- China

- /

- Electrical

- /

- SZSE:002638

More Unpleasant Surprises Could Be In Store For Dongguan Kingsun Optoelectronic Co.,Ltd.'s (SZSE:002638) Shares After Tumbling 26%

The Dongguan Kingsun Optoelectronic Co.,Ltd. (SZSE:002638) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 16% in that time.

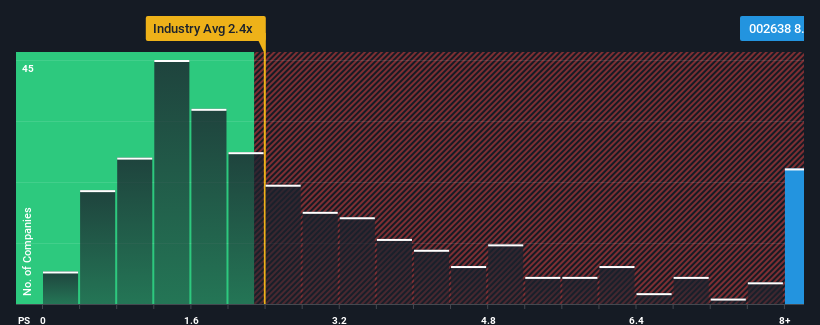

Even after such a large drop in price, you could still be forgiven for thinking Dongguan Kingsun OptoelectronicLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 8.5x, considering almost half the companies in China's Electrical industry have P/S ratios below 2.4x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Dongguan Kingsun OptoelectronicLtd

How Dongguan Kingsun OptoelectronicLtd Has Been Performing

The revenue growth achieved at Dongguan Kingsun OptoelectronicLtd over the last year would be more than acceptable for most companies. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Dongguan Kingsun OptoelectronicLtd will help you shine a light on its historical performance.How Is Dongguan Kingsun OptoelectronicLtd's Revenue Growth Trending?

Dongguan Kingsun OptoelectronicLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 68% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 25% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Dongguan Kingsun OptoelectronicLtd's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

A significant share price dive has done very little to deflate Dongguan Kingsun OptoelectronicLtd's very lofty P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Dongguan Kingsun OptoelectronicLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Dongguan Kingsun OptoelectronicLtd you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002638

Dongguan Kingsun OptoelectronicLtd

Manufactures and sells LED lighting products in China and internationally.

Flawless balance sheet with weak fundamentals.

Market Insights

Community Narratives