- China

- /

- Metals and Mining

- /

- SHSE:600608

Global Market Insights: Shanghai Broadband TechnologyLtd And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances and significant economic events, investors are seeking opportunities that align with current trends. Penny stocks, often associated with smaller or newer companies, continue to capture interest due to their potential for growth at accessible price points. Despite being considered an outdated term by some, these stocks can offer promising prospects when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.50 | HK$933.97M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (NasdaqGS:LX) | $4.66 | $811.03M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.04 | A$439.55M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.49 | HK$2.1B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.09 | SGD441.77M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.22 | MYR489.9M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.52 | SGD13.85B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.57 | $331.36M | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ✅ 5 ⚠️ 0 View Analysis > |

Click here to see the full list of 3,594 stocks from our Global Penny Stocks screener.

We'll examine a selection from our screener results.

Shanghai Broadband TechnologyLtd (SHSE:600608)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shanghai Broadband Technology Co., Ltd, with a market cap of CN¥1.39 billion, produces and sells communication and metal products in the People's Republic of China.

Operations: Shanghai Broadband Technology Co., Ltd does not report specific revenue segments.

Market Cap: CN¥1.39B

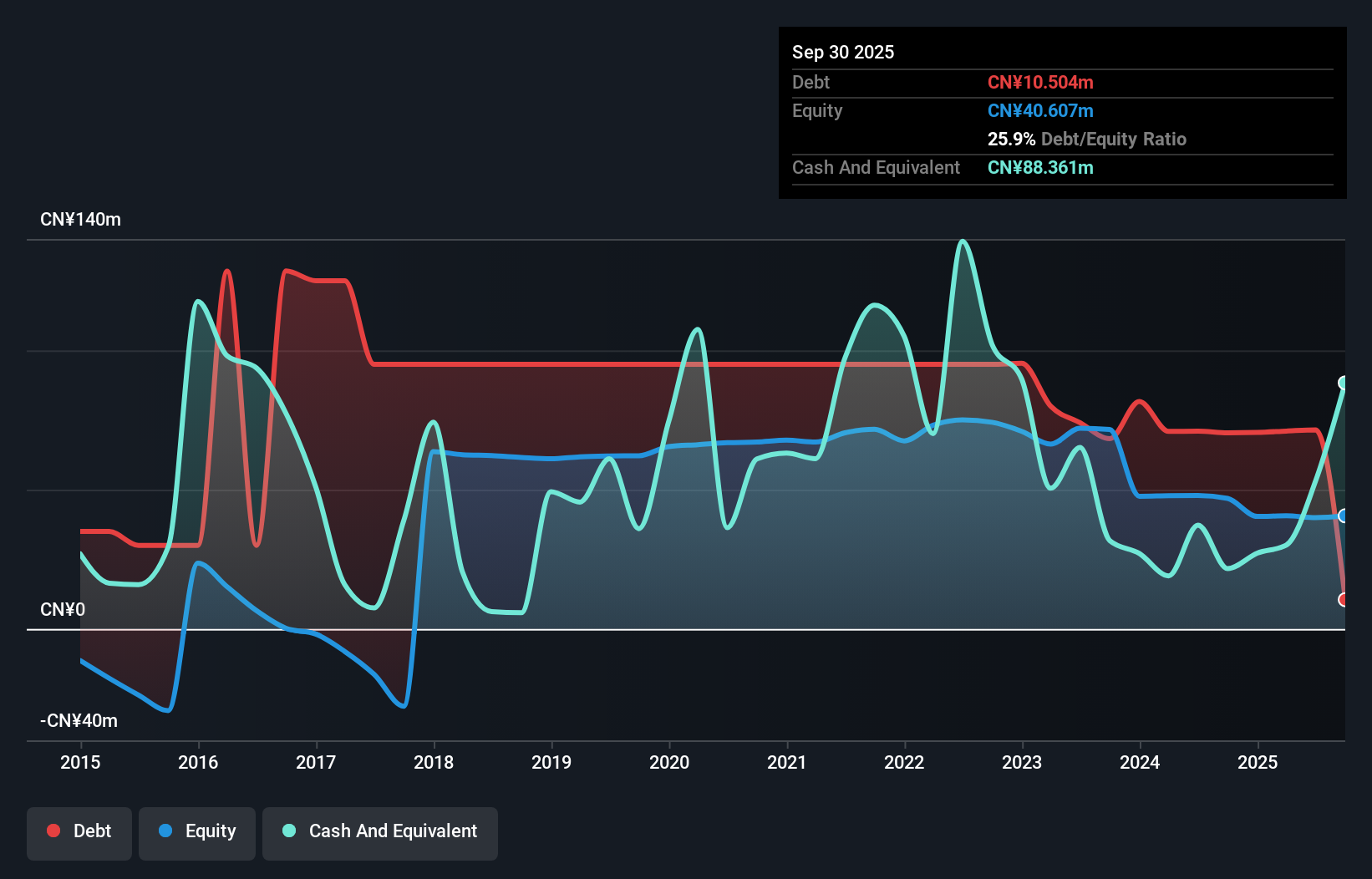

Shanghai Broadband Technology Co., Ltd, with a market cap of CN¥1.39 billion, has shown a significant reduction in its debt-to-equity ratio from 141.6% to 25.9% over the past five years and maintains more cash than total debt, indicating strong financial management. However, it remains unprofitable with declining earnings over the past five years and negative return on equity at -15.37%. Recent earnings reports show decreased sales but improved net income compared to last year. Despite stable weekly volatility at 4%, the company trades significantly below estimated fair value and faces challenges in revenue growth within its sector.

- Click to explore a detailed breakdown of our findings in Shanghai Broadband TechnologyLtd's financial health report.

- Learn about Shanghai Broadband TechnologyLtd's historical performance here.

Dongguan Kingsun OptoelectronicLtd (SZSE:002638)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Dongguan Kingsun Optoelectronic Co., Ltd. manufactures and sells LED lighting products both in China and internationally, with a market capitalization of approximately CN¥3.85 billion.

Operations: Revenue Segments: No specific revenue segments reported.

Market Cap: CN¥3.85B

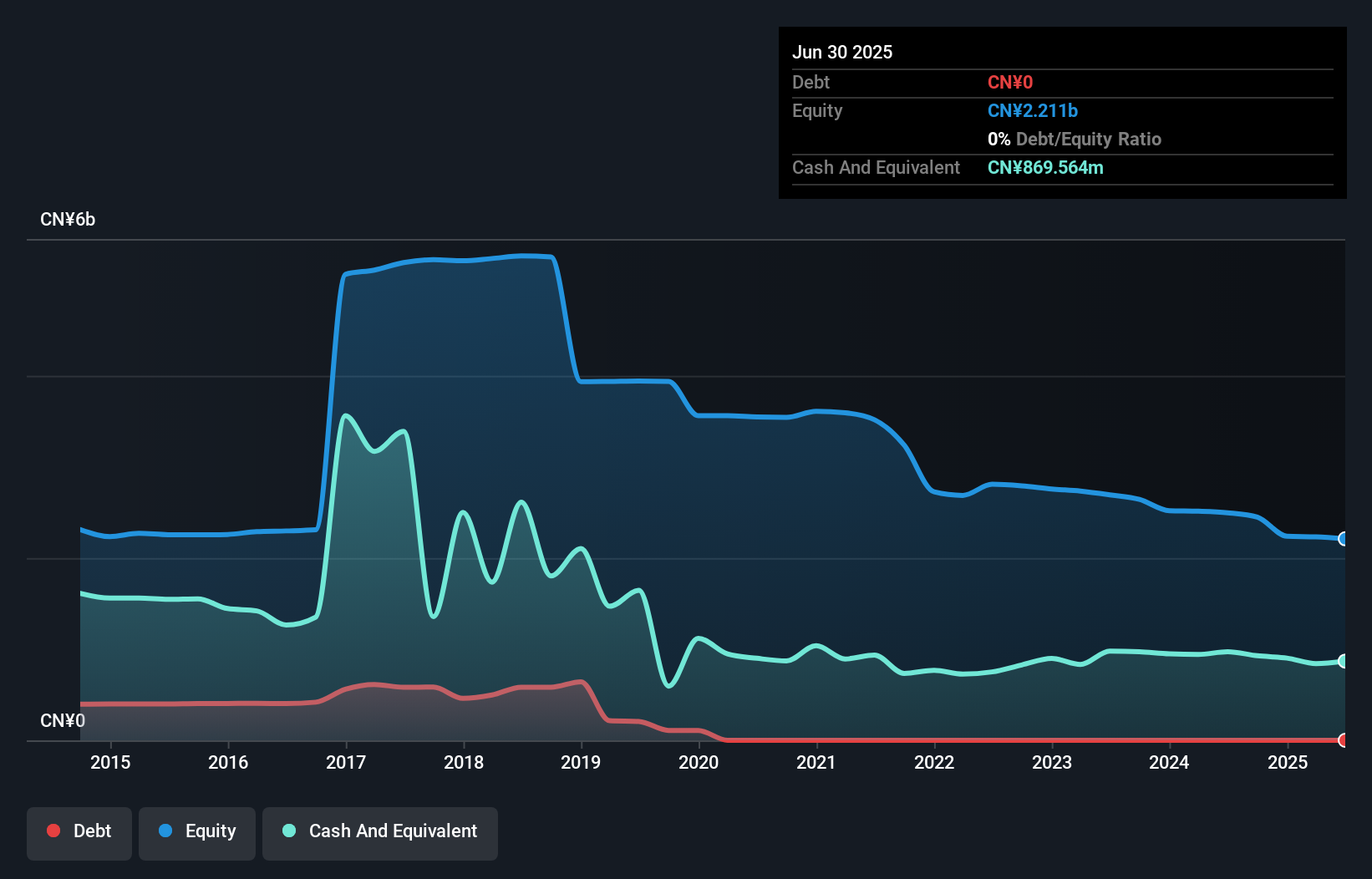

Dongguan Kingsun Optoelectronic Co., Ltd. has a market cap of CN¥3.85 billion and remains unprofitable, with an increased net loss of CN¥178.56 million for the nine months ended September 2025 compared to the previous year. Despite this, the company reported sales growth from CN¥290.12 million to CN¥310.9 million over the same period, reflecting some positive revenue momentum in its LED lighting products segment. The company's short-term assets significantly exceed both its short-term and long-term liabilities, providing a solid financial cushion, while it maintains more cash than total debt and has not experienced significant shareholder dilution recently.

- Unlock comprehensive insights into our analysis of Dongguan Kingsun OptoelectronicLtd stock in this financial health report.

- Assess Dongguan Kingsun OptoelectronicLtd's previous results with our detailed historical performance reports.

Cubic Digital TechnologyLtd (SZSE:300344)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cubic Digital Technology Co., Ltd. manufactures and sells steel frame foamed cement composite boards in China, with a market cap of CN¥3.31 billion.

Operations: Cubic Digital Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥3.31B

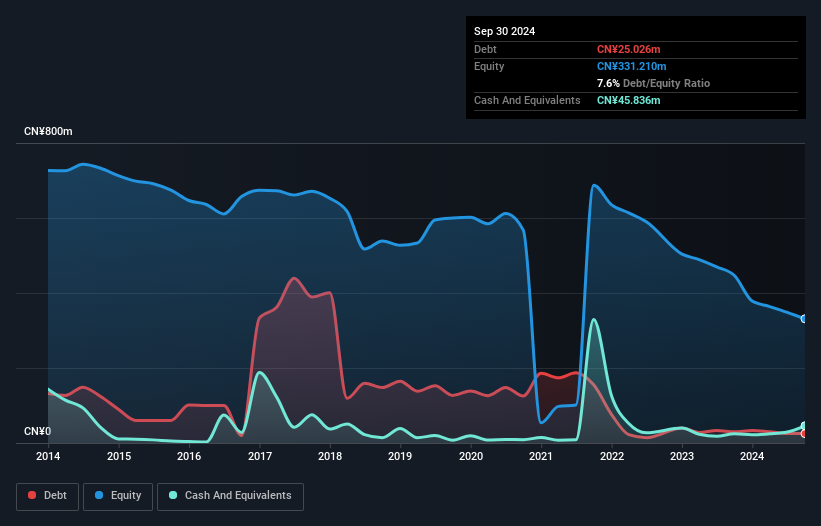

Cubic Digital Technology Co., Ltd., with a market cap of CN¥3.31 billion, reported sales of CN¥203.33 million for the nine months ended September 2025, slightly down from the previous year. Despite reducing its debt to equity ratio significantly over five years and maintaining short-term assets that cover both short and long-term liabilities, the company remains unprofitable with a net loss of CN¥62.21 million in the same period. The share price has been highly volatile recently, and while losses have decreased annually by 28.1%, it faces challenges with less than a year of cash runway at current free cash flow levels.

- Navigate through the intricacies of Cubic Digital TechnologyLtd with our comprehensive balance sheet health report here.

- Evaluate Cubic Digital TechnologyLtd's historical performance by accessing our past performance report.

Key Takeaways

- Take a closer look at our Global Penny Stocks list of 3,594 companies by clicking here.

- Looking For Alternative Opportunities? The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600608

Shanghai Broadband TechnologyLtd

Produces and sells communication and metal products in the People's Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives