Discovering Hidden Potential In Asia With These 3 Undiscovered Gems

Reviewed by Simply Wall St

Amid rising geopolitical tensions and fluctuating economic indicators, small-cap stocks have been particularly volatile, with indices such as the S&P MidCap 400 and Russell 2000 experiencing notable declines. In this dynamic environment, identifying hidden gems in Asia's stock markets requires a keen understanding of local economic conditions and the potential for growth in underexplored sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Techno Ryowa | 0.12% | 8.04% | 26.08% | ★★★★★★ |

| Shandong Sacred Sun Power SourcesLtd | 19.09% | 13.32% | 42.32% | ★★★★★★ |

| Sinotherapeutics | NA | 25.52% | -7.66% | ★★★★★★ |

| Ascentech K.K | NA | 134.28% | 78.96% | ★★★★★★ |

| Jiangsu Lianfa TextileLtd | 26.67% | 2.17% | -26.08% | ★★★★★☆ |

| Wison Engineering Services | 41.36% | -3.70% | -15.32% | ★★★★★☆ |

| Ningbo Kangqiang Electronics | 43.28% | 3.45% | -5.24% | ★★★★★☆ |

| TSTE | 36.22% | 3.96% | -8.49% | ★★★★★☆ |

| Guangdong Delian Group | 28.18% | 5.07% | -36.51% | ★★★★★☆ |

| Forth Smart Service | 51.94% | -6.63% | -7.91% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Qianjiang Yongan Pharmaceutical (SZSE:002365)

Simply Wall St Value Rating: ★★★★★☆

Overview: Qianjiang Yongan Pharmaceutical Co., Ltd. operates in the pharmaceutical industry and has a market cap of CN¥7.30 billion.

Operations: The company generates revenue primarily from its pharmaceutical products. It has a market cap of CN¥7.30 billion, indicating its scale in the industry.

