- China

- /

- Construction

- /

- SZSE:003013

Discovering Jiangsu Cai Qin Technology And 2 More Hidden Small Cap Treasures With Solid Foundations

Reviewed by Simply Wall St

As global markets navigate through a landscape of rising inflation and volatile treasury yields, small-cap stocks have been trailing behind their larger counterparts, with the Russell 2000 Index underperforming the S&P 500. Amidst these dynamics, identifying stocks with solid foundations becomes crucial for investors seeking stability and potential growth in less crowded corners of the market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.73% | 7.10% | 12.89% | ★★★★★★ |

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Li Ming Development Construction | 236.64% | 31.54% | 34.00% | ★★★★☆☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Jiangsu Cai Qin Technology (SHSE:688182)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Cai Qin Technology Co., Ltd specializes in the research, development, production, and sale of microwave dielectric ceramic components both domestically and internationally, with a market capitalization of CN¥7.46 billion.

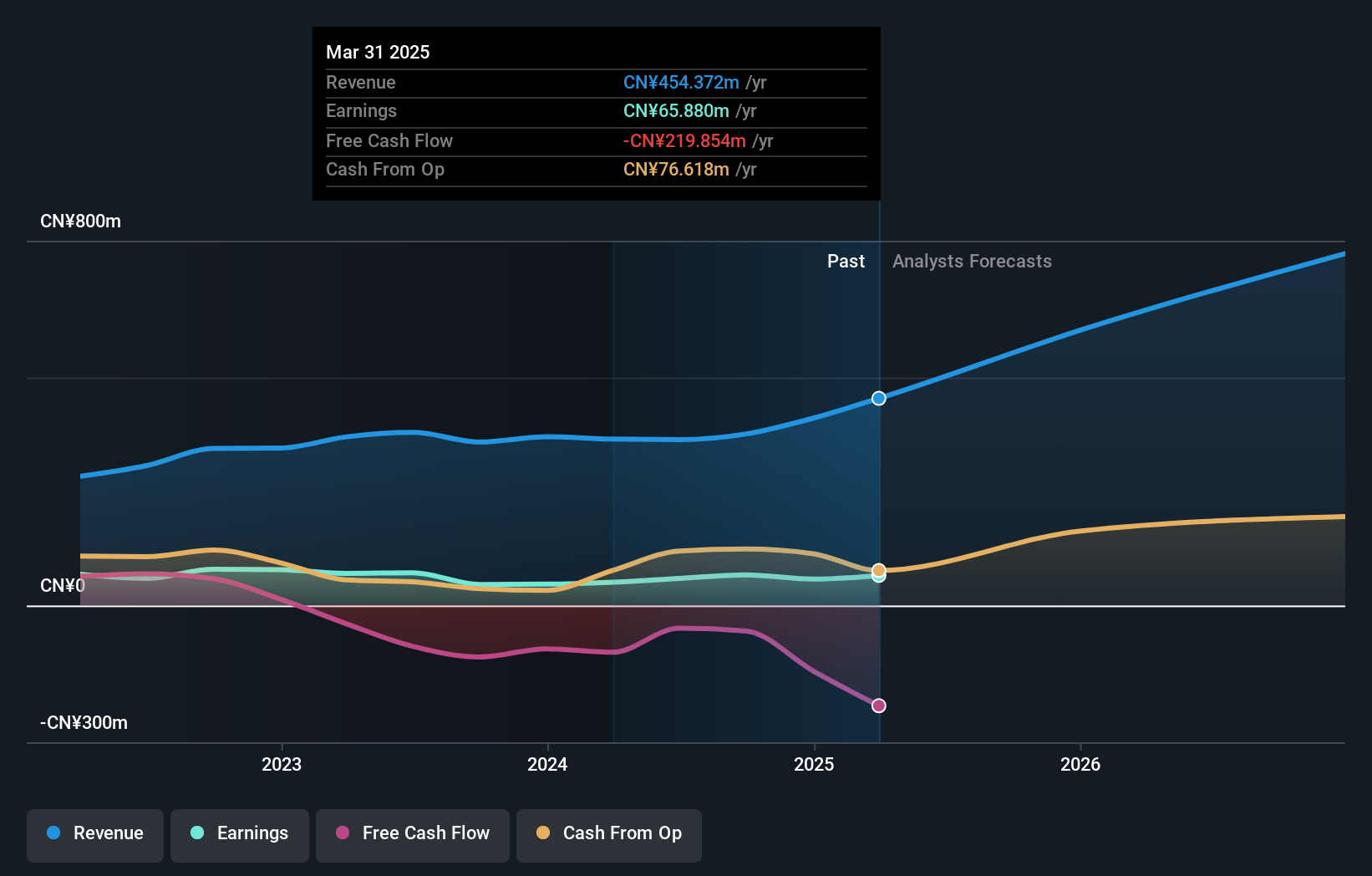

Operations: Cai Qin Technology generates revenue primarily from its communication equipment manufacturing segment, which reported CN¥376.27 million. The company's financial performance is characterized by a focus on this core revenue stream.

Jiangsu Cai Qin Technology stands out with its high-quality earnings and a debt-free status, painting a promising picture. Over the past year, earnings surged by 45.1%, surpassing the Electronic industry's growth of 1.9%. Despite this recent uptick, it's important to note that earnings have decreased by 67.8% annually over the last five years. The company is forecasted to see revenue grow at an impressive rate of 34.15% per year, suggesting potential for future expansion within its sector. A special shareholders meeting scheduled for December highlights ongoing corporate governance activities in Zhangjiagang, Jiangsu China.

Guangzhou Metro Design & Research Institute (SZSE:003013)

