As global markets navigate fluctuating trade relations and shifting inflation rates, investors are increasingly looking towards smaller companies for potential opportunities. Penny stocks, despite the outdated connotation of their name, continue to be a relevant area of interest for those seeking value in lesser-known sectors. In this article, we explore three penny stocks that exhibit strong financial foundations and may offer promising prospects for long-term growth amidst the current market dynamics.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.51 | HK$933.97M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.81 | A$424.49M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.585 | MYR297.46M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.61 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.17 | SGD474.19M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.26 | MYR505.96M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.47 | SGD13.66B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.565 | $328.45M | ✅ 4 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.04 | €281.97M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,559 stocks from our Global Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Uju Holding (SEHK:1948)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Uju Holding Limited is an investment holding company offering digital marketing services and live-streaming e-commerce in the People’s Republic of China, with a market cap of HK$2.91 billion.

Operations: The company generates CN¥10.30 billion in revenue from its all-in-one online marketing solutions services.

Market Cap: HK$2.91B

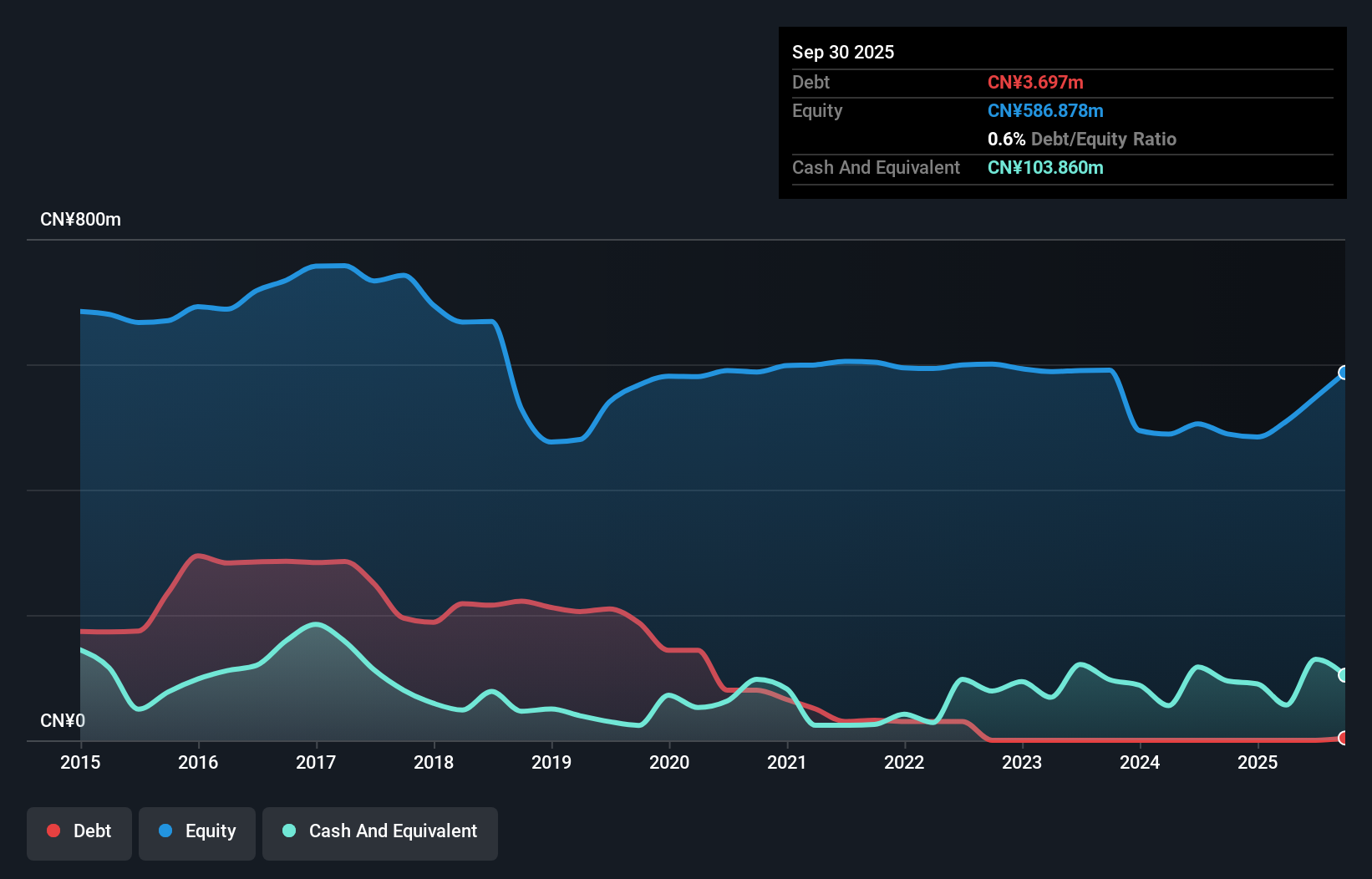

Uju Holding Limited, with a market cap of HK$2.91 billion, has shown significant growth in its earnings, which increased by 26.7% over the past year and exceeded industry averages. The company reported CN¥5.02 billion in sales for the first half of 2025, up from CN¥3.87 billion a year ago, with net income rising to CN¥66.27 million from CN¥43.41 million previously. Uju Holding's debt is well-covered by operating cash flow and interest payments are comfortably managed by EBIT at 17.7 times coverage; however, its return on equity remains low at 7.7%.

- Unlock comprehensive insights into our analysis of Uju Holding stock in this financial health report.

- Learn about Uju Holding's historical performance here.

Shandong Mining Machinery Group (SZSE:002526)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shandong Mining Machinery Group Co., Ltd. operates in the manufacturing and sale of mining equipment, with a market cap of CN¥6.70 billion.

Operations: The company's revenue is primarily derived from its Coal Machinery and Equipment segment, generating CN¥1.66 billion, followed by Intelligent Bulk Material Conveying Equipment at CN¥289.72 million, and Printing Equipment at CN¥206.65 million, with Building Materials Machinery and Equipment contributing CN¥13.40 million.

Market Cap: CN¥6.7B

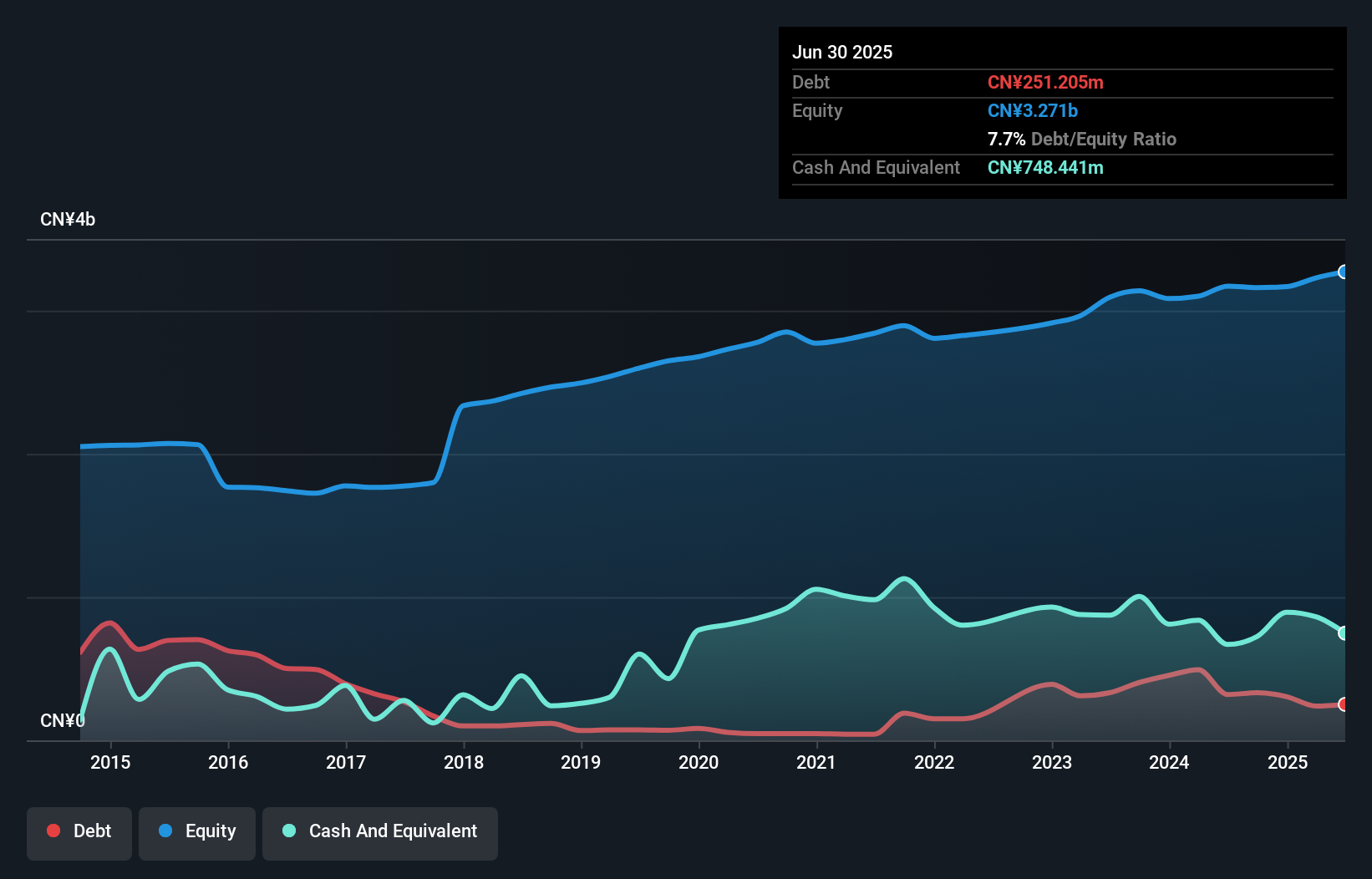

Shandong Mining Machinery Group, with a market cap of CN¥6.70 billion, has demonstrated robust financial health and growth potential within the penny stock domain. The company reported half-year revenues of CN¥1.05 billion for 2025, slightly down from the previous year, yet net income increased to CN¥98.46 million due to improved profit margins and earnings growth surpassing industry averages at 23.7%. Despite a low return on equity of 4.1%, the firm benefits from strong debt management with cash exceeding total debt and operating cash flow covering liabilities well; however, one-off gains have impacted recent results significantly.

- Click here and access our complete financial health analysis report to understand the dynamics of Shandong Mining Machinery Group.

- Evaluate Shandong Mining Machinery Group's historical performance by accessing our past performance report.

Ningbo Xianfeng New MaterialLtd (SZSE:300163)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ningbo Xianfeng New Material Co., Ltd is engaged in the development and manufacturing of screen fabrics for a global market, with a market cap of CN¥1.71 billion.

Operations: No specific revenue segments are reported for Ningbo Xianfeng New Material Co., Ltd.

Market Cap: CN¥1.71B

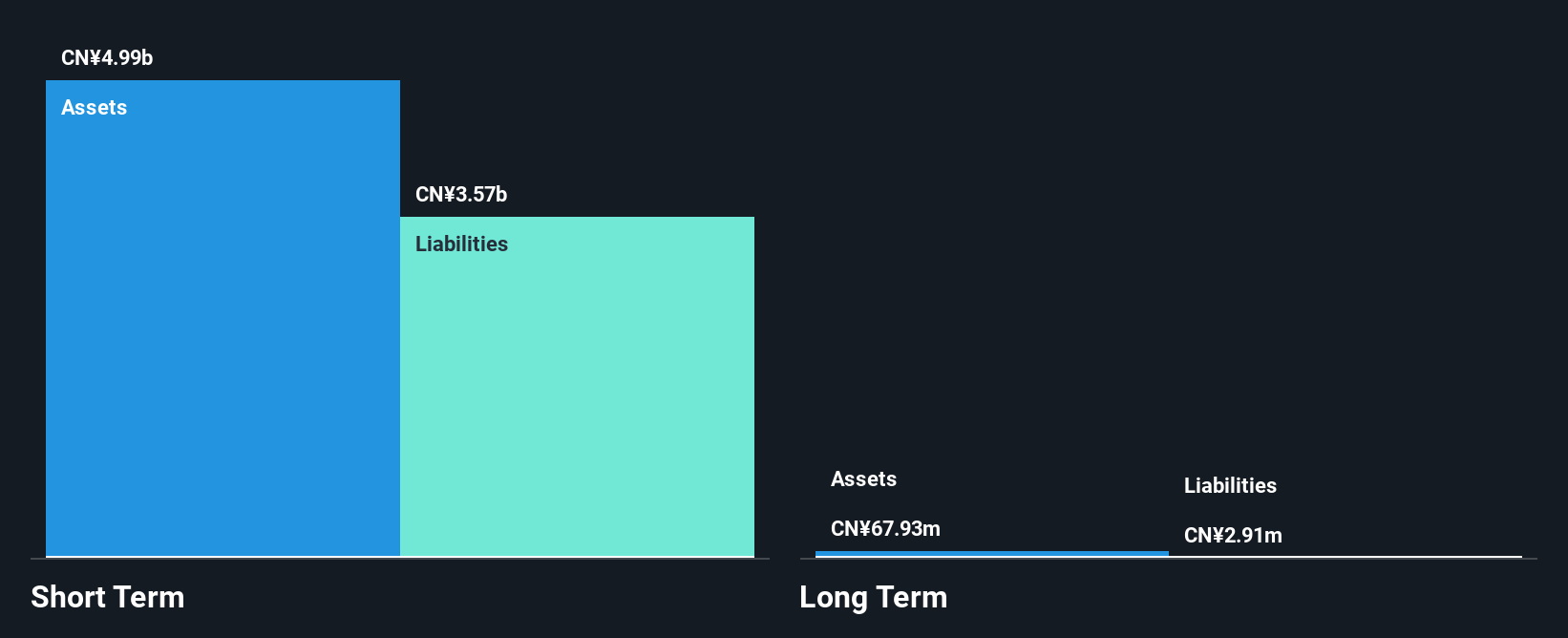

Ningbo Xianfeng New Material Ltd, with a market cap of CN¥1.71 billion, has shown improved financial performance over the past year. The company reported nine-month sales of CN¥175.08 million and transitioned to profitability with a net income of CN¥96.98 million from a prior loss, reflecting enhanced earnings quality despite negative operating cash flow. Its debt management is strong, evidenced by reduced debt-to-equity ratios and short-term assets surpassing liabilities significantly. However, its return on equity remains low at 15.8%, and the board's limited experience could pose governance challenges as it navigates growth in the competitive screen fabrics market globally.

- Navigate through the intricacies of Ningbo Xianfeng New MaterialLtd with our comprehensive balance sheet health report here.

- Assess Ningbo Xianfeng New MaterialLtd's previous results with our detailed historical performance reports.

Seize The Opportunity

- Click this link to deep-dive into the 3,559 companies within our Global Penny Stocks screener.

- Curious About Other Options? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002526

Shandong Mining Machinery Group

Shandong Mining Machinery Group Co., Ltd.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives