Global markets have experienced fluctuations recently, with U.S. stocks ending the week lower amid tariff uncertainties and mixed economic data, including a cooling labor market and expanding manufacturing activity. Despite these broader market challenges, certain investment opportunities remain attractive. Penny stocks, often representing smaller or newer companies, offer potential growth at lower price points when backed by strong financials. These under-the-radar investments can provide unique opportunities for investors seeking value beyond traditional large-cap equities.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.90 | HK$44.77B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.545 | MYR2.71B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.98 | £480.06M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.932 | £148.53M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| Warpaint London (AIM:W7L) | £3.83 | £309.02M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.27 | £161.95M | ★★★★★☆ |

Click here to see the full list of 5,707 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Vista Land & Lifescapes (PSE:VLL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vista Land & Lifescapes, Inc. is an investment holding company that functions as an integrated property developer and homebuilder in the Philippines, with a market cap of ₱19.55 billion.

Operations: The company generates revenue primarily from its operations in the Philippines, amounting to ₱35.61 billion.

Market Cap: ₱19.55B

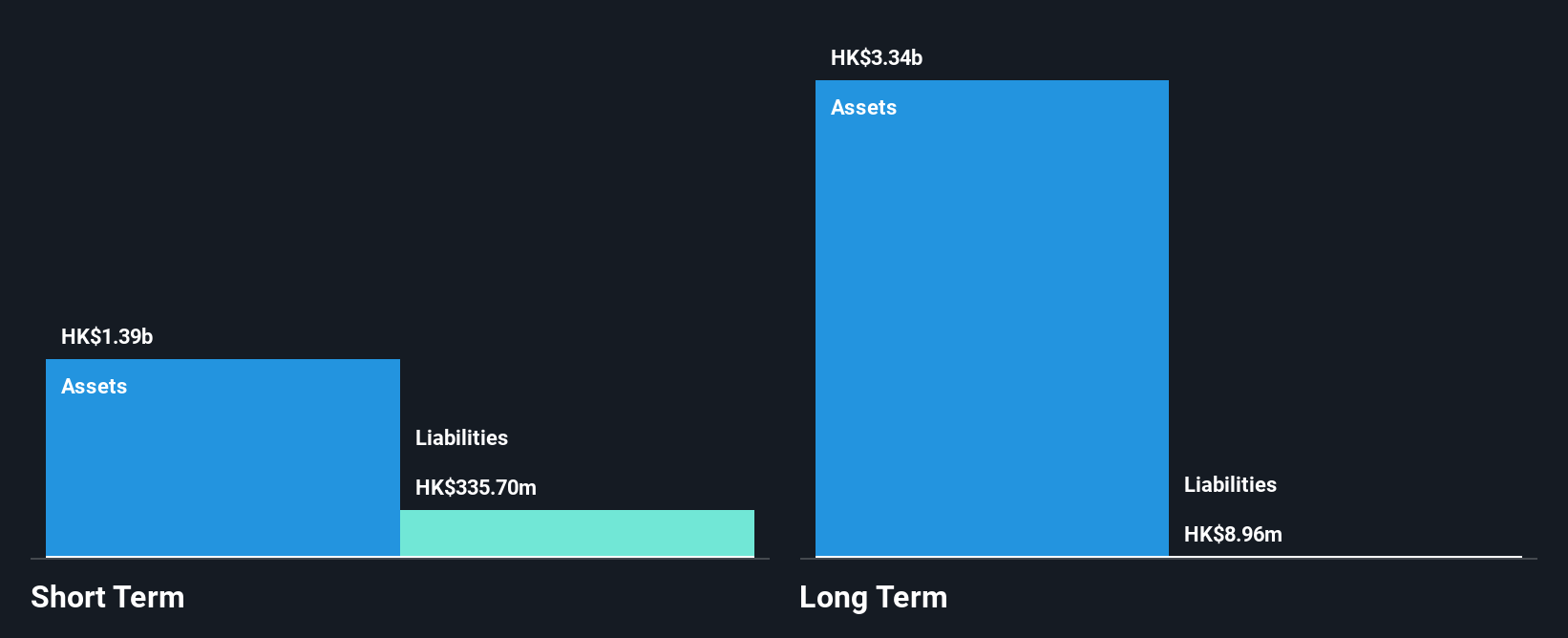

Vista Land & Lifescapes, Inc. operates with a market cap of ₱19.55 billion and generates significant revenue from its Philippine operations, totaling ₱35.61 billion. The company recently declared cash dividends on its preferred shares, indicating a commitment to returning value to shareholders despite challenges such as high net debt to equity ratio (111.1%) and earnings growth that lags behind the industry average. While Vista Land's short-term assets cover both short- and long-term liabilities effectively, its operating cash flow does not adequately cover debt obligations, suggesting potential liquidity concerns amidst otherwise stable weekly volatility in stock performance.

- Click here and access our complete financial health analysis report to understand the dynamics of Vista Land & Lifescapes.

- Explore Vista Land & Lifescapes' analyst forecasts in our growth report.

China Vered Financial Holding (SEHK:245)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Vered Financial Holding Corporation Limited is an investment holding company offering asset management, consultancy, financing, and securities advisory and brokerage services across Hong Kong, Mainland China, Japan, and Canada with a market cap of approximately HK$1.78 billion.

Operations: The company's revenue is primarily derived from investment holding (HK$58.71 million), followed by asset management (HK$16.56 million) and securities brokerage, including investment banking (HK$9.04 million).

Market Cap: HK$1.78B

China Vered Financial Holding Corporation Limited, with a market cap of HK$1.78 billion, has announced a significant turnaround in expected earnings for 2024, projecting a net profit of at least HK$220 million due to substantial investment gains. Despite this positive outlook, the company remains unprofitable over the past five years and has faced increasing losses at an annual rate of 0.9%. The firm is debt-free and maintains sufficient cash runway for over three years but lacks experienced management and board teams. Recent leadership changes aim to strengthen governance as it navigates these challenges.

- Navigate through the intricacies of China Vered Financial Holding with our comprehensive balance sheet health report here.

- Assess China Vered Financial Holding's previous results with our detailed historical performance reports.

D&O Home Collection GroupLTD (SZSE:002798)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: D&O Home Collection Group Co., LTD specializes in the production and sale of sanitary ware and architectural ceramic products in China, with a market cap of CN¥1.43 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥1.43B

D&O Home Collection Group Co., LTD, with a market cap of CN¥1.43 billion, faces challenges as an unprofitable entity with increasing losses over the past five years. Despite this, the company maintains a positive cash flow and has sufficient runway for more than three years. Its short-term assets (CN¥3.1 billion) exceed both short-term and long-term liabilities, indicating some financial stability despite high debt levels. The board and management are experienced, but the company's share price remains highly volatile. Recent buyback activity was minimal, and upcoming shareholder meetings will address credit lines and guarantee quotas for 2025.

- Click to explore a detailed breakdown of our findings in D&O Home Collection GroupLTD's financial health report.

- Examine D&O Home Collection GroupLTD's past performance report to understand how it has performed in prior years.

Key Takeaways

- Get an in-depth perspective on all 5,707 Penny Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002798

DO and Shuihua Group

Produces and sells sanitary ware and architectural ceramic products in China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives