Improved Earnings Required Before Hefei Meyer Optoelectronic Technology Inc. (SZSE:002690) Stock's 37% Jump Looks Justified

Hefei Meyer Optoelectronic Technology Inc. (SZSE:002690) shares have had a really impressive month, gaining 37% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 15% over that time.

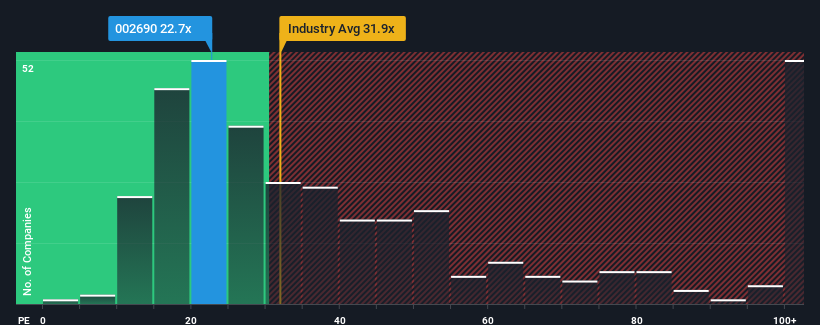

Even after such a large jump in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 34x, you may still consider Hefei Meyer Optoelectronic Technology as an attractive investment with its 22.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Hefei Meyer Optoelectronic Technology has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Hefei Meyer Optoelectronic Technology

How Is Hefei Meyer Optoelectronic Technology's Growth Trending?

In order to justify its P/E ratio, Hefei Meyer Optoelectronic Technology would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 11%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 24% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 12% each year during the coming three years according to the nine analysts following the company. Meanwhile, the rest of the market is forecast to expand by 19% per year, which is noticeably more attractive.

In light of this, it's understandable that Hefei Meyer Optoelectronic Technology's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Despite Hefei Meyer Optoelectronic Technology's shares building up a head of steam, its P/E still lags most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Hefei Meyer Optoelectronic Technology maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - Hefei Meyer Optoelectronic Technology has 1 warning sign we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hefei Meyer Optoelectronic Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002690

Hefei Meyer Optoelectronic Technology

Hefei Meyer Optoelectronic Technology Inc.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives