Stock Analysis

- China

- /

- Semiconductors

- /

- SZSE:300223

Southchip Semiconductor Technology Shanghai Leads Three High Insider Ownership Growth Stocks On Chinese Exchange

Reviewed by Simply Wall St

As recent data highlights a slowdown in China's manufacturing sector, the broader Chinese economy faces challenges that could influence investor strategies. In this context, companies like Southchip Semiconductor Technology Shanghai with high insider ownership might offer a degree of resilience, as significant insider stakes often align leadership interests closely with long-term growth and stability.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

| Ningbo Deye Technology Group (SHSE:605117) | 23.4% | 29.0% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

| UTour Group (SZSE:002707) | 23% | 33.1% |

Let's review some notable picks from our screened stocks.

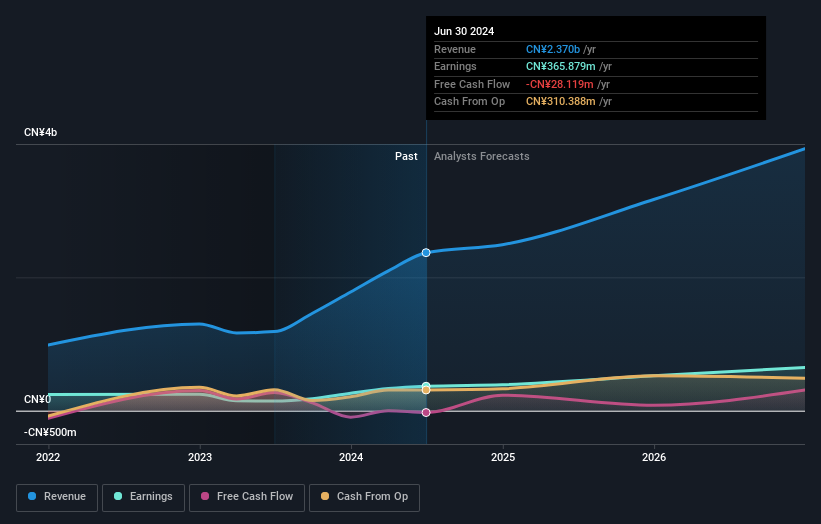

Southchip Semiconductor Technology(Shanghai) (SHSE:688484)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Southchip Semiconductor Technology (Shanghai) Co., Ltd. is a semiconductor design company specializing in power and battery management solutions in China, with a market capitalization of CN¥15.59 billion.

Operations: The company generates its revenue primarily from semiconductors, totaling CN¥2.10 billion.

Insider Ownership: 17.2%

Revenue Growth Forecast: 21.2% p.a.

Southchip Semiconductor Technology(Shanghai) exhibits robust growth potential with earnings and revenue forecasts outpacing the broader Chinese market. The company's earnings grew by 122% last year, and its future annual earnings are expected to rise by 24.9%, while revenue is anticipated to grow at 21.2% per year. Despite a low dividend coverage, the firm maintains a competitive price-to-earnings ratio slightly below industry average. Recent financial results show significant increases in sales and net income, affirming its upward trajectory in performance.

- Click here and access our complete growth analysis report to understand the dynamics of Southchip Semiconductor Technology(Shanghai).

- The valuation report we've compiled suggests that Southchip Semiconductor Technology(Shanghai)'s current price could be inflated.

