Why Investors Shouldn't Be Surprised By Shenzhen Colibri Technologies Co., Ltd.'s (SZSE:002957) P/E

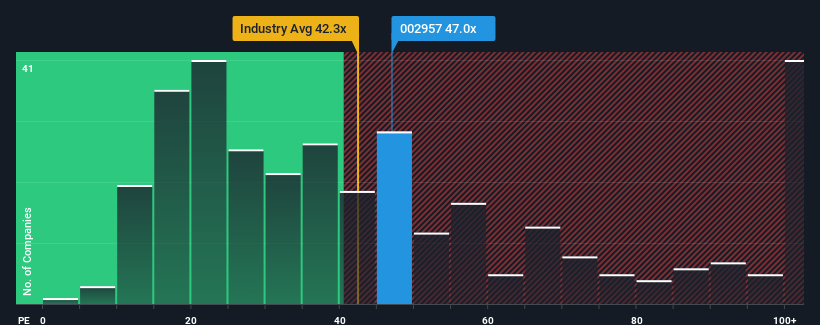

When close to half the companies in China have price-to-earnings ratios (or "P/E's") below 38x, you may consider Shenzhen Colibri Technologies Co., Ltd. (SZSE:002957) as a stock to potentially avoid with its 47x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Shenzhen Colibri Technologies as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for Shenzhen Colibri Technologies

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Shenzhen Colibri Technologies would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 39% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 27% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 84% over the next year. Meanwhile, the rest of the market is forecast to only expand by 37%, which is noticeably less attractive.

With this information, we can see why Shenzhen Colibri Technologies is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Shenzhen Colibri Technologies' P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Shenzhen Colibri Technologies' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for Shenzhen Colibri Technologies that you should be aware of.

Of course, you might also be able to find a better stock than Shenzhen Colibri Technologies. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002957

Shenzhen Colibri Technologies

Engages in the research and development, design, production, sale, and technical service of industrial automation equipment and precision parts in China.

Excellent balance sheet and good value.

Market Insights

Community Narratives