- China

- /

- Aerospace & Defense

- /

- SZSE:002985

Beijing Beimo High-tech Frictional Material Co.,Ltd's (SZSE:002985) P/S Is Still On The Mark Following 35% Share Price Bounce

Beijing Beimo High-tech Frictional Material Co.,Ltd (SZSE:002985) shareholders would be excited to see that the share price has had a great month, posting a 35% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 36% in the last twelve months.

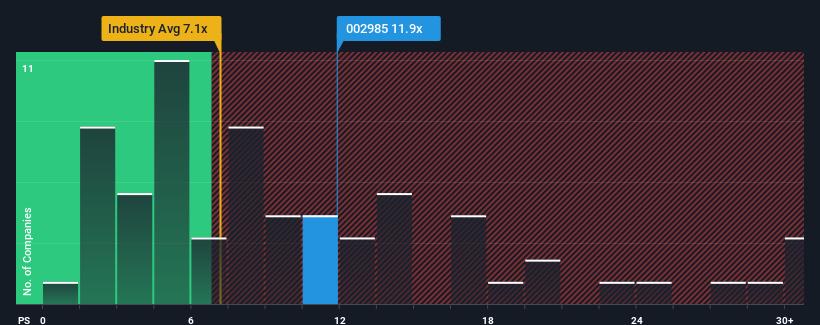

Following the firm bounce in price, given around half the companies in China's Aerospace & Defense industry have price-to-sales ratios (or "P/S") below 7.1x, you may consider Beijing Beimo High-tech Frictional MaterialLtd as a stock to avoid entirely with its 11.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Beijing Beimo High-tech Frictional MaterialLtd

How Has Beijing Beimo High-tech Frictional MaterialLtd Performed Recently?

Beijing Beimo High-tech Frictional MaterialLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beijing Beimo High-tech Frictional MaterialLtd.Is There Enough Revenue Growth Forecasted For Beijing Beimo High-tech Frictional MaterialLtd?

Beijing Beimo High-tech Frictional MaterialLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 31%. This means it has also seen a slide in revenue over the longer-term as revenue is down 35% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 92% during the coming year according to the three analysts following the company. That's shaping up to be materially higher than the 39% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Beijing Beimo High-tech Frictional MaterialLtd's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Beijing Beimo High-tech Frictional MaterialLtd's P/S Mean For Investors?

Beijing Beimo High-tech Frictional MaterialLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Beijing Beimo High-tech Frictional MaterialLtd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Aerospace & Defense industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Beijing Beimo High-tech Frictional MaterialLtd you should be aware of, and 1 of them doesn't sit too well with us.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Beimo High-tech Frictional MaterialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002985

Beijing Beimo High-tech Frictional MaterialLtd

Engages in the research and development, production, and sale of brake products for military aircraft and ground equipment.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026