Simply Wall St Value Rating: ★★★★★☆

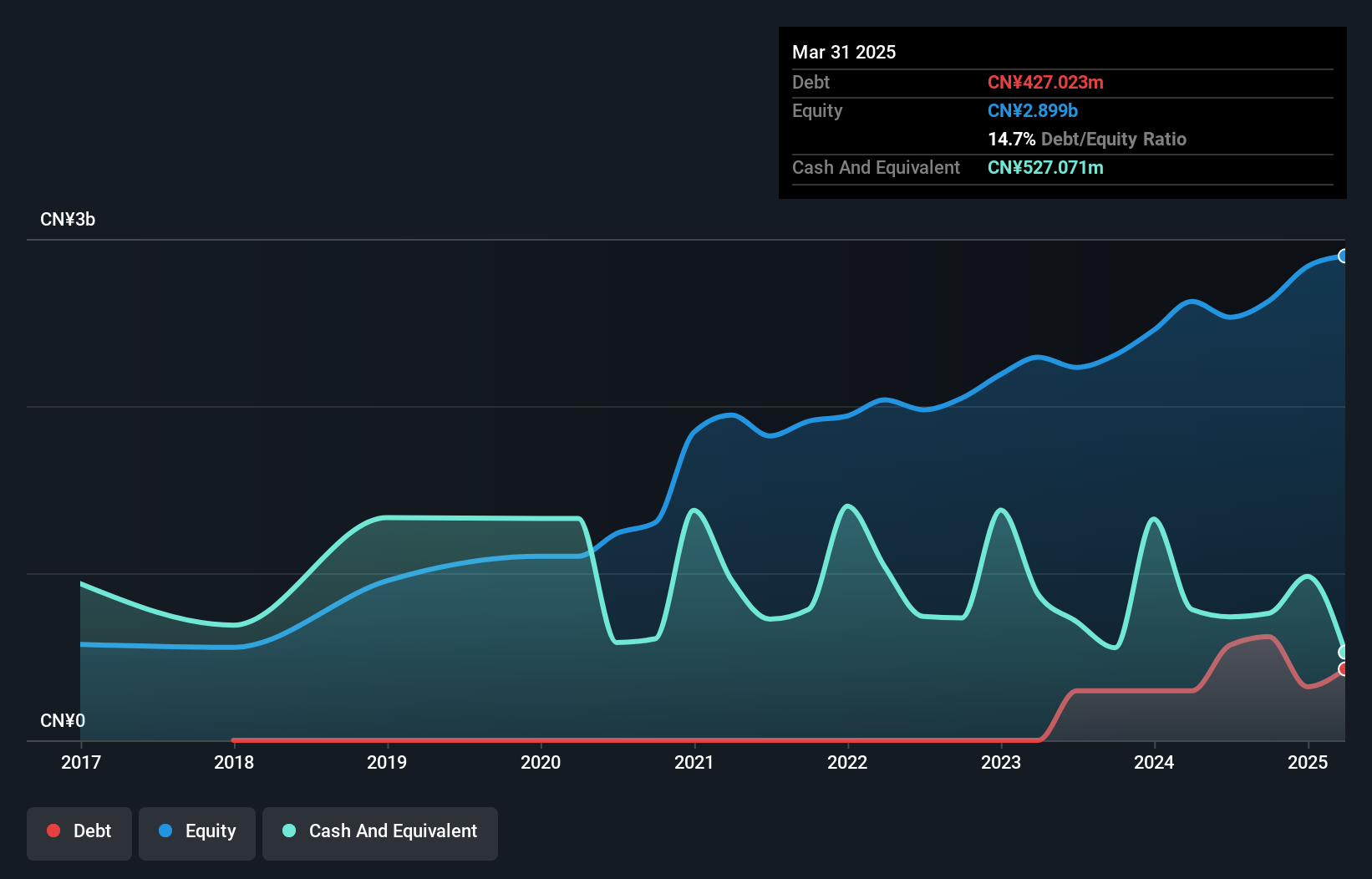

Overview: Guangzhou Metro Design & Research Institute Co., Ltd. specializes in providing engineering services with a market capitalization of CN¥5.72 billion.

Operations: The primary revenue stream for Guangzhou Metro Design & Research Institute comes from engineering services, generating CN¥2.63 billion.

Guangzhou Metro Design & Research Institute, a promising player in the construction sector, has shown resilience with its earnings growth of 3.4% over the past year, outpacing the industry average of -3.9%. The company is trading at a favorable price-to-earnings ratio of 14.2x compared to the broader CN market's 37.4x, suggesting it may be undervalued relative to peers. With high-quality earnings and more cash than total debt, financial stability seems assured. Recent private placements indicate strategic moves for expansion or investment opportunities, hinting at potential future growth as they aim for a forecasted annual earnings increase of 13.69%.

Tigerair Taiwan (TWSE:6757)

Simply Wall St Value Rating: ★★★★★★

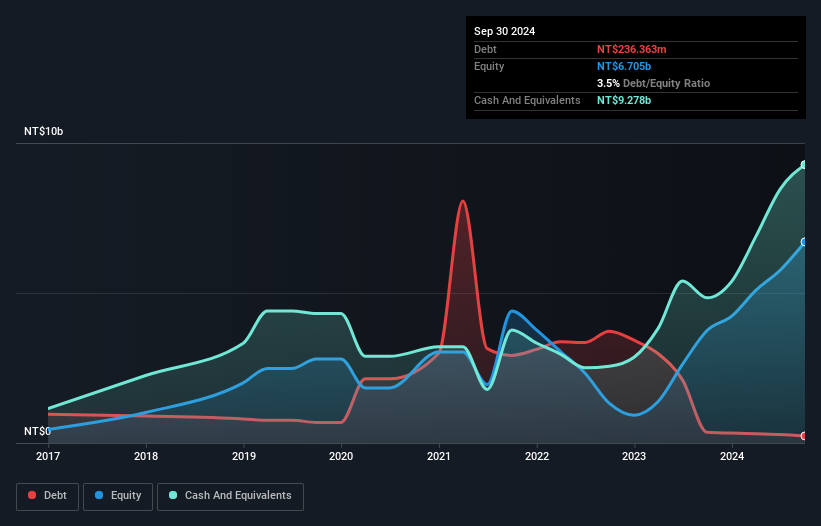

Overview: Tigerair Taiwan Co., Ltd. operates as an airline service provider in Taiwan with a market capitalization of NT$39.38 billion.

Operations: The company generates revenue primarily from passenger and cargo air transportation services, totaling NT$16.06 billion.

Tigerair Taiwan seems to be navigating its growth phase with notable strides. Over the last year, earnings surged by 210%, outpacing the broader airline industry's 56% growth. The company's debt-to-equity ratio has impressively decreased from 24.5% to a mere 3.5% over five years, indicating prudent financial management. Additionally, Tigerair's recent follow-on equity offering raised TWD 581 million, potentially bolstering its capital structure further. Despite a volatile share price in recent months, it trades at nearly 59% below estimated fair value and boasts high-quality earnings with interest payments well covered by EBIT at a substantial multiple of 173 times.

Where To Now?

- Click here to access our complete index of 4712 Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:003013

Guangzhou Metro Design & Research Institute

Guangzhou Metro Design & Research Institute Co., Ltd.

Adequate balance sheet and fair value.

Market Insights

Community Narratives