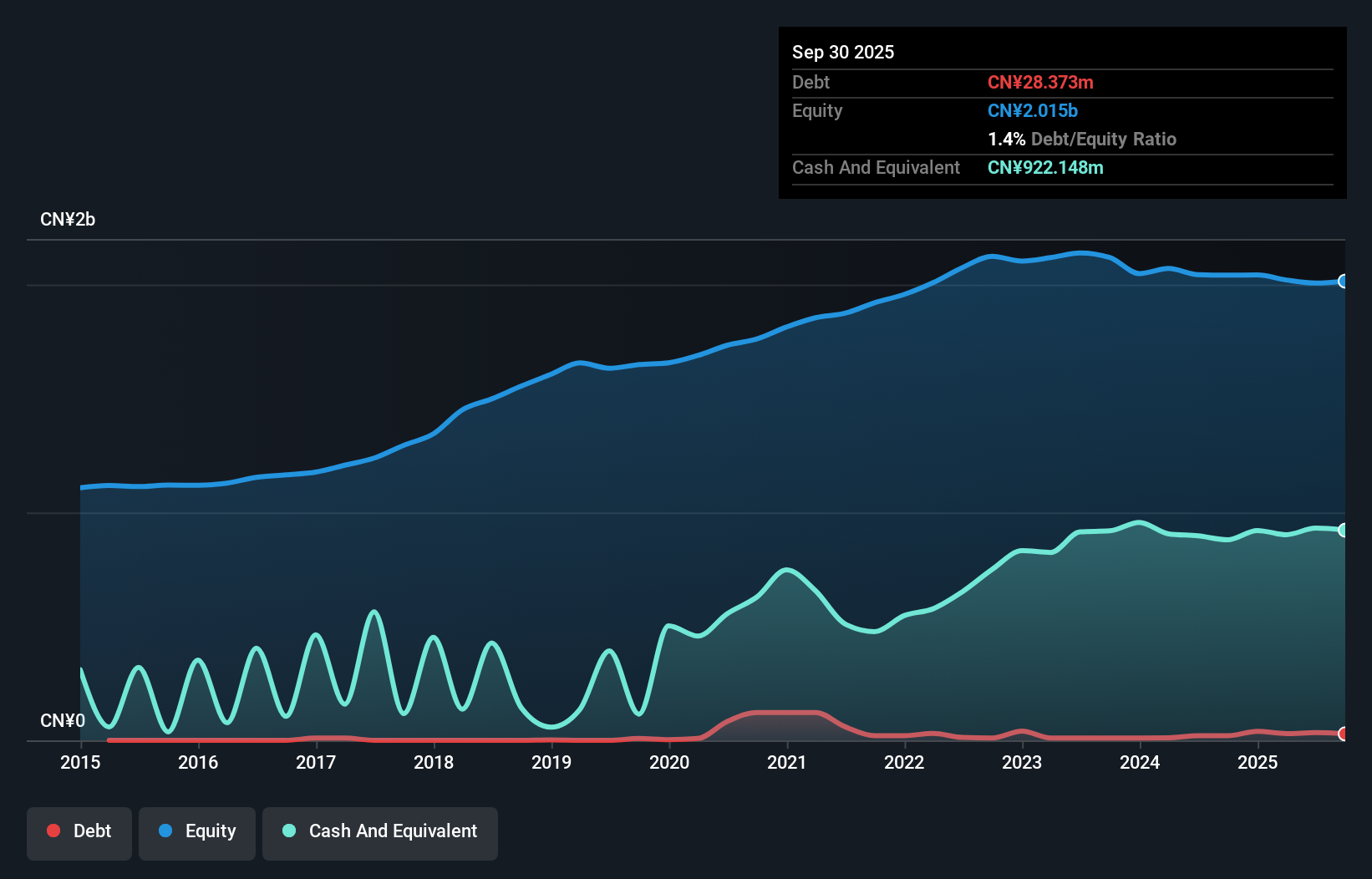

Qianjiang Yongan Pharmaceutical, a smaller player in the pharmaceutical sector, has shown significant volatility with its earnings over recent years. Despite a staggering earnings growth of 1974% last year, the company faced a net loss of CN¥4.37M in Q1 2025 against a previous net income of CN¥28.68M. Its debt to equity ratio increased from 0.5 to 1.5 over five years, yet it retains more cash than total debt, indicating financial resilience. The firm completed a buyback of 5.54 million shares for CN¥40.45M under its repurchase plan initiated in April 2024, reflecting strategic capital allocation efforts amidst fluctuating revenues and industry challenges.

Chengdu Leejun Industrial (SZSE:002651)

Simply Wall St Value Rating: ★★★★★★

Overview: Chengdu Leejun Industrial Co., Ltd. specializes in the research, development, design, manufacturing, sales, and servicing of grinding process system equipment both in China and internationally, with a market cap of CN¥12.35 billion.

Operations: Chengdu Leejun Industrial generates revenue primarily through the sale and servicing of grinding process system equipment. The company's financial performance includes a notable net profit margin trend, reflecting its ability to manage costs effectively in relation to its revenue streams.

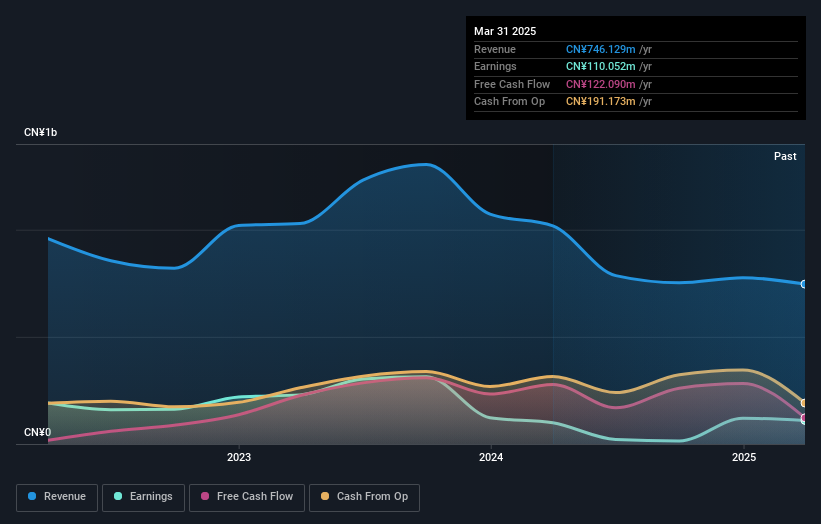

Chengdu Leejun Industrial, a nimble player in the machinery sector, has shown resilience despite recent challenges. Over the past year, earnings grew by 11%, outpacing the industry average of 1%. However, over five years, annual earnings have decreased by 12.9%. The company is debt-free and boasts high-quality past earnings. Recent financials reveal a first-quarter net income of CNY 46 million on sales of CNY 175 million, both lower than last year's figures. A cash dividend of CNY 0.60 per ten shares was recently approved for shareholders at their Annual General Meeting in May 2025.

- Get an in-depth perspective on Chengdu Leejun Industrial's performance by reading our health report here.

Learn about Chengdu Leejun Industrial's historical performance.

Cybozu (TSE:4776)

Simply Wall St Value Rating: ★★★★★★

Overview: Cybozu, Inc. develops, sells, and operates groupware solutions in Japan with a market cap of ¥163.57 billion.

Operations: The company generates revenue primarily through the sale and operation of groupware solutions. Its financial performance is reflected in a market cap of ¥163.57 billion.

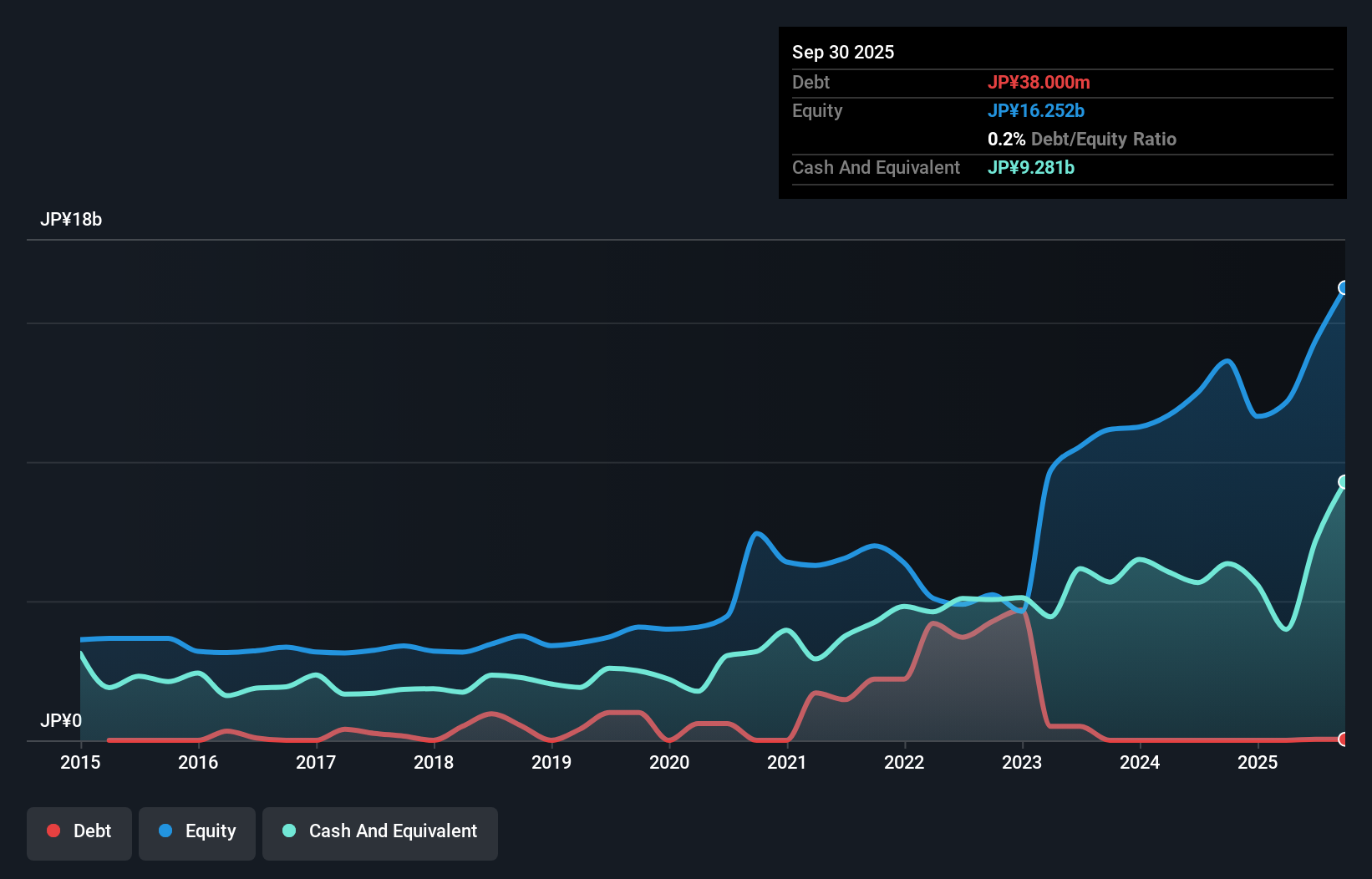

Cybozu stands out with its impressive financial health, having eliminated debt over the past five years from a debt to equity ratio of 14.8%. This software company has demonstrated robust earnings growth, achieving a 66.9% increase last year, significantly outpacing the industry's 11.8%. In recent results, Cybozu reported first-quarter sales of ¥8.76 billion and net income of ¥1.80 billion compared to ¥6.91 billion and ¥1.02 billion respectively in the previous year, highlighting strong performance momentum with earnings per share rising from ¥21 to ¥39 amidst high-quality earnings and positive free cash flow trends.

- Take a closer look at Cybozu's potential here in our health report.

Examine Cybozu's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Explore the 2603 names from our Asian Undiscovered Gems With Strong Fundamentals screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qianjiang Yongan Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002365

Qianjiang Yongan Pharmaceutical

Qianjiang Yongan Pharmaceutical Co., Ltd.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives