- Taiwan

- /

- Semiconductors

- /

- TWSE:6531

Undiscovered Gems And 2 Other Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and geopolitical uncertainties, small-cap stocks have been trailing behind their larger counterparts, with the Russell 2000 Index lagging the S&P 500 by a notable margin. Despite this challenging environment, opportunities abound for discerning investors who recognize that strong potential often lies in companies with solid fundamentals and innovative strategies.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Guangdong Rifeng Electric Cable (SZSE:002953)

Simply Wall St Value Rating: ★★★★★☆

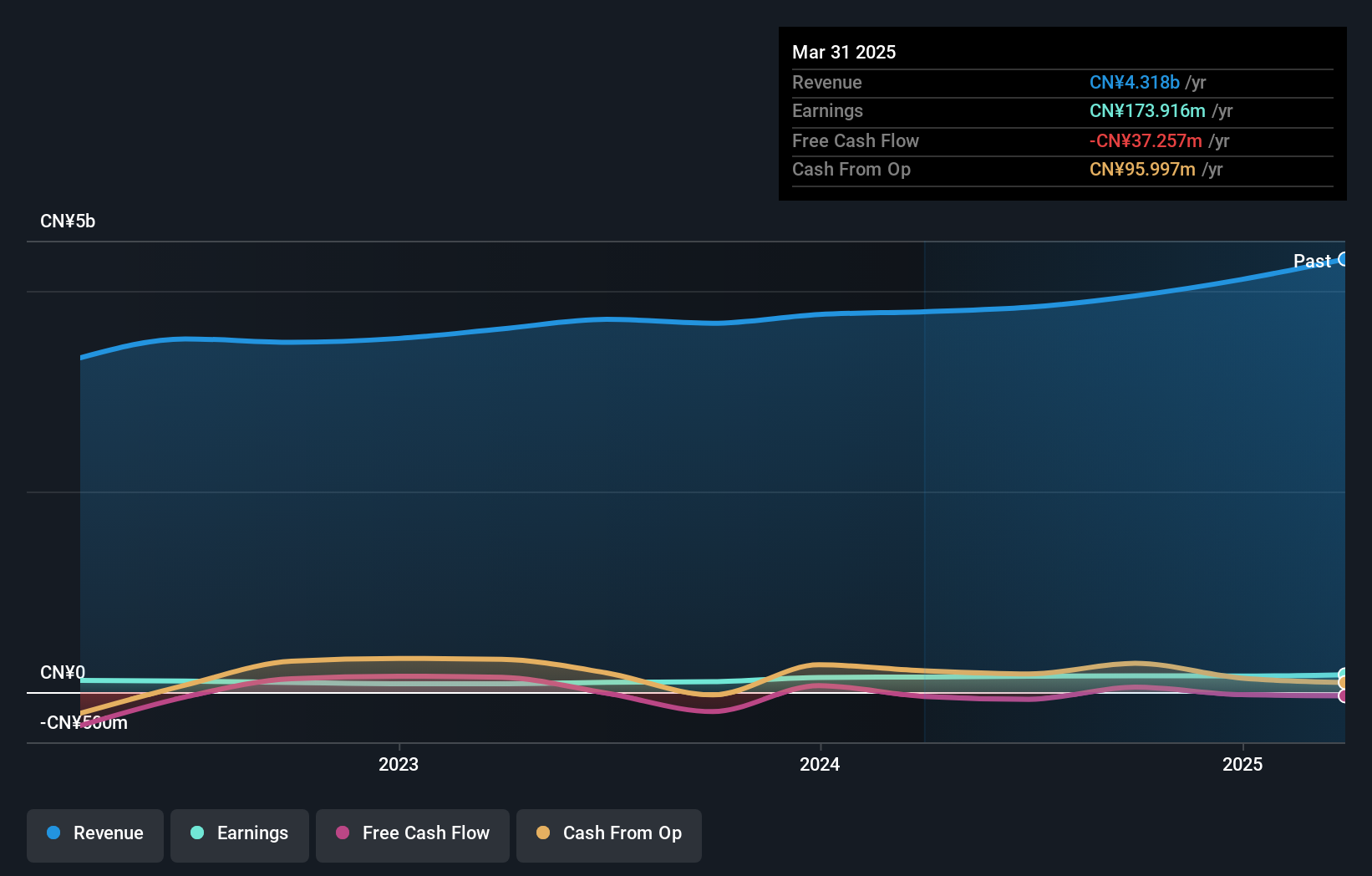

Overview: Guangdong Rifeng Electric Cable Co., Ltd. is a company involved in the manufacturing and distribution of electric cables, with a market capitalization of CN¥5.52 billion.

Operations: Rifeng Electric Cable generates its revenue primarily from wire and cable products, amounting to CN¥3.95 billion.

Rifeng Electric, with its satisfactory net debt to equity ratio of 16.6%, presents a balanced financial profile. Over the past year, earnings surged by 57%, outpacing the broader electrical industry's growth of just 1.1%. The company's price-to-earnings ratio stands at 34x, which is below the CN market average of 36.6x, suggesting potential value for investors. Interest payments are well covered by EBIT at 11.7 times coverage, indicating strong financial health in servicing debt obligations. However, recent share price volatility could be a concern for some investors despite these promising metrics and high-quality earnings performance.

- Take a closer look at Guangdong Rifeng Electric Cable's potential here in our health report.

Understand Guangdong Rifeng Electric Cable's track record by examining our Past report.

Tel-Aviv Stock Exchange (TASE:TASE)

Simply Wall St Value Rating: ★★★★★☆

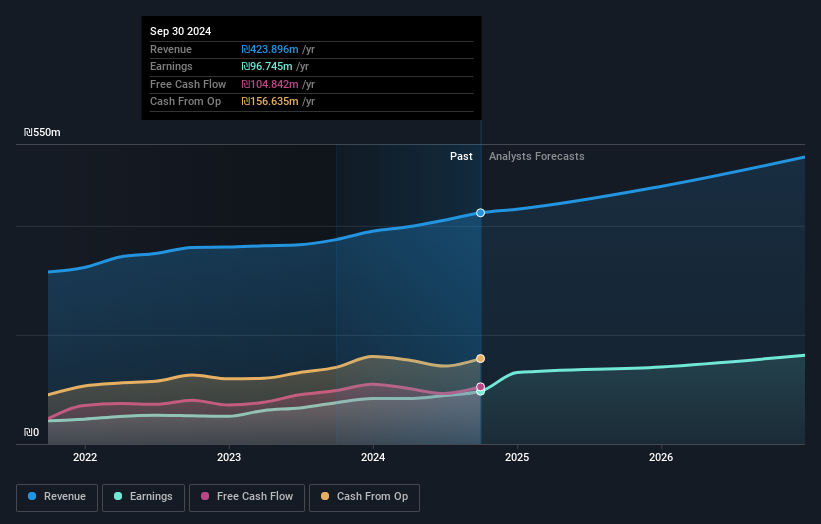

Overview: The Tel-Aviv Stock Exchange Ltd. operates a stock exchange in Israel with a market cap of ₪4.44 billion.

Operations: Revenue primarily derives from services, totaling ₪423.90 million.

TASE, a notable player in its sector, has demonstrated robust earnings growth of 27.8% over the past year, outpacing the industry's 12.8%. With a debt-to-equity ratio climbing to 16.4% over five years, it still holds more cash than total debt, underscoring financial stability. The recent buyback of 4.62 million shares for ILS 202.4 million from Manikay Fund sparked legal challenges alleging minority oppression due to premium pricing above market value (ILS 43.79 vs ILS 43.04). Despite this hiccup, TASE's high-quality earnings and positive free cash flow position it favorably within capital markets dynamics.

- Click here and access our complete health analysis report to understand the dynamics of Tel-Aviv Stock Exchange.

Assess Tel-Aviv Stock Exchange's past performance with our detailed historical performance reports.

AP Memory Technology (TWSE:6531)

Simply Wall St Value Rating: ★★★★★★

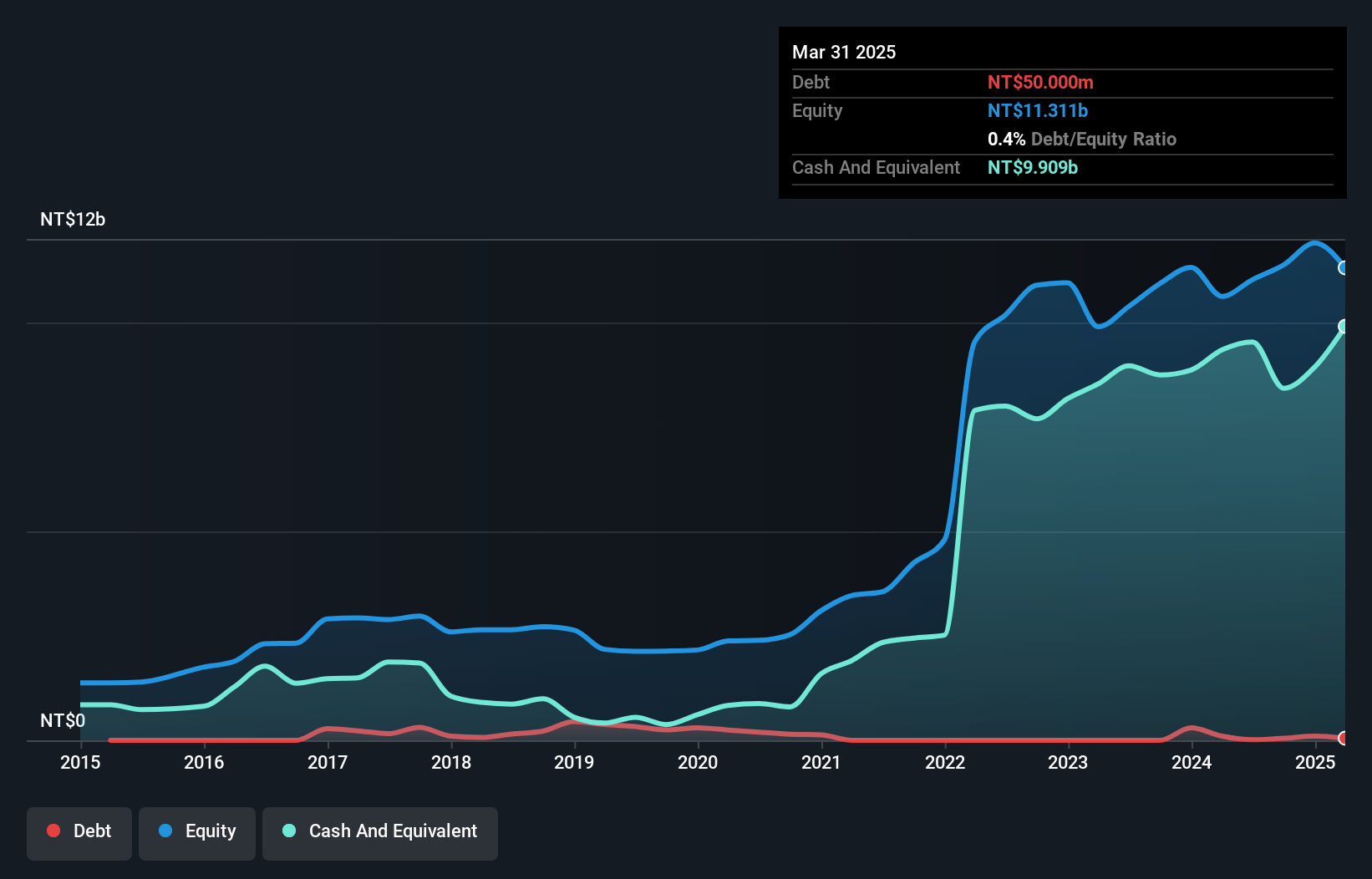

Overview: AP Memory Technology Corporation specializes in the design, development, licensing, manufacturing, and sale of customized memory-related integrated circuit chip products globally with a market cap of NT$52.49 billion.

Operations: AP Memory Technology generates revenue primarily from its AI Division and IoT Division, with the latter contributing NT$3.56 billion.

AP Memory Technology, a nimble player in the semiconductor space, has demonstrated impressive financial agility. Over the past year, earnings surged by 26.9%, outpacing the industry average of 5.9%. The company appears financially sound with more cash than total debt and a reduced debt-to-equity ratio from 11.7% to just 0.4% over five years. A notable NT$435 million one-off gain influenced recent results but hasn't overshadowed its robust free cash flow of NT$1.32 billion as of September 2024. Recent leadership changes could bring fresh strategic directions, potentially enhancing its growth trajectory forecasted at nearly 23.88% annually.

- Get an in-depth perspective on AP Memory Technology's performance by reading our health report here.

Key Takeaways

- Click here to access our complete index of 4725 Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6531

AP Memory Technology

Engages in designing, development, licensing, manufacturing, and selling customized memory-related integrated circuit (IC) chip products and technologies in China, Japan, Taiwan, Europe, the Americas, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives