- China

- /

- Renewable Energy

- /

- SZSE:000690

November 2024's Standout Penny Stocks To Watch

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration, investors are closely watching sector-specific impacts and policy shifts. In this climate, penny stocks—though a somewhat outdated term—continue to capture interest as they represent smaller or less-established companies with potential value. By focusing on those with robust financials and clear growth trajectories, investors can uncover opportunities in these often-overlooked segments of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR346.22M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.41B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$539.57M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.59 | A$68.57M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR292.11M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.55 | MYR781.78M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

Click here to see the full list of 5,801 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Guangdong Baolihua New Energy Stock (SZSE:000690)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guangdong Baolihua New Energy Stock Co., Ltd. operates in the energy sector with a focus on new energy solutions and has a market cap of CN¥10.36 billion.

Operations: The company's revenue primarily comes from its operations in China, totaling CN¥8.68 billion.

Market Cap: CN¥10.36B

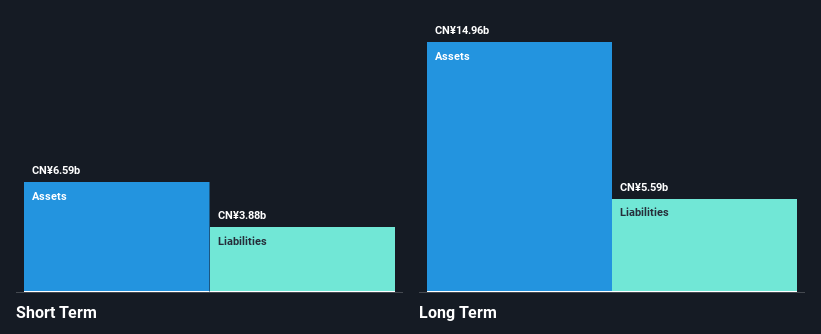

Guangdong Baolihua New Energy Stock Co., Ltd. has demonstrated significant earnings growth of 31% over the past year, surpassing the industry average. Despite trading at a substantial discount to its estimated fair value, the company's financial stability is supported by short-term assets exceeding both short and long-term liabilities, along with satisfactory debt levels. However, its dividend yield of 6.34% is not well covered by free cash flows, indicating potential sustainability issues. Recent earnings show a decline in revenue compared to last year but an improvement in net profit margins from 6.3% to 9.6%. The board's experience and stable volatility further bolster investor confidence amidst strategic shifts discussed at recent shareholder meetings.

- Unlock comprehensive insights into our analysis of Guangdong Baolihua New Energy Stock stock in this financial health report.

- Review our growth performance report to gain insights into Guangdong Baolihua New Energy Stock's future.

China Zhonghua Geotechnical Engineering Group (SZSE:002542)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Zhonghua Geotechnical Engineering Group Co., Ltd. operates in the geotechnical engineering sector and has a market cap of CN¥8.52 billion.

Operations: Revenue segments for China Zhonghua Geotechnical Engineering Group Co., Ltd. are not reported.

