- China

- /

- Aerospace & Defense

- /

- SZSE:002985

What Does The Future Hold For Beijing Beimo High-tech Frictional Material Co.,Ltd (SZSE:002985)? These Analysts Have Been Cutting Their Estimates

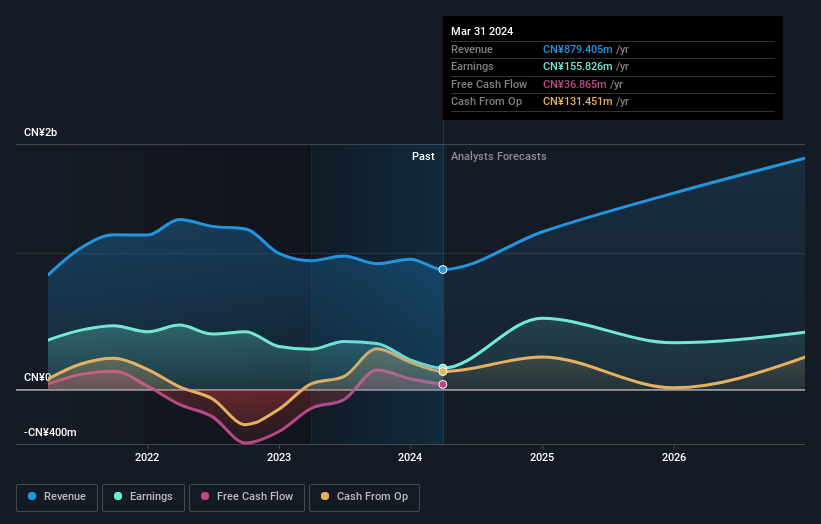

The analysts covering Beijing Beimo High-tech Frictional Material Co.,Ltd (SZSE:002985) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Revenue estimates were cut sharply as the analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

Following the downgrade, the current consensus from Beijing Beimo High-tech Frictional MaterialLtd's three analysts is for revenues of CN¥1.2b in 2024 which - if met - would reflect a major 31% increase on its sales over the past 12 months. Statutory earnings per share are presumed to shoot up 234% to CN¥1.57. Prior to this update, the analysts had been forecasting revenues of CN¥1.3b and earnings per share (EPS) of CN¥1.66 in 2024. Indeed, we can see that analyst sentiment has declined measurably after the new consensus came out, with a substantial drop in revenue estimates and a small dip in EPS estimates to boot.

See our latest analysis for Beijing Beimo High-tech Frictional MaterialLtd

It'll come as no surprise then, to learn that the analysts have cut their price target 19% to CN¥25.23.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The analysts are definitely expecting Beijing Beimo High-tech Frictional MaterialLtd's growth to accelerate, with the forecast 31% annualised growth to the end of 2024 ranking favourably alongside historical growth of 17% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 21% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Beijing Beimo High-tech Frictional MaterialLtd to grow faster than the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Beijing Beimo High-tech Frictional MaterialLtd. While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. Furthermore, there was a cut to the price target, suggesting that the latest news has led to more pessimism about the intrinsic value of the business. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Beijing Beimo High-tech Frictional MaterialLtd after today.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Beijing Beimo High-tech Frictional MaterialLtd going out to 2026, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Beimo High-tech Frictional MaterialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002985

Beijing Beimo High-tech Frictional MaterialLtd

Engages in the research and development, production, and sale of brake products for military aircraft and ground equipment.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026