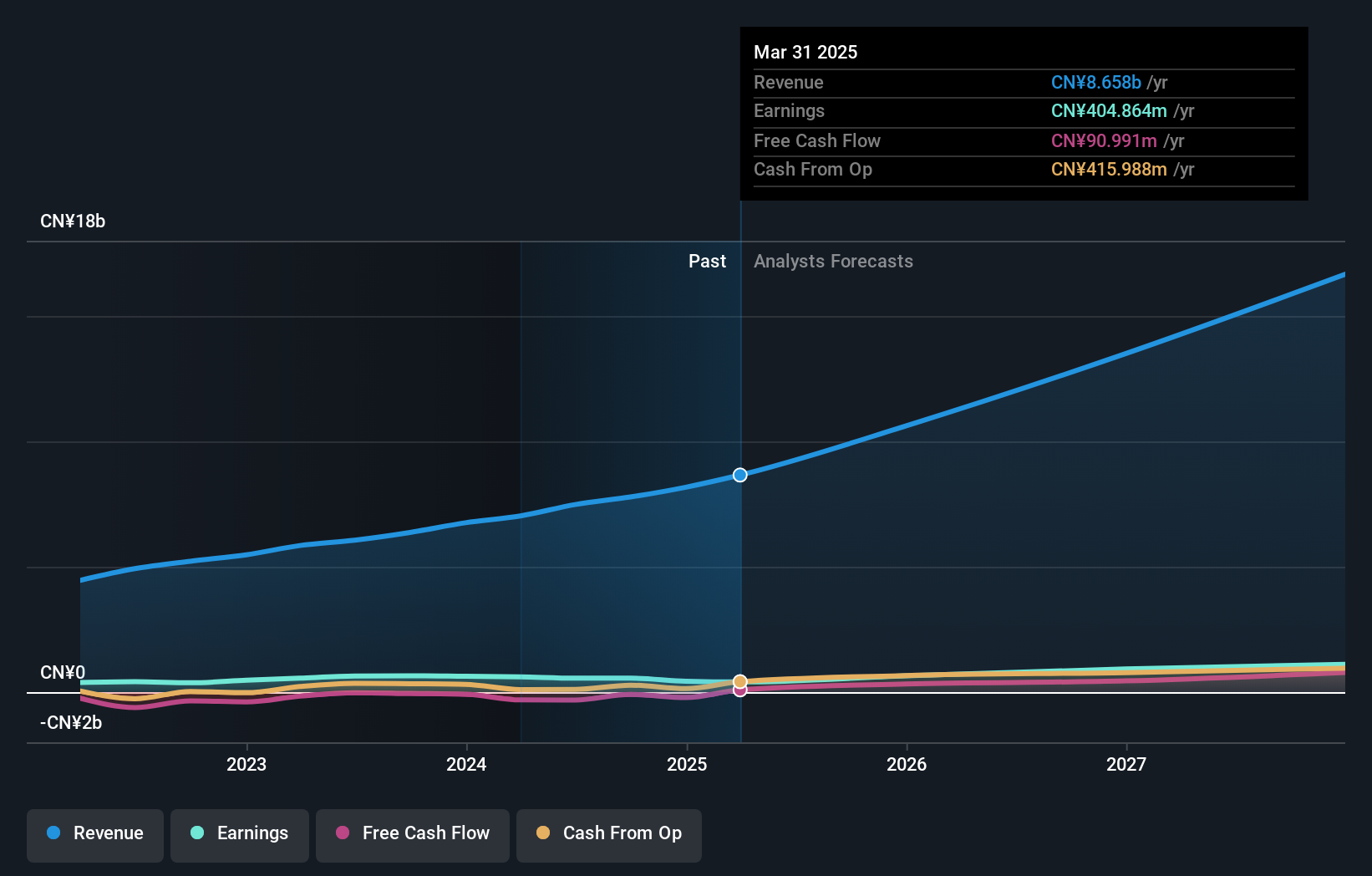

Shenzhen Megmeet Electrical (SZSE:002851)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Megmeet Electrical Co., Ltd specializes in the research, development, production, and sale of hardware, software, and system solutions for electrical automation in China, with a market capitalization of approximately CN¥12.79 billion.

Operations: The company generates its revenue primarily from the development, production, and sale of electrical automation solutions in China.

Insider Ownership: 28.9%

Revenue Growth Forecast: 21.1% p.a.

Shenzhen Megmeet Electrical is poised for substantial growth, with earnings and revenue expected to outpace the broader Chinese market. Forecasts suggest a 24.77% annual increase in earnings and a 21.1% rise in revenue. However, its dividend sustainability is questionable due to poor cash flow coverage, and it maintains a volatile share price. Recent actions include approving a modest dividend increase at their AGM, reflecting confidence despite past financial volatility marked by fluctuating net income figures.

- Get an in-depth perspective on Shenzhen Megmeet Electrical's performance by reading our analyst estimates report here.

- The analysis detailed in our Shenzhen Megmeet Electrical valuation report hints at an deflated share price compared to its estimated value.

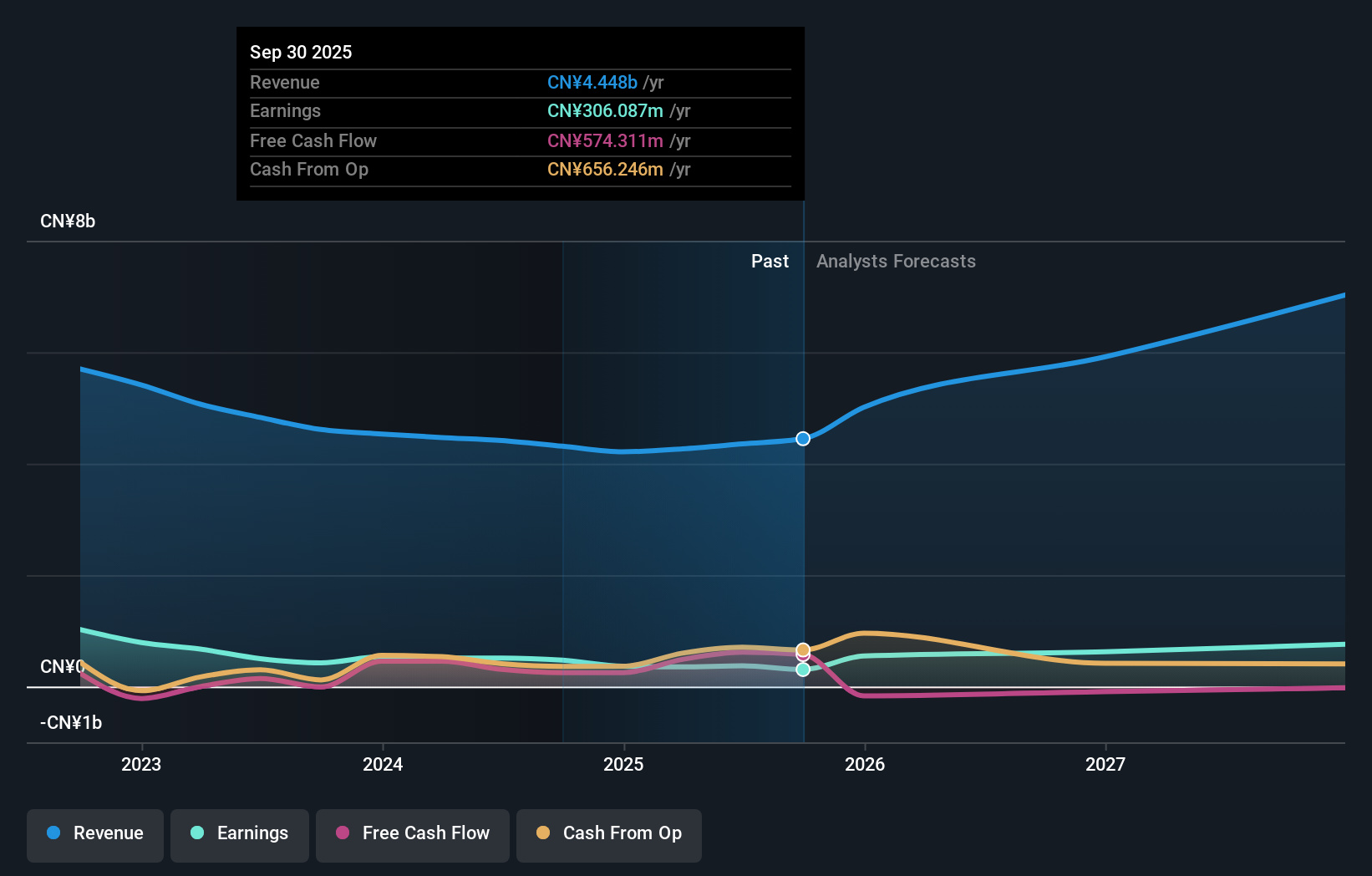

Ingenic SemiconductorLtd (SZSE:300223)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ingenic Semiconductor Co., Ltd. specializes in the research, development, design, and sale of integrated circuit chips both domestically and internationally, with a market capitalization of approximately CN¥26.62 billion.

Operations: The company generates its revenue primarily through the design and sale of integrated circuit chips across domestic and international markets.

Insider Ownership: 16.7%

Revenue Growth Forecast: 19% p.a.

Ingenic Semiconductor Co., Ltd. is navigating a challenging landscape with mixed financial results. While the company's earnings are expected to grow by 28.85% annually, surpassing the Chinese market average, its revenue growth forecast of 19% lags behind the desired 20% threshold yet still outperforms the market norm of 13.6%. Recent corporate activities include dividend distributions and amendments to company bylaws, indicating active governance amidst a backdrop of declining year-over-year profits and revenues in both quarterly and annual comparisons.

- Click to explore a detailed breakdown of our findings in Ingenic SemiconductorLtd's earnings growth report.

- According our valuation report, there's an indication that Ingenic SemiconductorLtd's share price might be on the expensive side.

Seize The Opportunity

- Unlock more gems! Our Fast Growing Chinese Companies With High Insider Ownership screener has unearthed 365 more companies for you to explore.Click here to unveil our expertly curated list of 368 Fast Growing Chinese Companies With High Insider Ownership.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300223

Ingenic SemiconductorLtd

Engages in the research and development, design, and sale of integrated circuit chip products in China and internationally.

Flawless balance sheet with reasonable growth potential.