Market Cap: CN¥8.52B

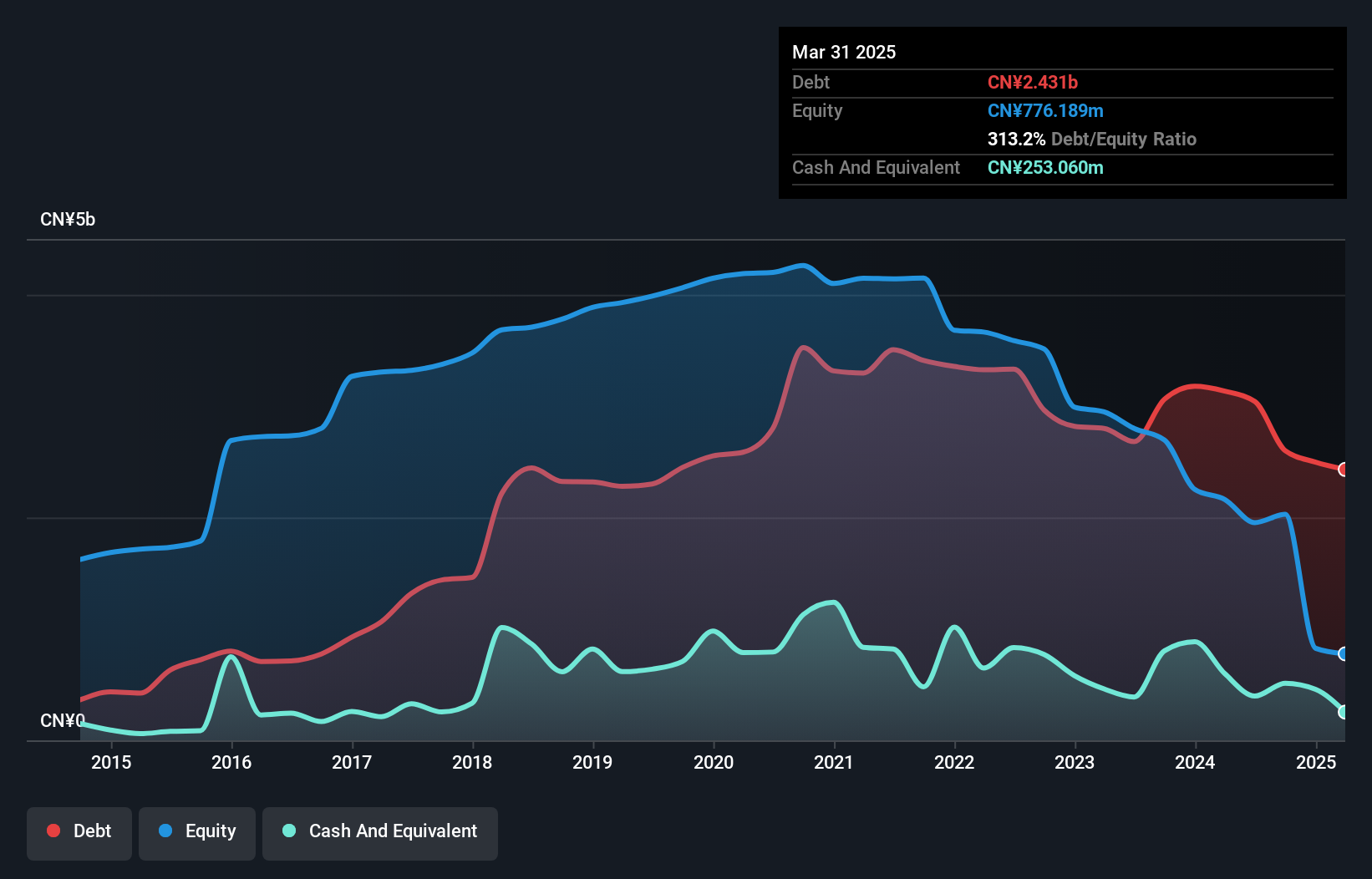

China Zhonghua Geotechnical Engineering Group Co., Ltd. has faced challenges with declining earnings over the past five years, reporting a net loss of CN¥192.76 million for the recent nine-month period despite generating CN¥1.17 billion in revenue. The company's financial position is bolstered by short-term assets exceeding liabilities, although its high net debt to equity ratio of 102.9% raises concerns about leverage. While unprofitable, it maintains a positive cash flow with a runway extending beyond three years, supported by an experienced management team and board of directors that may provide stability amidst its volatile share price and market conditions.

- Navigate through the intricacies of China Zhonghua Geotechnical Engineering Group with our comprehensive balance sheet health report here.

- Evaluate China Zhonghua Geotechnical Engineering Group's historical performance by accessing our past performance report.

Tangel Culture (SZSE:300148)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tangel Culture Co., Ltd. operates in the research and development, distribution, agency, and operation of mobile games, book publishing and distribution, and educational businesses in China with a market cap of CN¥3.43 billion.

Operations: No specific revenue segments are reported for Tangel Culture Co., Ltd.

Market Cap: CN¥3.43B

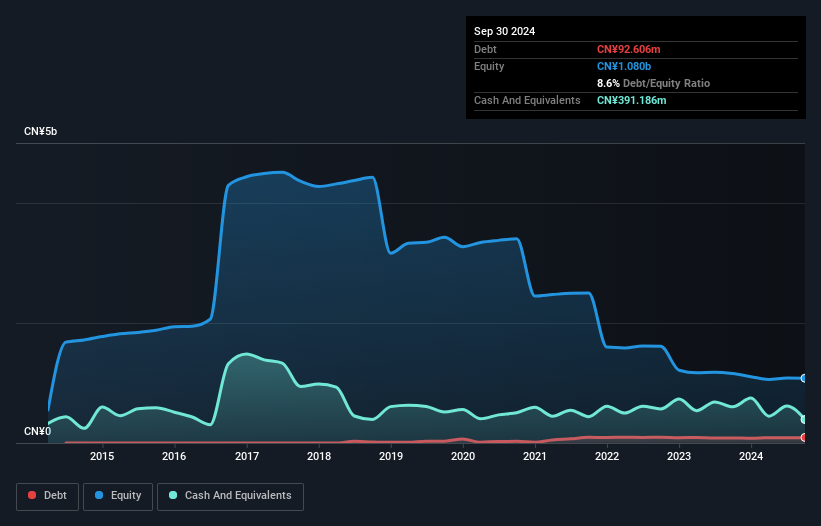

Tangel Culture Co., Ltd. has shown improvement with a net income of CN¥20.96 million for the nine months ending September 2024, a turnaround from a loss in the previous year. Despite being unprofitable historically, it holds more cash than debt and maintains short-term assets well above its liabilities, indicating financial resilience. The company's earnings have grown annually by 18.2% over five years, although its share price remains highly volatile and the board is relatively inexperienced with an average tenure of 2.2 years. Tangel's recent buyback completion reflects strategic capital management despite increasing debt levels over time.

- Take a closer look at Tangel Culture's potential here in our financial health report.

- Understand Tangel Culture's track record by examining our performance history report.

Where To Now?

- Discover the full array of 5,801 Penny Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000690

Guangdong Baolihua New Energy Stock

Guangdong Baolihua New Energy Stock Co., Ltd.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives