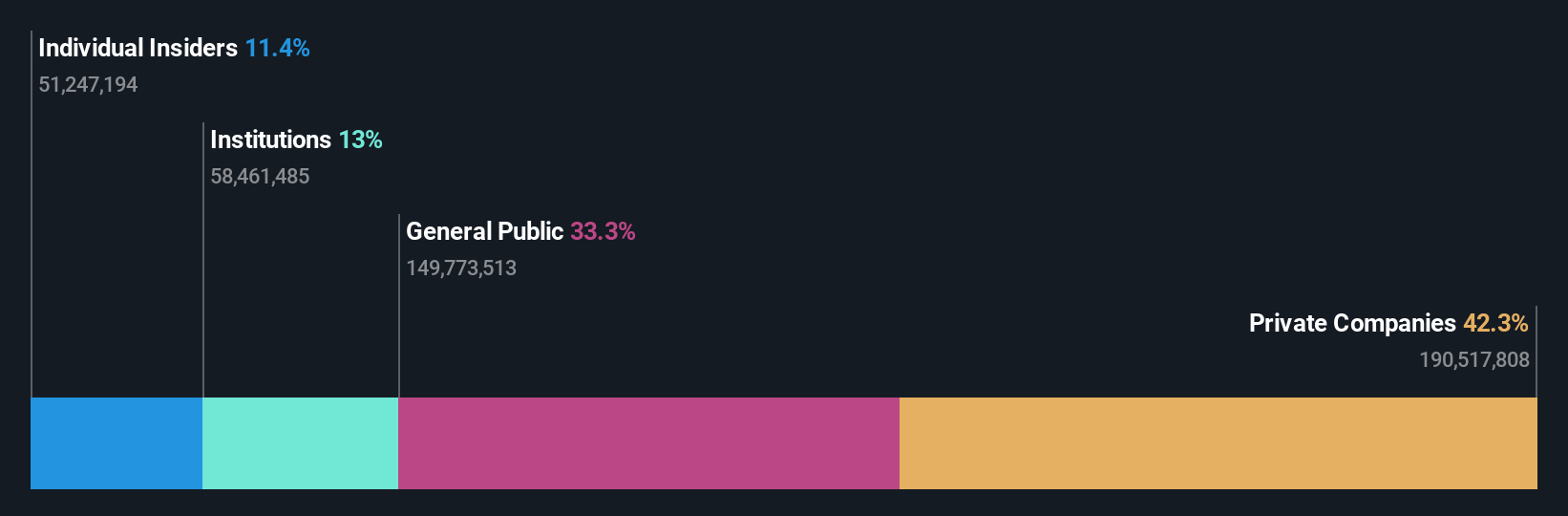

Insider Ownership: 11.4%

Shanghai Allist Pharmaceuticals demonstrates strong growth potential with substantial insider ownership. The company's recent earnings report shows a significant revenue increase to CNY 1.10 billion, up from CNY 742.84 million the previous year, and net income rising to CNY 410.5 million. Although forecasted annual profit growth of 18.8% is below the market average, revenue is expected to grow faster than the CN market at 20.1%. The stock trades at a good value compared to peers and industry estimates.

- Get an in-depth perspective on Shanghai Allist Pharmaceuticals' performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Shanghai Allist Pharmaceuticals' shares may be trading at a discount.

Shenzhen Zhaowei Machinery & Electronics (SZSE:003021)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Zhaowei Machinery & Electronics Co., Ltd. operates in the machinery and electronics sector, with a market capitalization of approximately CN¥23.57 billion.

Operations: Shenzhen Zhaowei Machinery & Electronics Co., Ltd. generates its revenue primarily through its operations in the machinery and electronics sector.

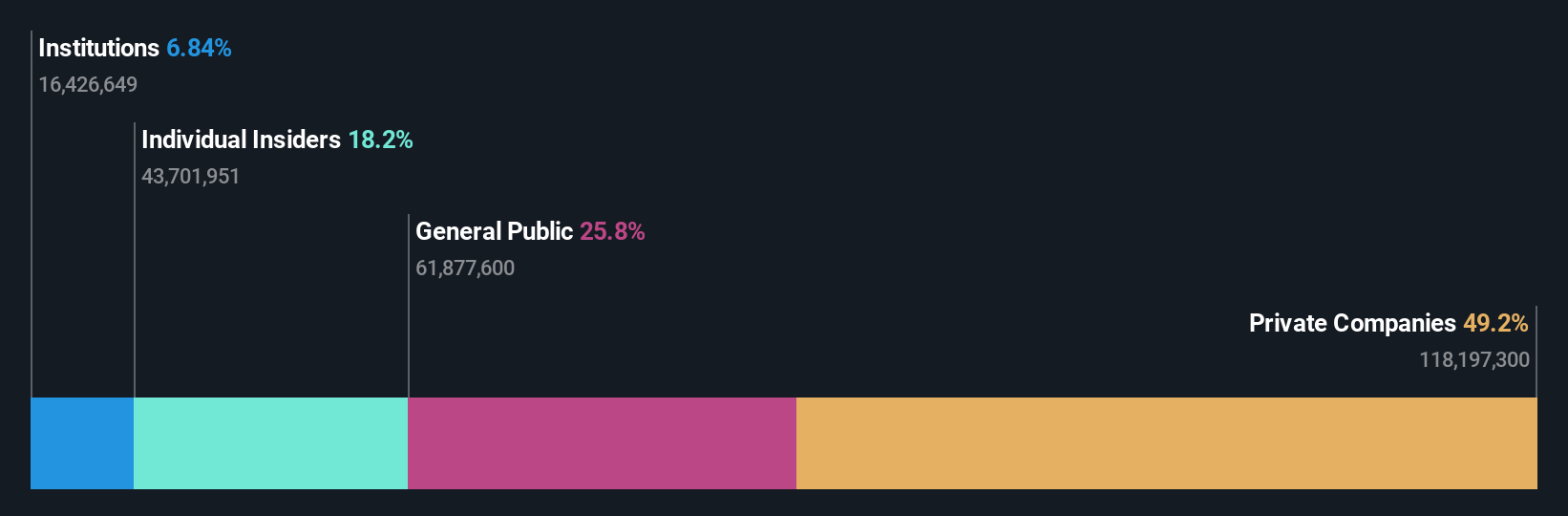

Insider Ownership: 18.2%

Shenzhen Zhaowei Machinery & Electronics shows promising growth prospects with significant insider ownership. Recent inclusion in major stock indices highlights its growing market presence. The company reported a revenue increase to CNY 1.52 billion and net income of CNY 225.09 million for 2024, reflecting solid financial performance. Despite a dividend decrease, earnings are expected to grow significantly at over 23% annually, outpacing the Chinese market's average growth rate while maintaining low forecasted return on equity at 9.5%.

- Navigate through the intricacies of Shenzhen Zhaowei Machinery & Electronics with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Shenzhen Zhaowei Machinery & Electronics is trading beyond its estimated value.

Qingdao Huicheng Environmental Technology Group (SZSE:300779)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Qingdao Huicheng Environmental Technology Group Co., Ltd. (SZSE:300779) operates in the environmental technology sector with a market cap of CN¥33.10 billion.

Operations: Qingdao Huicheng Environmental Technology Group generates its revenue through various segments, although specific segment details are not provided in the available text.

Insider Ownership: 31.8%

Qingdao Huicheng Environmental Technology Group demonstrates strong growth potential with high insider ownership. The company's revenue is expected to grow significantly at 42.4% annually, surpassing the Chinese market's average. Despite a recent net loss of CNY 8.3 million in Q1 2025 and decreased profit margins, the firm was added to the Shenzhen Stock Exchange Component Index, enhancing its market visibility. Earnings are forecasted to grow substantially at over 92% per year.

- Delve into the full analysis future growth report here for a deeper understanding of Qingdao Huicheng Environmental Technology Group.

- Our comprehensive valuation report raises the possibility that Qingdao Huicheng Environmental Technology Group is priced higher than what may be justified by its financials.

Taking Advantage

- Get an in-depth perspective on all 817 Fast Growing Global Companies With High Insider Ownership by using our screener here.

- Searching for a Fresh Perspective? The end of cancer? These 24 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Qingdao Huicheng Environmental Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300779

Qingdao Huicheng Environmental Technology Group

Qingdao Huicheng Environmental Technology Group Co., Ltd.

High growth potential slight.

Similar Companies

Market Insights

Community Narratives