- China

- /

- Consumer Durables

- /

- SZSE:301187

Undiscovered Gems Three Stocks To Watch In February 2025

Reviewed by Simply Wall St

As global markets edge toward record highs, small-cap stocks have been trailing behind their larger counterparts, with the Russell 2000 Index lagging the S&P 500 by 146 basis points. In this environment of rising inflation and volatile interest rates, discovering undervalued opportunities becomes crucial for investors seeking to diversify their portfolios. Identifying a good stock often involves looking for companies that demonstrate resilience and potential growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Vidhi Specialty Food Ingredients | 10.37% | 6.57% | 1.01% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| 3B Blackbio Dx | 0.31% | -9.96% | -9.16% | ★★★★★★ |

| Tai Sin Electric | 28.69% | 9.56% | 4.66% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| KP Green Engineering | 51.37% | 120.79% | 51.32% | ★★★★★☆ |

| Dolat Algotech | 40.17% | 19.73% | 14.84% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Guangdong Ellington Electronics TechnologyLtd (SHSE:603328)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangdong Ellington Electronics Technology Co., Ltd specializes in the research, development, manufacturing, and sale of high-precision, high-density double-layer and multi-layer printed circuit boards in China with a market cap of CN¥10.56 billion.

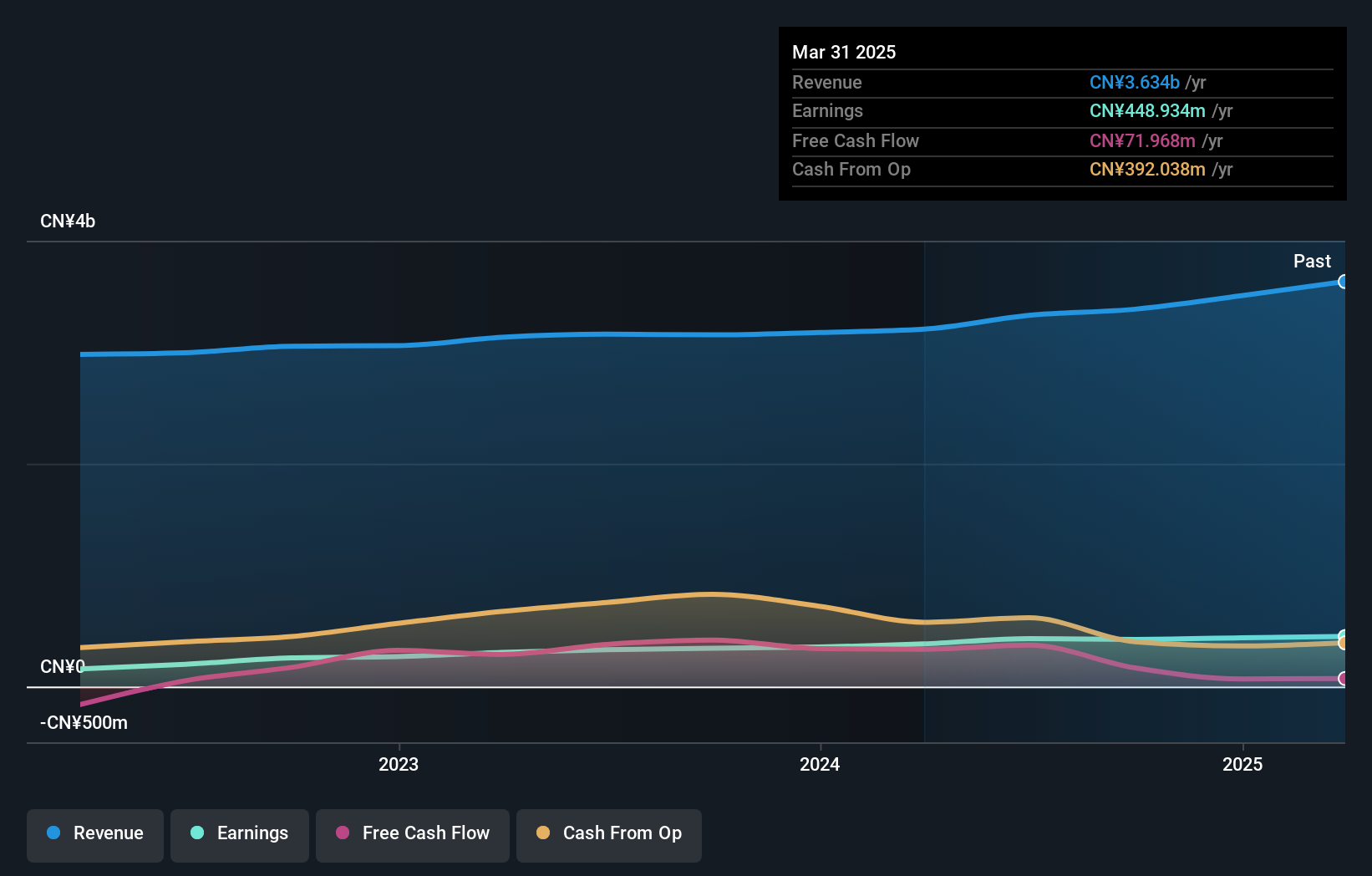

Operations: Ellington Electronics generates revenue primarily from the printed circuit board industry, amounting to CN¥3.51 billion. The company's financial performance is characterized by its focus on high-precision and high-density products within this sector.

Guangdong Ellington, a notable player in the electronics sector, showcases its robust financial health with a price-to-earnings ratio of 25x, notably lower than the China market average of 36.5x. The company reported impressive earnings growth of 25.5% over the past year, far outpacing the electronic industry's average of 1.9%. With net income rising to CNY 445.67 million from CNY 355 million and basic earnings per share increasing to CNY 0.446 from CNY 0.356, it demonstrates strong profitability and efficient debt management as its debt-to-equity ratio remains modest at just over five years despite an increase to 5.3%.

Wuchan Zhongda GeronLtd (SZSE:002722)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuchan Zhongda Geron Co., Ltd. focuses on the research, development, production, and sales of textile combing equipment and stainless steel decorative materials in China, with a market cap of CN¥3.28 billion.

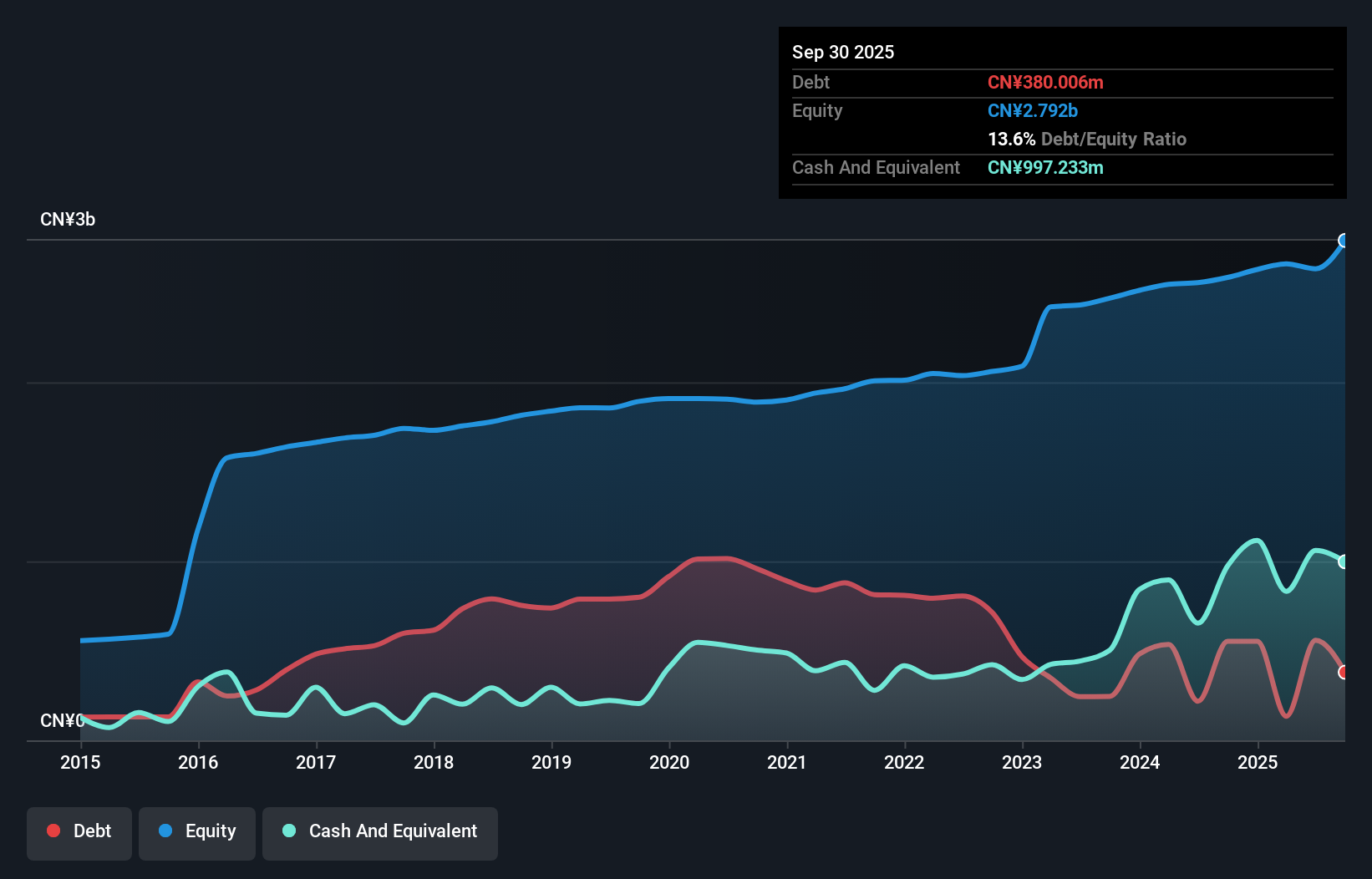

Operations: The company generates revenue primarily from its industrial segment, amounting to CN¥2.71 billion.

With a price-to-earnings ratio of 24.1x, Wuchan Zhongda GeronLtd offers a more attractive valuation compared to the broader CN market at 36.5x. The company's earnings surged by 26% over the past year, outpacing its industry peers who saw virtually no growth. Over five years, it has halved its debt-to-equity ratio from 42% to 21%, suggesting improved financial health and stability. Furthermore, interest payments are well-covered with an EBIT coverage of nearly 28 times, indicating robust operational performance and cash flow generation capabilities that support ongoing profitability without liquidity concerns.

- Delve into the full analysis health report here for a deeper understanding of Wuchan Zhongda GeronLtd.

Gain insights into Wuchan Zhongda GeronLtd's past trends and performance with our Past report.

Suzhou Alton Electrical & Mechanical Industry (SZSE:301187)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou Alton Electrical & Mechanical Industry Co., Ltd. is engaged in the production and sale of electrical and mechanical equipment, with a market cap of approximately CN¥6.83 billion.

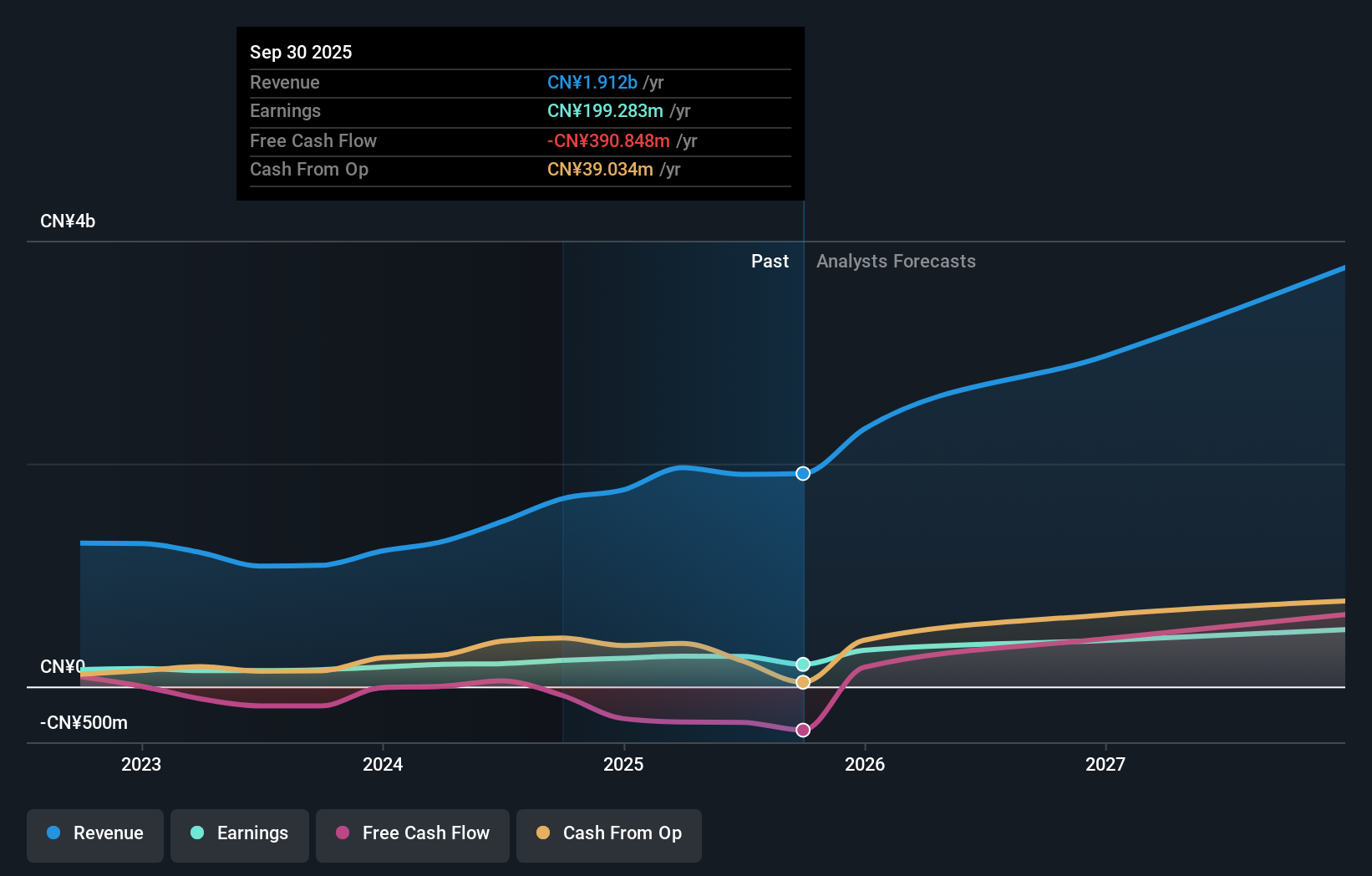

Operations: Suzhou Alton generates revenue primarily from the sale of electrical and mechanical equipment. The company's financial performance reflects a focus on optimizing its cost structure, which includes raw materials and manufacturing expenses. Notably, Suzhou Alton's net profit margin shows significant variation over recent periods.

Suzhou Alton Electrical & Mechanical Industry has demonstrated robust earnings growth of 54.9% over the past year, outpacing the Consumer Durables industry which saw a -1.9% change. The company shows strong financial health with more cash than total debt and interest payments well covered by EBIT at 27.6 times coverage. However, its debt to equity ratio has risen from 0% to 39.4% in five years, indicating increased leverage. Despite a volatile share price recently, it trades at about 3.1% below estimated fair value, offering potential investment appeal alongside a special dividend payout of CNY 4 per ten shares announced this month.

Summing It All Up

- Delve into our full catalog of 4733 Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301187

Suzhou Alton Electrical & Mechanical Industry

Suzhou Alton Electrical & Mechanical Industry Co., Ltd.

Very undervalued with exceptional growth potential.

Similar Companies

Market Insights

Community Narratives