- China

- /

- Electrical

- /

- SZSE:002823

Subdued Growth No Barrier To Shenzhen Kaizhong Precision Technology Co., Ltd. (SZSE:002823) With Shares Advancing 25%

Shenzhen Kaizhong Precision Technology Co., Ltd. (SZSE:002823) shares have continued their recent momentum with a 25% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 39%.

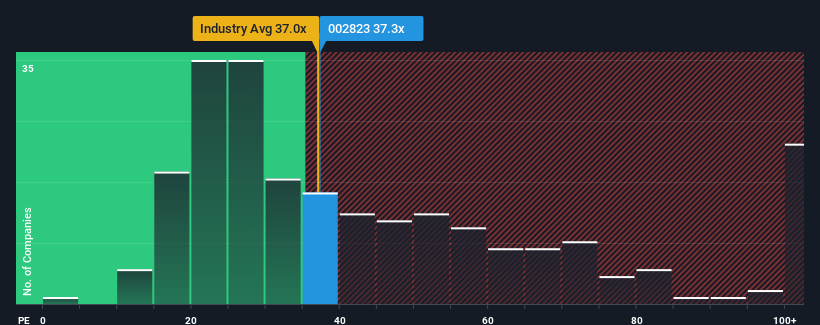

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Shenzhen Kaizhong Precision Technology's P/E ratio of 37.3x, since the median price-to-earnings (or "P/E") ratio in China is also close to 36x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been quite advantageous for Shenzhen Kaizhong Precision Technology as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Shenzhen Kaizhong Precision Technology

Does Growth Match The P/E?

In order to justify its P/E ratio, Shenzhen Kaizhong Precision Technology would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 291% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

This is in contrast to the rest of the market, which is expected to grow by 41% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Shenzhen Kaizhong Precision Technology is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

What We Can Learn From Shenzhen Kaizhong Precision Technology's P/E?

Shenzhen Kaizhong Precision Technology appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Shenzhen Kaizhong Precision Technology currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Shenzhen Kaizhong Precision Technology you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002823

Shenzhen Kaizhong Precision Technology

Shenzhen Kaizhong Precision Technology Co., Ltd.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026